patrick.net

An Antidote to Corporate Media

1,363,437 comments by 15,736 users - ForcedTQ, HeadSet online now

« First « Previous Comments 143 - 150 of 150 Search these comments

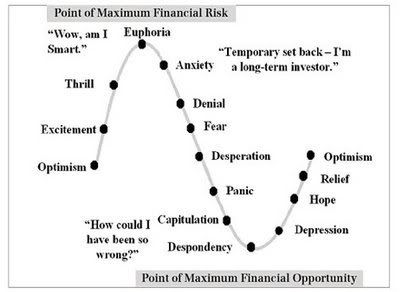

So Thomas in your opinion where are we in this chart?

Of course most bears will say we are still in the denial stage.

I like that…wanna argue about where on the graph we are - let’s go bears!!

ChrisLA, the question is who is in denial here...sounds like you are. Like I said, millions of people have LOST their homes...there is little to deny here, the denial happened before they got foreclosed on - right now all those folks are in a depression, ruined credit, lost their home. Don't deny it :)

You sound a bit naive SubOink.

Simply because the fundamentals are not there and yet you expect magical events to occur for price increases.

- Jobs are down.

- Pay cuts are pretty common still.

- More outsourcing to come.

- Government debt is huge.

- Consumer debt is huge.

- Businesses are closing down. (slower, but many still are).

- Fannie/Freddie being shut down (about time).

- Interest rate is very low.

I think we are going to have a slow recovery over next 5 to 10 years. But by recovery I mean recovery of the nation, not recovery of ballooned prices which are the main cause for the difficult position this country is in right now.

Looks like government is trying to do that as well, if they wind down subsidies (FN/FR) as they announced today. This will effectively turn money out of real estate and point it toward other sectors which produce something/anything other then debt. We can't have prosperity in a nation that produces nothing...

I'm personally looking forward to that time, a moving economy is what we need as a nation, not some ponzi scheme ruining us into destitution. And with money flowing out of real estate into real sound business we are going to recover, it will take some time, but it wont bring back ballooned prices. Hoping for those ballooned prices because you made poor financial decisions is fools hopes.

You can believe what you like of course, it's a free country.

You sound a bit naive SubOink.

Simply because the fundamentals are not there and yet you expect magical events to occur for price increases.

- Jobs are down.- Pay cuts are pretty common still.

- More outsourcing to come.

- Government debt is huge.

- Consumer debt is huge.

- Businesses are closing down. (slower, but many still are).

- Fannie/Freddie being shut down (about time).

- Interest rate is very low.

Nobody says that we are going back to bubble level prices anytime soon. But there are signs of recovery, jobless rate has reversed direction...its going down, not up. Stockmarket has recovered massivly. But you probably consider that naive too.

I agree with all your facts...but your interpretation is not correct. You are not looking at the whole picture, you are only looking at the negative aspects.

My neighborhood has an average income of 90k/yeah per household. Most people have owned their homes for 20 + years...the inventory in this neighborhood (and many others like it too) is very low. There aren't a lot of homes for sale (unlike in the inland empire)...I do see prices holding here or maybe going a little lower...max 10%, that would be a lot. If interest rates rise, prices will come down BUT that won't help you too much because you're still looking at a $3000 /month payment...you don't win much by your wait (but waste more money on rent, and finish paying your house off later).

I agree with you about a long drawn out recovery. We are at 2003 prices right now, let's say in 10 years from now we are still at 2003 prices which means 20 years of stagnant sideways development, Japan style...wouldn't your rent, wait for prices to drop mentality be completey wrong? You would waste 10 years of paying rent with the result of having to pay the same amount for a house (in monthly payment)...might as well do it now and get the time on your side so that you are rent free when you retire.

I am looking forward to Fannie/Freddi to be shut down - Damn right, its about time. But don't be naive about the consequence...they won't shut them down overnight...VERY slowly. It won't make the market crash. Look at real estate in Europe, France and Germany - over there they don't have Fannie Freddie style loans with 3.5% down - you HAVE to have at least 20% down...but look at prices over there. Just as inflated as here (in City's like Paris, Berlin, Munich, Barcelona) - so just because Fannie are being fizzled out does not mean we're going to just crash into the ground overnight. That's Panic BS.

Nobody says that we are going back to bubble level prices anytime soon. But there are signs of recovery, jobless rate has reversed direction…its going down, not up. Stockmarket has recovered massivly. But you probably consider that naive too.

I agree with all your facts…but your interpretation is not correct. You are not looking at the whole picture, you are only looking at the negative aspects.

My neighborhood has an average income of 90k/yeah per household. Most people have owned their homes for 20 + years…the inventory in this neighborhood (and many others like it too) is very low. ...

You are conflating stock market events with reality that most people live. Dow Jones Industrial Index doesn't represent the quality of life an average citizen of America has. It has no relation there, and my portfolio is doing better this year... almost recovered from the crash.

You also live in a neighborhood that is better off financially where 90k is average. In my area average income is closer to 60k (although now many are living off unemployment checks). 60 x 3 = 180... and houses used to be around 150k to 250 out here. that was the range and it matched incomes. now prices are still dropping... so far down from 600 to roughly mid 300's. still have some time to go... we have tons of foreclosures too. check out victory/corbin cross street... there is a wall of foreclosures, some have squatters living in them even.

As patrick said, all real estate is local. Maybe in your neighborhood things are great and peachy. It isn't like that out here. And with more outsourcing, I can only see more unemployment and crime in this neighborhood.

You are right - stockmarket has nothing to do with how most of us live but it is an indicator of sentiment. And people feel like spending when their 401k's look good - it does have a huge impact. When your portfolio is 100% recovered, you are more likely to take on a risk (home purchase) then when your 401k is 80% down and you feel like you have just lost your retirement. Wouldn't you agree?

Yeah, I know victory/corbin well...I would probably not buy a house there right now. If you are in the 200-250k pricerange, move to the temecula valley - It's gorgeous and a 3000sqft house built in 2004 is $230k. We considered it many times. But there is a reason why its so cheap out there - no jobs!

I sometimes seriously think that i should get oout of BA in few years......these guys are trying to shitholes for an enormous sum in a gand ponzi scheme.

« First « Previous Comments 143 - 150 of 150 Search these comments

Every broken clock is right every 12 hours...

If you keep being a doom and gloomer...you will be right at some point, if you are bullish you will also we right.

I have been a bear on real estate ever since 2003, when we first looked into buying and got terribly frustrated here in LA, not to sound like a broken record but of course all realtors were laughing at me, CA would NEVER crash...maybe level out...yeah right, I don't call a 35% drop leveling out - I was stubbron back then and I am very happy to have waited it out...the fact is though...I have lived in a crappy rental for 6 years, landlord is a pain in the ass, I work from home and would love to setup a nice office alla new floors, cabinets, possible break down a wall and extend - all the things I cannot do in a rental. I am in escrow now on a much much nicer house (w/pool), even better neighborhood and my mortgage is going to be only slightly higher than my rent is. (20%down 30yr loan) -

I don't care what anybody says...I don't see how that is not a no brainer. And if the market goes down further - so what? If I don't buy, I still have to pay the rent, in essence I am still paying a mortgage, somebody else's mortgage because I have to live somewhere. I'd rather pay my own. Been on the sidelines way too long. We rented a really nice house for a while in 2003...then the landlord had to sell - BAM, we had to move. Totally sucks living with that uncertainty! And moving sucks anyways...

Funny Thing is...I have kept all 45 listings that we looked at in 2003 and just looked them up on zillow and guess what...that's exactly where we are now here in LA. 2003 prices. Amazing!! Of course, back then I didn't have the downpayment like now so it still helped to have rented all these years.

Don't be a bear forever! I have a few older friends that have been bearish on real estate for 30 years...I almost became one of them :)

Buy a house for the right reason - because you need a place to live. If you are waiting for the market to be at the very bottom then you are speculating just like you would with a stock. That mindset is what has caused the bubble in the first place. Don't expect to make big money with your home. Buy it so you have a place for your kids to grow up. And once its free and clear in 30 years, the kids can have it and rent it out and get a head start like some of you in this forum who were lucky enough to inherit a rental prop.

…Deals are out there!

The only person I feel bad for is the next tenant in this crappy rental house with a landlord that hates to fix anything...but there is always a sucka out there. I was that sucka for a long time...

Now, go and buy a house! The time has come.

#housing