patrick.net

An Antidote to Corporate Media

1,192,369 comments by 13,871 users - BigSky, clambo, RWSGFY online now

Comments 1 - 1 of 1 Search these comments

1

tdeloco

2012 Aug 2, 6:12am

tdeloco

2012 Aug 2, 6:12am

Why the M2 Growth Spurt? (John B Taylor)

Based on a scan through the release, it looks to me like demand deposits and savings deposits at banks are the two components of M2 that are most responsible for the recent increase in M2.

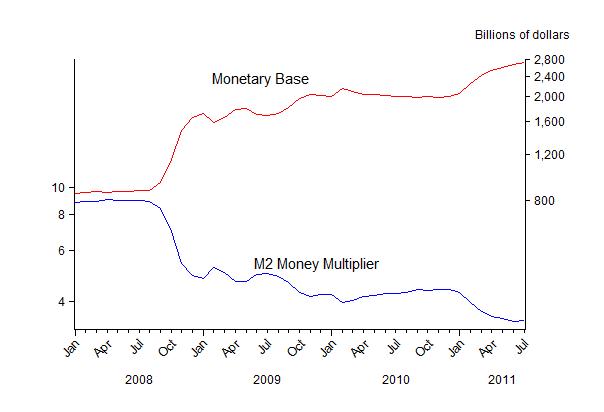

As such, M2 Multiplier is moving in the opposite direction of the monetary base in lock-step fashion.

M2: M1 + most savings accounts, money market accounts, retail money market mutual funds, and small denomination time deposits (certificates of deposit of under $100,000).

M2 does not represent most of the debt. Perhaps M3, which is estimated at over $50T.

http://seekingalpha.com/article/755871-happy-10-trillion-day?source=email_the_daily_dispatch&ifp=0

Some time ago there was a thread predicting the monetization of all credit. (Sorry, Patrick, it's hard to find anything in your forums nowaday.)

Anyway I do not undersatand how the rapid growth of M2 corrsponds to disappearance of credit. Would anyone explain this?