patrick.net

An Antidote to Corporate Media

1,363,580 comments by 15,734 users - FortWayneHatesRealtors, Misc, MolotovCocktail, stereotomy online now

« First « Previous Comments 104 - 143 of 150 Next » Last » Search these comments

i think it’s pretty well documented that real estate market goes in cycles.

It will be obvious once we come out of this down cycle.That is the most unsophisticated, NAR-sponsored analysis of the housing bubble someone could come up with. I know people that bought in the “buyer’s market†of 2007 and 2008. Guess how they are doing.

Depends on where and when they bought - If you bought a place in temecula, CA in 2008 for $250k (that used to be 600k)...you are doing just fine. Pay your monthly and enjoy life. Prices have not gone down much more.

If you bought in LA in 2008, your house would be a lot less than you bought it for. If you bought a house in 2003, your house would now be just as much as back in 2003 - not a loss, after all you have paid into it for 8 years and have only 22 years left to pay vs. someone like me who waited it out and bought now and has 30 years.

I want to emphasize again, IMHO it's a time to buy when you find something that you love, that works for you and that you can COMFORTABLY afford. If you are in for making money, then you are a speculator that attempts to figure out market bottoms and tops and you may get burned when you are wrong. I have no sympathy for flippers.

A house should not be treated like a stock!

In the long run (20 years) it does not matter if you get in 2007 or 2008...you live there to enjoy the house, personalize it, upgrade it and raise your kids. 20 years later, the house will be worth more, regardless of where you got in.

If you wait to buy because you think its going lower...you may be right...you may be wrong. Just be aware of that. I don't think thats a good reason not to buy. My reason was that I did not have the same financial situation yet back in 2003. I would have had to do a 5% down loan...and I wouldn't have had any savings after that. So I waited because I simply couldn't afford it back then...Now, the time for me has come. I can afford it, have savings, have 20% down and will pay the same for the house as a renter pays for that house. If the market goes down more for 1-3 years, so be it - in 10 years from now, I'll be happy that I did it because rents will be a lot higher than my payment every month.

Bubblesitter, I did not voice a global..."now is the time to buy" advise. Your twisting my words around. But it certainly seems to be a good time, if you have 20% for a downpayment, extra savings and find a house in the location you love that works for you.

Here is my global statement "You gotta live somewhere"

Curious as to what zipcode in LA you are speaking of.

SubOink, not sure if you answered this question - or if you're comfortable disclosing this information on a public message board. But what zipcode did you end up purchasing in?

Lets all remember that most buyers today are only doing a 3.5% downpayment and walking away in the future is STILL on the table and will continue to be so - in non recourse states like CA.

One lesson we learned from the bubble - people who put large downpayments/pay cash on thier homes are taking the full monty of all the risk.

FB's with zero down purchase strategy= today's sqauting for free money saving geniouses

FB's who bought with large down= today's complaining broke ass/cant sell/wont sell until I get mah monay back/ poor fools.

This whole situation is of course backwards so this dimension MUST be bizarro world and the other dimension is the sane one! who knew?!

I want to emphasize again, IMHO it’s a time to buy when you find something that you love, that works for you and that you can COMFORTABLY afford. If you are in for making money, then you are a speculator that attempts to figure out market bottoms and tops and you may get burned when you are wrong. I have no sympathy for flippers.

A house should not be treated like a stock!

Agreed, but being underwater is a situation that ought be avoided. Saying that there's no difference between being underwater or not ignores the long-term financial and situational implications that the buyer is stuck with.

And no, the "market cycle, buyer/seller market" is not sophisticated or relevant to the housing bubble. It's just noise from realtards that never passed high school Algebra.

I did answer it - read above..but here it is again - Agoura Hills

Looks like a nice area - much better than the Inland/Riverside area. Close to the coast and to L.A.

I think prices are still very inflated though, and have room to fall. However - best of luck. To each his own.

I did answer it - read above..but here it is again - Agoura Hills

Looks like a nice area - much better than the Inland/Riverside area. Close to the coast and to L.A.

I think prices are still very inflated though, and have room to fall. However - best of luck. To each his own.

Yes, it really is beautiful out here and amazing school system. I agree prices could fall further. Even though, almost every house that is listed in a reasonable price range is getting multiple offers. Nobody is overbidding, people give their offers and maybe come up a bit but then that's it - very different from 2003 (and very different from last year even), its still a buyers market. Our sellers are doing every single item on the list of repairs and paid all of our closing costs (incl. points to buy down rate) - that's another aspect about buying a little before the bottom hits - its much nicer to buy in a buyers market than in a sellers market. Our list of fixes was very long and we're thrilled to see it all taken care of.

Thing about these area's is - the job situation is very different than inland empire. Everybody here works. Restaurants are packed, movie theaters packed, I posted something last year on this forum about it. I was totally puzzled by what the news were saying and what I was seeing. It's just local I guess. Lots of people with money here. And the only reason why I could see that prices could easily stabilize here is that most owners have owned their houses here for 20 years and more...so the majority is not underwater and not even pressured to sell. They can all afford to wait. Very different in the inland empire where it was overbuilt, everyone had a subprime loan and now jobs are gone...loans have busted and house prices have crashed 70% from peak. I could also see how those prices will take 10 years+ to return...simply because of jobs.

Yeah, time will tell...we all want the same really, let's hope we can achieve it.

i think it’s pretty well documented that real estate market goes in cycles.

It will be obvious once we come out of this down cycle.That is the most unsophisticated, NAR-sponsored analysis of the housing bubble someone could come up with. I know people that bought in the “buyer’s market†of 2007 and 2008. Guess how they are doing.

it doesn't need to be complicated. Not sure about you but it's pretty common sense to me. The order of recovery will be stock market->job market->housing market.

bears point to jobs and housing as evidence against a recovery. That's the wrong way to look at it since these are lagging indicators.

But I don’t get the enslavement argument. You have to live somewhere. Whether you rent or own, you are a slave to some sort of housing cost. If you rent, you basically have a lifetime mortgage… Not only will you never pay it off, but the costs will almost certainly increase over time.

30 years vs 1 year get it?

But I don’t get the enslavement argument. You have to live somewhere. Whether you rent or own, you are a slave to some sort of housing cost. If you rent, you basically have a lifetime mortgage… Not only will you never pay it off, but the costs will almost certainly increase over time.

30 years vs 1 year get it?

After 1 year you get to live for free?

If you rent, you basically have a lifetime mortgage… Not only will you never pay it off, but the costs will almost certainly increase over time.

It's all a matter of which one is worse.

If you own, you will never pay off property tax, maintenance, and insurance. Ever. They will always increase over time as well.

If the rent is less than property tax, maintenance, and insurance, the renter wins. Every year. Forever, as long as that situation holds. And that's not even counting the return on capital that the renter can more profitably invest elsewhere.

tatupu70 saysBut I don’t get the enslavement argument. You have to live somewhere. Whether you rent or own, you are a slave to some sort of housing cost. If you rent, you basically have a lifetime mortgage… Not only will you never pay it off, but the costs will almost certainly increase over time.

30 years vs 1 year get it?

After 1 year you get to live for free?

Free for me means,... freedom to change. we all have to live somewhere. some just lock themselves in harder than others.

That's really the main point here folks. I can move and take work anywhere as a renter. at least I feel that way.

That is my own personal salvation. so don't F' with it! I like freedom not debt slavery.

as a borrower you're in the mans pocket. he owns your labor. these are my feelings make up your own just don't tell me mine are wrong for me. and don't expect me to ever drink the funny kool-aid.

You have some great points! I bought my home at one of the peaks in 1990. There were a few times when I was under water. My mortgage is now cheaper than rent.

We are itching to find a deal. But even the deals don't look that good when you compare income with housing prices.

Frankly, I don't see how houses cannot fall even lower. Unemployment is getting worse. ObamaCare is scaring the hell out of would be business owners.

Does the US still manufacture anything except paper assets?

Our borders have been infiltrated by day laborers rather than educated people who bring something to table in exchange for legal residence.

I am optimistic about the future after the bottom falls out. I long for a crash of the US dollar so it will be attached to gold and silver.

If you rent, you basically have a lifetime mortgage… Not only will you never pay it off, but the costs will almost certainly increase over time.

It’s all a matter of which one is worse.

If you own, you will never pay off property tax, maintenance, and insurance. Ever. They will always increase over time as well.

If the rent is less than property tax, maintenance, and insurance, the renter wins. Every year. Forever, as long as that situation holds. And that’s not even counting the return on capital that the renter can more profitably invest elsewhere.

In general that's true...and would have to be decided on a case by case basis...but in my case

The actual numbers are like this:

- My Prop Tax is 7000/year (and it's a tax write of, so its actually less)

- Insurance $80.- (state farm)

- Earthquake $100 (statefarm)

The rent for this house would be $3000/month and that is 2011 - not sure where it'll be in 2030...Prop Tax could go up of course but I doubt very much that prop tax would be anywhere near rents otherwise nobody could rent their house for profit anymore. So Prop Tax and Rent Prices will always have a relationship.

Maintenance is also upgrading floors, replaster pool and keeping things in very nice conditions, something a landlord will not do (none of my landlords ever did) - a landlord will pay for a plumbing stop up but not to put in efficient A/C , Heat, add a jacuzzi...my electricity bill in the rental was enormous because...no insulation, old A/C - more money out the window. In our house we are planning on going solar...many tax incentives for that stuff. It'll take 10 years to amortize that stuff but after that I am going to be selling power back to the grid. All things you can't do in a rental.

Look in great neighborhoods like Tarzana, south of Blvd, Woodland Hills etc Rentals are the biggest pieces of crap...and go for $2500-2800 for 1500sqft. house.

Most people that rent, don't invest their money - and if they did...how did they do in the last 10 years...?

The only way renting makes sense (imho) is if you find an amazing deal somewhere and lock that rent in for 2 years. We have looked at many rentals over the years and only found one that was absolutely amazing - we loved it there...unfortunately, the landlord decided to sell after only 1.5 years. We couldn't afford it, he wanted $900k...so we had to move out. I hate that part about renting. Some people call it freedom of choice where to go next - but once you move into a house, you don't want to move that often really. You end up staying. But you also have the uncertainty of your landlord raising the rent, forcing you to move out because he sells - once you are on a month to month lease - 30 day notice and you're out! How do you like to live without knowing for sure if you are going to be in the same place in a few months - especially when you have kids.

If you rent, you basically have a lifetime mortgage… Not only will you never pay it off, but the costs will almost certainly increase over time.

It’s all a matter of which one is worse.

If you own, you will never pay off property tax, maintenance, and insurance. Ever. They will always increase over time as well.

If the rent is less than property tax, maintenance, and insurance, the renter wins. Every year. Forever, as long as that situation holds. And that’s not even counting the return on capital that the renter can more profitably invest elsewhere.

I 100% agree.

Katy Perry saysBut I don’t get the enslavement argument. You have to live somewhere. Whether you rent or own, you are a slave to some sort of housing cost. If you rent, you basically have a lifetime mortgage… Not only will you never pay it off, but the costs will almost certainly increase over time.

30 years vs 1 year get it?

After 1 year you get to live for free?

Free for me means,… freedom to change. we all have to live somewhere. some just lock themselves in harder than others.

That’s really the main point here folks. I can move and take work anywhere as a renter. at least I feel that way.

That is my own personal salvation. so don’t F’ with it! I like freedom not debt slavery.

as a borrower you’re in the mans pocket. he owns your labor. these are my feelings make up your own just don’t tell me mine are wrong for me. and don’t expect me to ever drink the funny kool-aid.

It's not funny kool aid. You think you are more mobile renting--that's a perfectly reasonable reason to rent. Others would rather have more security--stable mortgage payment, can't be forced to move, etc. Just depends on what you want.

But the whole indentured slave business is just garbage.

Unemployment is getting worse.

How do you figure? You may or may not believe the government statistics, but even ADP is saying businesses are hiring. There's almost no chance unemployment is getting worse.

There’s almost no chance unemployment is getting worse.

This can be one of the memorable comment of the year, of course, depending on what's gonna happen in the future. :-)

Suboinc, your comments to me sound very phony and lacking integrity.. I think you over-leveraged and all of a sudden hoping your gamble will go up. I wish you all the best with your purchase, but be realistic; most people here on the forum do not care what you do with your money.

So coming here all of a sudden and telling everyone that it's time to buy is rather pointless, because I heard the same crap back in 2009. With interest rate being all time low, prices are going to be all time high. Simple as that.

I rather find it pathetic that someone who cried that times were bad, jumped onto the market and all of a sudden decided to become bearish. In America we appreciate honesty, not opportunism.

Of course if I misjudged, than I apologize.

Tatupu,

Businesses may be hiring, but it perhaps mostly temporary part-time help rather than good paying jobs with benefits. Unfortunately the government statistics around employment much like inflation are quite distorted.

Apocalypse

I think we should just eat the bankers and politicians. That would be a great start.

Suboinc, your comments to me sound very phony and lacking integrity.. I think you over-leveraged and all of a sudden hoping your gamble will go up. I wish you all the best with your purchase, but be realistic; most people here on the forum do not care what you do with your money.

So coming here all of a sudden and telling everyone that it’s time to buy is rather pointless, because I heard the same crap back in 2009. With interest rate being all time low, prices are going to be all time high. Simple as that.

I rather find it pathetic that someone who cried that times were bad, jumped onto the market and all of a sudden decided to become bearish. In America we appreciate honesty, not opportunism.

Of course if I misjudged, than I apologize.

I give up - You obviously, didn't understand one thing I said...

But the whole indentured slave business is just garbage.

One thing to consider - what if you or your wife lost your job and can't find another one locally?

What if you had to sell/move?

How underwater would you be?

Can you rent it for your mortgage payment?

How much stress would it impose on your marraige - trying to deal with "the house"? In that case, your marriage is a slave to the house.

You might say, this isn't a valid argument, but I know so many upside down debt slaves that are trying to sell/move/relocate.... They constantly say "I don't know what we're going to do about the house"...

I'd say it's very possible to be a debt slave, mortgage slave, or house slave.. It's happening all over.

I've gotten job offers in various parts of the country (how I got from the East coast, to TX, to CA) - and it's nice being flexible and being able to go after opportunity when it's presented. We love CA, but with all the garbage going on in this state, it's nice not to be owned (be a slave) to the mortgage company, knowing that if we wanted to, we could move on a dime.

I'm sure the slave/non slave mindset is viewed differently by each renter/mortgage holder - but you can't completely dismiss this view as "garbage."

America has not yet begun to achieve terminal velocity in its free fall to total chaos and, finally, cannibal anarchy.

Wall Street keeps shrieking for higher earnings and companies keep offshoring to slave states.

Whole generations of workers subsist by wolfing down fistfuls of food they can snatch while wandering around grocery stores or returning to hunter/gather subsistence, hunting feral animals and squatting in the ruins of smoldering, ruined cities like Detroit.

Tens of millions of unemployed will finally be herded as a political force by a united neonazi/teabagger party which will devolve into a religious cult led by apocalyptic prophet sarah palin who will write the first cannibal cook book when the crops fail due to a combination of meteorological convulsions and the loss of petroleum based fertilizers.

If you love your family, teach them to kill with rocks and sticks because in two generations that is all that will be left!

You're hilarious (and probably right). You need to film/produce you're own zombie movie - I'm thinking it will be similar to "28 Days Later."

Joshuatrio,

I understand your point. Some people (including myself) are very wary of excessive debt. I appreciate the flexibilty that renting provides me. For example, my job is transfering me to another location about 20 miles further than my current commute. If I want I can move easily. Its much more complicated and expensive if you "own" a home.

America has not yet begun to achieve terminal velocity in its free fall to total chaos and, finally, cannibal anarchy.

Wall Street keeps shrieking for higher earnings and companies keep offshoring to slave states.

Whole generations of workers subsist by wolfing down fistfuls of food they can snatch while wandering around grocery stores or returning to hunter/gather subsistence, hunting feral animals and squatting in the ruins of smoldering, ruined cities like Detroit.

Tens of millions of unemployed will finally be herded as a political force by a united neonazi/teabagger party which will devolve into a religious cult led by apocalyptic prophet sarah palin who will write the first cannibal cook book when the crops fail due to a combination of meteorological convulsions and the loss of petroleum based fertilizers.

If you love your family, teach them to kill with rocks and sticks because in two generations that is all that will be left!

What took you so long? LOL.

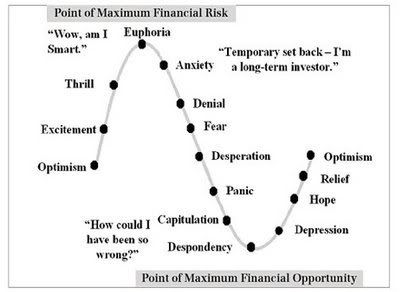

So Thomas in your opinion where are we in this chart?

Of course most bears will say we are still in the denial stage.

I like that...wanna argue about where on the graph we are - let's go bears!!

“temporary setback — I’m a long term investorâ€

You think the millions of people that have been foreclosed on and evicted from their homes and the thousand of homes that are just going into foreclosure now and all the short sale home owners are saying "I am a long term investor"...I doubt that - we're past that stage for sure! They are capitulating and they want OUT!

I would say we are somewhere between Panic and Capitulation…

In the markets that were affected by the late 80's mini-bubble, it was a full 6 years from the peak when prices started rising again. That includes LA by the way.

Given that this bubble was, oh just slightly larger, it's hardly a stretch to think it will take longer than that to resolve.

I would say we are somewhere between Panic and Capitulation…

In the markets that were affected by the late 80’s mini-bubble, it was a full 6 years from the peak when prices started rising again. That includes LA by the way.

Given that this bubble was, oh just slightly larger, it’s hardly a stretch to think it will take longer than that to resolve.

Not sure how long it will take in between the dots on that graph above - it could be 5 years to get from Capitulation to Despondency...and another 5 years to get from there to Depression...the graph does not say anything about how long it will take. We are not talking time, we're talking sentiment.

Given that this bubble was, oh just slightly larger

What few people apparently realize is that the bubble itself was keeping the economy afloat 2003-2007.

You can't just take away ~$500B/yr of free money injection from an economy and expect it to recover in any sort of cyclical manner, especially since the economy was already sliding into recession in the 2001-2002 timeframe.

What has been going on since 2008 has been very aggressive fiscal intervention. It has stopped the slide but not fixed the weakness in the system.

The damage is simply too many middle-class Americans and not enough middle-class jobs for them.

This is what happens when we integrate our economy with those where a $5/hr gross is a pretty decent salary in the scheme of things.

http://research.stlouisfed.org/fred2/series/PAYEMS

The ongoing intervention is going to serve to further divide the country into haves and have nots, as those with inflation-protection stay afloat and those without come under increasing levels of economic stress.

The CBO in its deficit predictions has dialed in $1.5T/yr deficits.

$1.5T!

This is $13,600/household/yr, a simply stunning amount of deficit spending.

This is when we were supposed to have our fiscal house in order to be able to handle the surging baby boom retirees, the front rank of which are now turning 60-65 this year.

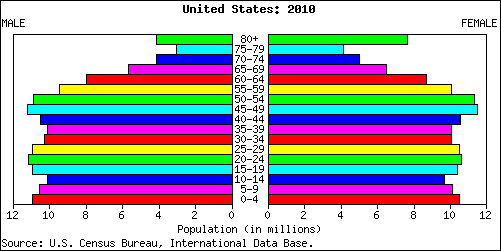

In the next 10 years the age 70+ population is going to expand from 28M to 38M (+33%), and the age 55-69 population is going to expand from 48M to 60M (+25%)!

The yuan is going to strengthen from 1/6 to ~1/4, giving 400 million or so first-world Chinese an additional 33% of buying power.

I don't know where this is all going, but damn if we'll be lucky to end up as well as Japan has.

They are capitulating and they want OUT!

The Japanese were capitulating in 1995, too. They still had 10 more years of normalization ahead.

We are not talking time, we’re talking sentiment.

The idea that we're going to just oscillate from 'bad' to 'good' is really ignoring a lot of fundamental stresses that have been building up and not resolved, not resolved at all.

Chart: consumer debt + corporate debt + federal government debt (blue) vs. GDP (red)

Troy I wouldn't call those years as years of prosperity. It was very obvious that time that people were living in huge debt, many were not working but simply living off home equity destroying economic output.

It was a giant ponzi scheme. Those who got into the market early lived off the debt of those who jumped into it after them. Sponsored by our lovely corrupt government officials.

I do agree with you on most points, we are in for a few years of recession. Takes a while for people to change skills from real estate to real world needs, takes a while for economy to turn around and find reality. Some are still holding on to the hope of ponzi real estate come back, of course I also know a few people who are hoping for DotCom bubble to return.... wishful thinking.

Troy - thanks for pointing out some of the angles that a lot of us are forgetting about.

it doesn’t need to be complicated. Not sure about you but it’s pretty common sense to me. The order of recovery will be stock market->job market->housing market.

bears point to jobs and housing as evidence against a recovery. That’s the wrong way to look at it since these are lagging indicators.

I think it goes way deeper than that. Fundamentals do not support current home prices. Prices will start rising when the fundamentals (household GDP) increase legitimately (not through a bubble) and prices aren't based on govt-created gimmicks like subsidized uber-low rates and bribes for people to buy.

Arguments about unemployment are easily dismissed because they're reflected in our GDP statistics. Yes, reduced unemployment will help the housing sector, but it's better measured in terms of income that's a result of it since that's what correlates with home prices.

Sub you just lost your argumentAPOCALYPSEFUCK says

America has not yet begun to achieve terminal velocity in its free fall to total chaos and, finally, cannibal anarchy.

Wall Street keeps shrieking for higher earnings and companies keep offshoring to slave states.

Whole generations of workers subsist by wolfing down fistfuls of food they can snatch while wandering around grocery stores or returning to hunter/gather subsistence, hunting feral animals and squatting in the ruins of smoldering, ruined cities like Detroit.

Tens of millions of unemployed will finally be herded as a political force by a united neonazi/teabagger party which will devolve into a religious cult led by apocalyptic prophet sarah palin who will write the first cannibal cook book when the crops fail due to a combination of meteorological convulsions and the loss of petroleum based fertilizers.

If you love your family, teach them to kill with rocks and sticks because in two generations that is all that will be left!

What about bows and arrows?

We are not talking time, we’re talking sentiment.

The idea that we’re going to just oscillate from ‘bad’ to ‘good’ is really ignoring a lot of fundamental stresses that have been building up and not resolved, not resolved at all.

Chart: consumer debt + corporate debt + federal government debt (blue) vs. GDP (red)

Much agreed. These cheer leaders are probably motivated by something, and are ignoring reality.... perhaps we are approaching the stage of denial on the chart above: "http://img.photobucket.com/albums/v475/financemanila/NewPicture13.jpg"

So Thomas in your opinion where are we in this chart?

Of course most bears will say we are still in the denial stage.

I like that…wanna argue about where on the graph we are - let’s go bears!!

ChrisLA, the question is who is in denial here...sounds like you are. Like I said, millions of people have LOST their homes...there is little to deny here, the denial happened before they got foreclosed on - right now all those folks are in a depression, ruined credit, lost their home. Don't deny it :)

« First « Previous Comments 104 - 143 of 150 Next » Last » Search these comments

Every broken clock is right every 12 hours...

If you keep being a doom and gloomer...you will be right at some point, if you are bullish you will also we right.

I have been a bear on real estate ever since 2003, when we first looked into buying and got terribly frustrated here in LA, not to sound like a broken record but of course all realtors were laughing at me, CA would NEVER crash...maybe level out...yeah right, I don't call a 35% drop leveling out - I was stubbron back then and I am very happy to have waited it out...the fact is though...I have lived in a crappy rental for 6 years, landlord is a pain in the ass, I work from home and would love to setup a nice office alla new floors, cabinets, possible break down a wall and extend - all the things I cannot do in a rental. I am in escrow now on a much much nicer house (w/pool), even better neighborhood and my mortgage is going to be only slightly higher than my rent is. (20%down 30yr loan) -

I don't care what anybody says...I don't see how that is not a no brainer. And if the market goes down further - so what? If I don't buy, I still have to pay the rent, in essence I am still paying a mortgage, somebody else's mortgage because I have to live somewhere. I'd rather pay my own. Been on the sidelines way too long. We rented a really nice house for a while in 2003...then the landlord had to sell - BAM, we had to move. Totally sucks living with that uncertainty! And moving sucks anyways...

Funny Thing is...I have kept all 45 listings that we looked at in 2003 and just looked them up on zillow and guess what...that's exactly where we are now here in LA. 2003 prices. Amazing!! Of course, back then I didn't have the downpayment like now so it still helped to have rented all these years.

Don't be a bear forever! I have a few older friends that have been bearish on real estate for 30 years...I almost became one of them :)

Buy a house for the right reason - because you need a place to live. If you are waiting for the market to be at the very bottom then you are speculating just like you would with a stock. That mindset is what has caused the bubble in the first place. Don't expect to make big money with your home. Buy it so you have a place for your kids to grow up. And once its free and clear in 30 years, the kids can have it and rent it out and get a head start like some of you in this forum who were lucky enough to inherit a rental prop.

…Deals are out there!

The only person I feel bad for is the next tenant in this crappy rental house with a landlord that hates to fix anything...but there is always a sucka out there. I was that sucka for a long time...

Now, go and buy a house! The time has come.

#housing