patrick.net

An Antidote to Corporate Media

1,195,363 comments by 14,017 users - clambo, Insearchofme, PeopleUnited, richwicks, Stout, Tenpoundbass, zzyzzx online now

Comments 1 - 40 of 71 Next » Last » Search these comments

I am... But I'm keeping my eyes open and staying optimistic... I'd imagine the market won't fall more than 1000 pts in a single day. But if that happens I think I'm out...

I'll lose my maybe 8% of my gains for the year.. but keep the 30-50% run up prior to that...

I am. I did some "profit taking" a while back...of course I would be better off today if I hadn't. My problem is that I don't have a better place to put it, so I'm long cash right now...which I know won't bring a return.

Who knows.

swebb, when I was thinking like you in 2007, I took a long look at "investing" in some energy improvements like solar on the roof, a more economical car, etc. (Got the car but not the roof).

My problem is that I don't have a better place to put it, so I'm long cash right now...which I know won't bring a return.

It lets you be opportunistic though. I think there will be plenty of opportunities to get back in at better prices.

No change in plans. I trust the market will perform the same as it has for the past 100+ years meaning there will be ups and there will be downs. But in the end it means an overall long-term gain. Guessing is simply guessing. There will ALWAYS be risk and there ALWAYS has been.

I'm not concerned. I'm worried more about taxes and what will happen when everyone who saved nothing is dumpster diving. Uncle Sam may go after anyone who has saved and invested to skim off his accounts somehow.

Well, people are borrowing and spending like there's no tomorrow. Borrowing Increased by $17.8B.

I'm not concerned. I'm worried more about taxes and what will happen when everyone who saved nothing is dumpster diving. Uncle Sam may go after anyone who has saved and invested to skim off his accounts somehow.

If you read ferfal's blog, Argentina just solved this by raiding everyone's 401k type accounts

That's what I am afraid of. Peron type socialism fails, needs money and goes after anyone who was smart and frugal enough to save some and ballsy enough to invest it. Lefty Democrats scare me because they'll turn the USA into Argentina.

Living in Santa Cruz I see it everywhere and it's like invasion of the body snatchers. It's hard to actually find someone here who is 1. not getting some govt. handout 2. not working for the govt. 3. not illegal 4. not homeless, crazy and begging. 5. not working undercover, paying no taxes, doing business on ebay and craigslist and using paypal for all their income.

All of the groups above need to suck the blood out of anyone who actually saves and invests his money.

I took my money out of the market and bought a new Hyundai Elantra. 40 mpg, xm radio, and named North American car of the year. And it's made in America.

The Dow & Housing reached their 2006 highs based on new cash generated from the new "Information Age", that surge was amplified with "over zealous investing". That was justified.

Come 2012, The Dow has reached typical highs. Except this time, from gubmint rigging.

Gubmint can only pray that some new cash generating technology will come along before total collapse. They KNOW housing values will seek justification on their own, so they quit offering those real estate smoke & mirror schemes.

But Stocks are still being manipulated.

So,,,,,, Stay long till Bernanke goes broke ? 30 yr fixed rose yesterday, meaning the FED may be losing control of low interest rates.

That's what I am afraid of. Peron type socialism fails, needs money and goes after anyone who was smart and frugal enough to save some and ballsy enough to invest it. Lefty Democrats scare me because they'll turn the USA into Argentin

Yes... because what we reaallllyyy need is to elect another Republican president so they can once again wreck the economy just like they have done repeatedly.

Edvard, who wants income redistribution from the haves to give to the have nots? Democrats.

If you believe the president spends money and passes laws, look at your constitution.

Congress does that and I fear them going after anyone who has saved and invested their whole life.

The last president to start the ball rolling to set up our present disaster was Clinton, since Sandy Weill, Rubin, Greenspan, Summers convinced most of Congress to repeal Glass-Steagal and the Commodity Exchange Act (1936).

Edvard, who wants income redistribution from the haves to give to the have nots? Democrats.

Well hey, I don't have to 'want' anything because the previous President already 'Redistributed" the wealth via those lovely tax cuts.

Edvard, who wants income redistribution from the haves to give to the have nots? Democrats.

And yet my tax returns have been giving me back MORE THAN EVER the last few years. I'm not just not seeing your "income redistribution" unless what you mean is its going into my big fat checking account.

TODAY the market is just spinning it's wheels. Instead of feel acrophobia, I feel the need for a NAP.

ZZZZzzzzzzzz........

TODAY the market is just spinning it's wheels. Instead of feel acrophobia, I feel the need for a NAP.

ZZZZzzzzzzzz........

I don't think there's going to be some kind of major "crash" or anything. I just think there's enough "headline risk" over the whole european debt fiasco that could result in lower prices in the coming months.

TODAY the market is just spinning it's wheels. Instead of feel acrophobia, I feel the need for a NAP.

ZZZZzzzzzzzz........

I don't think there's going to be some kind of major "crash" or anything. I just think there's enough "headline risk" over the whole european debt fiasco that could result in lower prices in the coming months.

Yup. I feel that at sometime in the future between now and 100 years from now there 'could' possibly be something that could occur that 'might' cause the market to react. I dunno... I just feel that something is going to happen someday.

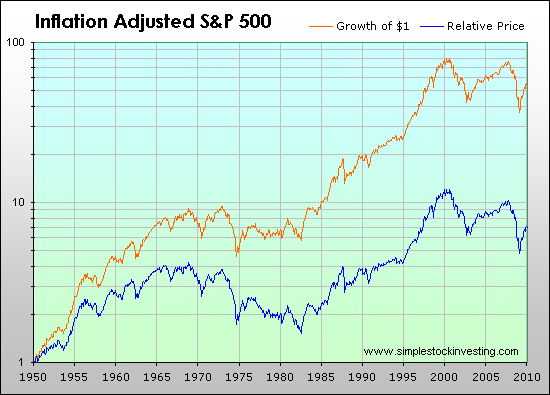

Case-Shiller has an index for U.S. stocks too:

That's my main reason for thinking stocks are just a bit too high relative to long term earnings. I think a lot of money has flowed into the markets simply because interest rates are so low. It's "yield chasing." If interest rates gradually start going up again, I think stocks will slowly decrease. Or they'll just stay flat with earnings growth and buybacks balancing the effect of money outflow.

edvard and vicente, the only reason you see more tax refunds of your OWN money is most politicians were chicken to increase taxes. What's the mystery?

Ben Bernake however is still able to punish savers and benefit debtors which is another subtle form of meddling with distribution of wealth.

Democrats want to take our investment returns after we save and risk our own sweat and blood and postpone chicks and cars to have it.

I fear taxes, not the stock market. Balls to the wall, because 1. interest rates are low 2. the world keeps growing.

Travel some developing economies and see what's happening out there.

Ben Bernake however is still able to punish savers and benefit debtors which is another subtle form of meddling with distribution of wealth.

True that. And it has the added "benefit" of being much sneakier than an actual tax increase.

edvard and vicente, the only reason you see more tax refunds of your OWN money is most politicians were chicken to increase taxes. What's the mystery?

But I thought folks on your side didn't want to raise taxes. EVER. Thus if you are in agreement that we are paying less taxes because politicians didn't raise taxes... isn't that exactly what you all want? What's the complaint then?

That's my main reason for thinking stocks are just a bit too high relative to long term earnings. I think a lot of money has flowed into the markets simply because interest rates are so low.

I'm no economist but there's a lot more going on then that. The global economy is becoming more global all the time. A LOT of major us companies are now all doing a ton of business overseas and particularly in the growing Asian markets. Thus they are making a lot of money.

Simply "guessing" that the stock market will crash doesn't really make a whole lot of sense. Will it crash? Yup. Its crashed before and it will crash again. That's not what is important. What's important is what you can make overall, crashes and booms.

I'm no economist but there's a lot more going on then that. The global economy is becoming more global all the time. A LOT of major us companies are now all doing a ton of business overseas and particularly in the growing Asian markets. Thus they are making a lot of money.

That graph is relative to earnings. The increased earnings are taken into account.

Obviously I can't reliably predict short-term market behavior. That chart won't predict it either. Short term movements are anyone's guess.

My point is that future returns are poorer when stocks are richly valued, and visa versa. Also, interest rates are at historic lows (there's a link to a chart of interest rates as well).

Look at the 5 year chart and you can see the correction pattern. Seems like we have a bit more upside.

DOW is probably going to 14k

Lefty Democrats scare me because they'll turn the USA into Argentina.

Isn't the current house republican by something like 240-190 and the senate democrat 51-47 with 2 ind? I believe the house has been R since Clintons first term except the 111th congress and the senate has been R 10 of the last 14 years. So what lefty democrats are creating the laws that scare you so much? Almost all legislation for the last 17 years except obamacare has come from a republican majority.

I'm getting a bit of a nosebleed, but...

The market could be high for a couple other reasons:

1) So many assets in the world are now toxic that money is going into the market in search of safety

2) With assets shaky, and a potentially ruinous inflation waiting for the M2 cork to pop, the market might justify even higher values in nominal future dollars, as the value of the dollar drops precipitously.

1) So many assets in the world are now toxic that money is going into the market in search of safety

Exactly. Banks are no longer risk averse enough to invest in real estate.

They are putting ALL your bailout money on AAPL.

No wonder they passed THEIR stress test.

edvard and vicente, the only reason you see more tax refunds of your OWN money is most politicians were chicken to increase taxes.

Translation: My reflexive garbage about "income redistribution" and ruinous taxes was called out, and I'm too chicken-shit to say MATH PROVES ME WRONG LET ME RETRACT. Time to change the subject instead of admitting a lie.

You guys are something else. When Obama wanted to allow taxes to rise he was opposed not by Pelosi and her ilk.

The truth is that the danger to my future net worth is TAXES not the stock market.

What do you need, links to youtubes of various democrats like Obama saying we need to spread the wealth? That's income redistribution.

If you like that fine. You are a liberal. Join the ranks of the others who want to pick my pocket to give it to someone else.

You will have the opportunity to vote to raise taxes on California yet higher. Meanwhile, smart businesses like Apple are expanding to non tax states, like Texas for instance. Apple is going to spend $310 million on some center in Austin and hire about 4,000 people. (that was what the golden gate cost by the way, but in more valuable dollars)

I am not lying. Democrats created another sneaky tax on wealth in many states called the "annuity premium tax". Some people bought variable annuities because the IRA contribution limit was so small, just $2000.

This clever "premium tax" is a straight tax on the TOTAL in your annuity after it has had decades to grow with its sub accounts like mutual funds.

Of course, you are taxed on the increase in value as income when you eventually spend your annuity.

I predict that the Democrats will seek clever ways to tax our 401Ks, IRAs, and other investments.

The rationale for the new annuity taxes was: "We did a study, and we found that the average owner of an annuity was richer than the average dumpster diving loser. They can afford this new tax."

The rationale you guys give for taking another guys money is always the same: "He can afford it, he's rich."

Having over $1million in investments will make us the rich targets.

So, I fear taxes more than the stock market.

I also fear ignorant people who think that taxes won't matter to their investment returns and future well being.

The truth is that the danger to my future net worth is TAXES not the stock market.

Inflation-adjusted stock-charts shows retail investors are gaining little or nothing there for over a decade.

Your determination that taxes are the single and only threat to your real long-term wealth building, is plainly wrong. Some people have had money sitting in CSCO waiting for the NASDAQ to hit 4,000 again since 1999 and sadly never heard of "opportunity cost".

My taxes are lower than ever, if yours have risen within the same bracket you quite plainly are making a huge mistake and need to have your taxes professionally prepared next time.

You guys are something else. When Obama wanted to allow taxes to rise he was opposed not by Pelosi and her ilk.

The truth is that the danger to my future net worth is TAXES not the stock market.

What do you need, links to youtubes of various democrats like Obama saying we need to spread the wealth? That's income redistribution.

... and once again, as repeated earlier, if one wants to go on about "Wealth distribution", well I can't think of a better example of this than when Republicans decided 30+ years ago to start putzing around with the tax system, and trying "Trickle-down" economics via tax cuts for the wealthy. If that's not a redistribution of wealth then I don't know what is.

Secondly, do you folks who complain about taxes realize that as of now Taxes in the US are the LOWEST they've been since the 50's? That's right. We are currently paying less taxes than anyone has in over half a century and doing so with a Democrat in the office.

Anything else?

We are currently paying less taxes than anyone has in over half a century and doing so with a Democrat in the office.

Anything else?

But I heard Obama hung around with Bill Ayers.

vicente, you are constantly changing the subject and changing what I have written. That's not allowed.

I don't fear the gyrations of the stock market.

I fear the future attacks on my investments in the form of TAXES.

It is a known fact that taxes did not go up recently, but that was because Obama met resistance.

Apple agrees with me, they are building a huge place in Austin Texas, which will mean their employees will automatically avoid paying up to a 10% California income tax.

You do pay California taxes also don't you? Do you plan on paying them in retirement?

My investing history predates your graph, which is also completely meaningless because you picked recent history. I don't fear what happened in the past. My portfolio started in 1982 and is doing fine.

Tax the rich, tax the rich, tax the rich. Later when you need to spend some of your investments, you will be considered "rich" because you saved your sweat and blood money, and had the balls to invest it when everyone else spent it on chicks, cars, club med trips, etc.

You guys make me want to puke. You don't get to take my money from me to give away. You wouldn't dare try it in person, but you want to do it with liberal lefty politics.

I love this site ...lot's of creative people..... Stocks are the best and the fastest game in this casino... You want 2% on the 10 year? Hell no... It's time to gamble in a ____ stock ... What have the Banks done lately? You get your money in 3 days

I fear the future attacks on my investments in the form of TAXES.

Provably irrational fears can be resolved with counseling these days. Choosing to remain in irrational fear state when it is counter to reality, is of course a personal choice, as long as you are not stripping your clothes off on the street or climbing a clock tower. Taxes are at historic lows therefore your worries are misplaced.

Apple agrees with me, they are building a huge place in Austin Texas, which will mean their employees will automatically avoid paying up to a 10% California income tax.

I wouldn't read too much into that. The California jobs are extremely well paid engineering and design positions. The Texas jobs are call center, sales and accounting jobs. Better than nothing, but not like what we have here.

http://www.nbcdfw.com/news/tech/Apple-to-Build-New-Austin-Facility-142076693.html

I suspect it is more of a concession to California real estate costs than state income taxes.

Taxes are at historic lows therefore your worries are misplaced.

They are going up at the end of the year, assuming no congressional action, and no congressional action is a pretty safe bet with this Congress. Most alarming is that tax rates on dividends are looking to nearly triple from 15% to 42%+ for high income investors. Other taxes will rise in the 3-10% range, which might be 10-30% larger tax bill for some.

If you believe in Modern Monetary Theory, it probably seems all a bit unnecessary.

I predict that the Democrats will seek clever ways to tax our 401Ks, IRAs, and other investments.

They are so clever, it's already a done deal! (I don't want to rain on your parade, but you're paying tax on those things.) 401Ks already are taxed when you take the money out. IRAs are taxed before you put the money in. These are vehicles to encourage responsible saving and Democrats are likely to be solidly behind that. It helps keep social programs solvent by keeping wealthier people off their roles.

Now, *means testing* before you get social security benefits, that is something that the Democrats are likely to try! I'm sure they don't see much sense in making monthly social security payments to millionaires.

I also fear ignorant people who think that taxes won't matter to their investment returns and future well being.

Bah. It's not the end of the world. If you want, you can structure your investments into small cap / growth stocks that don't pay dividends. Your returns will then be entirely capital gains. You don't have to pay any tax until your sell, which is entirely under your control. You can curmudgeonly refuse to sell a single share for years until an administration you like comes into office. Even when you do pay taxes, it will be 20%, which is fairly modest.

Besides, I don't get all this hysteria and hostility about taxes. As charities go, the federal government is actually a fairly good one. It is far more effective at preventing murder and mayhem than all other domestic charities combined. It facilitates commerce through roads and rule by law, makes it possible to invest in markets, and gives us (read: prints) all the money that you are grumbling about having to pay taxes with. That's good stuff!

If you want a country with out a government, go look at Somalia. I just don't think that whatever line of business you are in will function all that well there, unless it is piracy. I'm sure you are much better off here, even with the ruinous tax rates.

Comments 1 - 40 of 71 Next » Last » Search these comments

Stocks are almost back up to where they were during the frothy days of 2007. There are still plenty of "Black Swans" around: European headline risk, China real estate, the usual geopolitical crap, and $4 gasoline. Anyone else getting nervous?

#housing