Buy A House For $213,000 If You Can Because Prices Will Only Go Up From Here

2014 Jun 23, 3:04am 29,285 views 61 comments

« First « Previous Comments 16 - 55 of 61 Next » Last » Search these comments

Lets say a new house costs $500,000 to build. The same model home built 5 years ago in the same area is available for $400,000. You, as a rational buyer will consider the $500,000 home as overpriced because there is hardly any difference compared to the $400,000.

Builders won't build in that scenario because their cost of construction is lets say $450,000, with no one willing to pay $500,000, the minimum price they need to make a reasonable return.

You could alternatively address why it costs $500K to build a new house -- i.e. increase supply of land available by loosening artificial restrictions on growth, lower permitting costs, have less restricting planning regulations, allow upzoning in combination with joining lots, etc.

You could alternatively address why it costs $500K to build a new house -- i.e. increase supply of land available by loosening artificial restrictions on growth,

Land is the number one cost in Coastal California.

Increasing supply by loosening restrictions on growth is a losing proposition by environmental conscious Californians. Like me.

lower permitting costs, have less restricting planning regulations, allow upzoning in combination with joining lots, etc.

That could work, but if they lower permit costs the pensions of the bureaucrats could get jeopardized.

Lets say a new house costs $500,000 to build. The same model home built 5 years ago in the same area is available for $400,000. You, as a rational buyer will consider the $500,000 home as overpriced because there is hardly any difference compared to the $400,000.

No, it's not the competition from existing houses because there aren't enough of those compared to the population growth. Builders are building less $500K houses because there simply aren't that many people who can afford them. Instead they should build massively at a much lower price, which obviously is possible since the MEDIAN price of a new home is $250K. But this isn't happening, and so kids are staying with parents, or taking roommates, since they are denied a house at a reasonable price.

Housing has been artificially made into a luxury item and most of the population standard of living has gone down dramatically as a result.

If anything, it's tough to get a loan these days

I don't believe it is. 30 yrs ago you couldn't get a loan without 20% down. Today you can get FHA loans with 3.5% down. Loans get all sorts of subsidies, government guaranties, etc...

The problem is NOT the availability of loans.

The problem is the price is too damn high.

It's really that simple.

Not at all.

Really? you can look at all actions the government take: they are all aimed at increasing household debts: direct subsidies on interest rates, government guaranties on debt, supply restrictions, tax breaks, etc, etc.... And that's true of housing, education, cars... pretty much any big spending people do.

If someone REALLY wanted to increase home-ownership, why not increase housing supply?

I can't thing of a single measure designed to increase the supply of housing.

They seldom ever go down.

Oh boy....

Glad you got the memo.

It's a good thing prices have only gone UP in past history, and no one has ever lost money on their "investment" any time in the past....

*

*

Oops... maybe not...

Where did I say prices only go up Call Crazy? I said "They seldom ever go down"

Which is true because prices are a lot lot higher then 20 years ago, 30 years ago, and in most places 2 years ago.

Give people longer time to pay (30 years vs. 10 years), artificially hold down mortgage rates and decrease down payments to 3.5% instead of 20%, and you get the housing market you have now...

What you are saying is that the way the mortgages are designed now are made to hide the real cost, and so allows people to buy at high prices.

This is true but the fact that there is (some) demand at these prices doesn't explain why there aren't more supply keep prices lower.

As it is, a lot of people are simply priced out.

You have like 6 months supply out in the marketplace now.... How much more do you need??

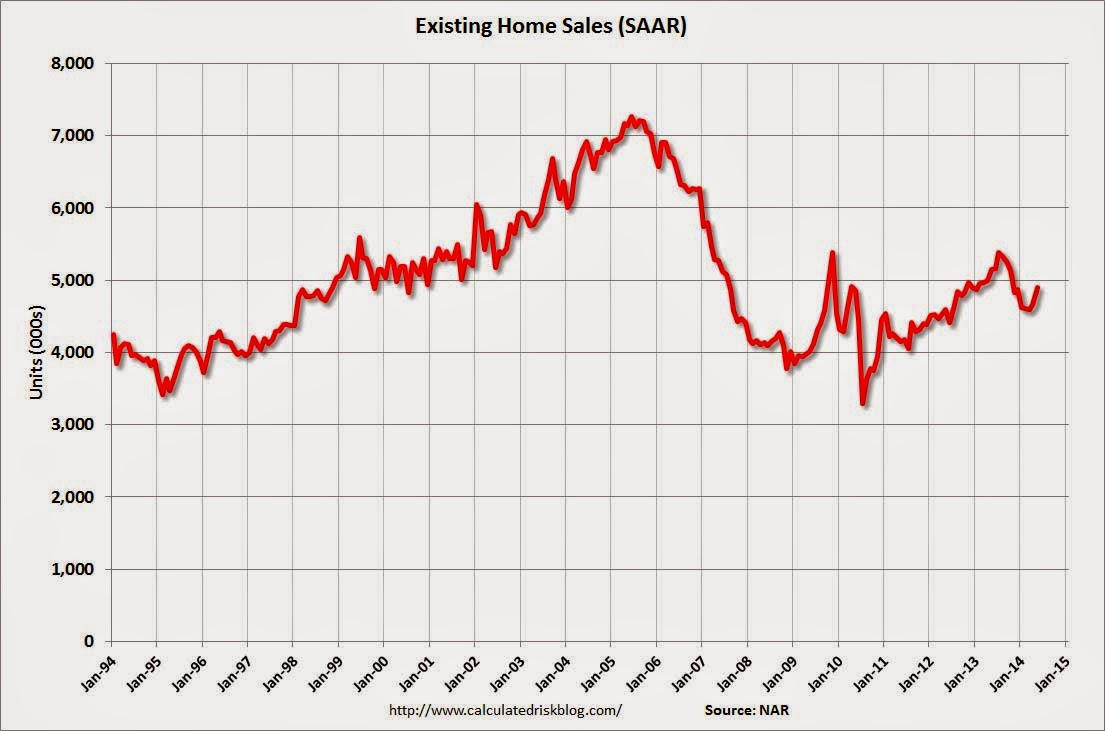

Sales of existing home are lower today than they were in 1999. That's 6 months of these low sales.

But with sales levels back to where they were in 1999, it appears that the additional inventory now has no effect....

More supplies means lower prices.

Obviously there would be more sales at lower prices.

Young people are not living with their parents because they like it.

There's another reason why houses aren't selling and it's not because we need more supply...

So why are rents going up?

There's another reason why houses aren't selling and it's not because we need more supply...

So why are rents going up?

Can't afford to buy or refuse to buy, so rent. Many out-of-state manage to get jobs in SFBA. Btw, I notice inventory for most cities in SFBA has been increasing (at a rate faster than similar period last year) since Jan.

Young people are not living with their parents because they like it.

They're living with their parents because:

They are carrying large student loans.

Their credit scores suck because they don't pay their bills on time.

They have no money saved for a down payment.

They have a crappy work and employment history which keeps them from getting approved for a mortgage.

They don't have the income to afford a mortgage

The current 6 months supply of houses or lack of inventory isn't the reason why they are living with mom....

You forgot they need jobs.

There's another reason why houses aren't selling and it's not because we need more supply...

So why are rents going up?

Because they can, as landlords know their tenants don't have the cash to buy a house... it's a captive audience, that is, unless you want to live in mom's basement or a refrigerator box under a bridge...

Or a tiny house. Its six one way half dozen the other.

They are plastering San Francisco financial district/south beach area right now with cheaply built condos in record time. The traffic is already collapsing, throw in a giants game and it's gridlock, just in time for cannibal anarchy.

Call it Crazy,

I think that AF talked about house prices should be at 1974 levels.

If one carries the latest C/S points level back in time they hit around 1974.I carry the points back to ~1893.

Damn me,I've been talking about offering 10% of list.If one uses the 1893 point,then I'm one of the idiots that would overpay.LOL

Young people are not living with their parents because they like it.

They're living with their parents because:

They are carrying large student loans.

Their credit scores suck because they don't pay their bills on time.

They have no money saved for a down payment.

They have a crappy work and employment history which keeps them from getting approved for a mortgage.

They don't have the income to afford a mortgageThe current 6 months supply of houses or lack of inventory isn't the reason why they are living with mom....

The lack inventory also cause rents to be higher than normal.

They can't buy. They can't rent. Better stay in that high-school room.

The only thing that made housing unaffordable are "payments".

Your presumption is it's all leverage but this is not that simple.

Free market works: given a supply of labor with stagnant wages that can build houses, and if there was no other restrictions, higher prices would just lead to more construction, at prices relatively aligned with labor wages. I.e. this would automatically realign prices with wages level.

This is in essence what happened in 2007 with the bust in the US: a lot of construction happened and prices fell.

This is not happening now. Housing went up faster than wages. This has to be because supply is constrained in some ways.

And this is consistent also with the fact that rents went up.

If anything, it's tough to get a loan these days

I don't believe it is. 30 yrs ago you couldn't get a loan without 20% down. Today you can get FHA loans with 3.5% down. Loans get all sorts of subsidies, government guaranties, etc...

30 years ago, you could save up for 2.5 years and buy the house outright with dad's salary while mom stayed home and raised the kids.

3.5% down, get's you the opportunity to pay $400 a month for the priveledge.

So let's do the math.

The house is a shithole, 3/2 that costs $500k.

Since you can't afford the $100k downpayment, you must pay $400 a month PMI to put $20k down.

Now you have a $500k loan (instead of a $400k loan). You also pay $400 more, so it's actually the monthly payment of a $600k loan.

That's how 'easy' it is to get a loan.

30 years ago, you could save up for 2.5 years and buy the house outright with dad's salary while mom stayed home and raised the kids.

Where was that??

30 years ago, you could save up for 2.5 years and buy the house outright with dad's salary while mom stayed home and raised the kids.

Where was that??

Most of the US including Los Angeles suburbs like Burbank and Culver City.

I actually addressed this very issue on other real estate forums when people started denying what homes actually cost in LA in the mid to late 90's. Things like a house in West LA going for under $200K in 1997 and not being an exception. Houses in Burbank at $200-250k as recently as 2001. There are sales histories to back this up as well. So say an engineer made $90k a year at that time...not an uncommon salary in the El Segundo aerospace companies....it would be very easy for him to support a family on one income AND buy a house in the area, while of course living frugally. In fact, even the DP would not be out of reach due to the lower nominal cost. Likewise condos went in the low hundreds, not out of reach for people like postmen, teachers, etc.

It used to be very easy to search histories on Redfin by simply clicking on random homes in post war neighborhoods, but for some reason many of those histories are no longer there.

Where was that??

My parents bought their house in 1974 for $10k

My neighbor bought his house in 1970 for $25k.

He said he made $400 a week at the GM plant (not Tesla) in Fremont.

He said the government gave him an interest free loan (Veteran) for ~$18k.

Where was that??

My parents bought their house in 1974 for $10k

My neighbor bought his house in 1970 for $25k.

He said he made $400 a week at the GM plant (not Tesla) in Fremont.

He said the government gave him an interest free loan (Veteran) for ~$18k.

I realize that's 40 years ago, but my neighbor was a union guy putting together cars.

My father was a mechanic, and my mom was a housewife.

I live in the bay area now. I make 92% more than all other Americans and I have no chance.

None at all.

He said he made $400 a week at the GM plant (not Tesla) in Fremont.

He must have a bad memory. Everything I can find shows autoworkers making about $4/hour or $160/week in 1970. That's before OT obviously, but nowhere near $400.

http://www.detroityes.com/mb/showthread.php?14529-automotive-wage-history

I realize that's 40 years ago, but my neighbor was a union guy putting together cars.

And it's also fiction.

He said he made $400 a week at the GM plant (not Tesla) in Fremont.

In 1974? I don't believe it. I've heard more like $250/week for 1975, so either he worked a lot of overtime or just doesn't remember correctly.

30 years ago, you could save up for 2.5 years and buy the house outright with dad's salary while mom stayed home and raised the kids.

This original claim sounds very questionable to me. 2.5 years sounds very fast if we're really talking about savings.

If you're buying with a mortgage, which is what the majority of people do, the price you pay is directly tied to what your income allows..

Assume for a minute you can produce new widgets at will for $250K.

Explain why financing and "what your income allows" can drive the price of an existing widget to $500K.

Financing is a necessary condition for prices being where they are. It is not a sufficient condition.

This is in essence what happened in 2007 with the bust in the US: a lot of construction happened and prices fell.

No, the bust happened because many people got mortgages and HELOCs that they couldn't afford

Yes and also because there was a slight bit of overbuilding around that time.

Some people who bought should never have bought and their houses should never have been built.

Assume for a minute you can produce new widgets at will for $250K.

Because you can't produce them "at will". Sure--you can build a lot of houses. But you can't build them where people want to live.

Assume for a minute you can produce new widgets at will for $250K.

Explain why financing and "what your income allows" can drive the price of an existing widget to $500K.No, the bust happened because many people got mortgages and HELOCs that they couldn't afford and there was a lot of game playing by mortgage companies...

You haven't explained why financing alone can raise the price of a readily available commodity.

geography is BS: as an example you can take a map of the SF peninsula and find lots of places that could be built and aren't.

It's not really BS. There may be some areas that are buildable, but people bid up prices on specific neighborhoods or cities because supply is limited.

Because you can't produce them "at will".

We could build them in large quantity.

Though obviously we aren't.

It's not really BS. There may be some areas that are buildable, but people bid up prices on specific neighborhoods or cities because supply is limited.

Other people would buy in more affordable neighborhood - if they were built at all.

Is it me or does the image (#4) highlights exaclty why you should be buying land in San Francisco, penninsula. It is literally, Ocean, seaside, mountain range, a teeny valley that is 3-7 miles wide and then the bay.

based on the image, I would buy in the south side of SFO, say San Bruno.

Compared that to say Fresno, Sacramento, Denver or even Dallas.

25% price drop from last; 45 percent drop from peak:

http://www.zillow.com/homedetails/26804-120th-Ave-SE-Kent-WA-98030/48829249_zpid/

And yeah it's really precious to grow flowers in an area of ultra high real estate prices. We really MUST keep that. I wonder why Manhattan doesn't have it.

It's called Central Park.

Our beloved Ducky said: Nearly all the neighbors I knew growing up are still living there. They will not give up their quiet estate properties until they are pried from their cold dead hands. Literally.

LaMorInda (emphasis on MorInda) inventory is up over 50% year to year. Admittedly, coming off all time lows, but at least some folks are getting out while the gettin 's good.

LaMorInda (emphasis on MorInda) inventory is up over 50% year to year.

To be fair, he may be talking about only The Bluffs, and not Moraga overall.

He must have a bad memory.

Guys,

He has a horrible memory. We have been over this before. He said he made $4k a month.

I believe the home price in 1970 and the VA loan.

He has a horrible memory. We have been over this before. He said he made $4k a month.

I know we've been over this before which is why I'm surprised you used that example again. Why keep repeating something you know is incorrect?

Second, the ecological (not geographical) argument is a pathetic thin veil hiding the most self-serving NIMBY mentality not to mention the ruthless willingness to extort new comers.

The desire of building of massive amount of homes in the bay, wetland, golf courses, hillside is an IMBY mentalality not to mention ruthless willigness to screw current residents who value the bay, parks, hills and wetlands.

« First « Previous Comments 16 - 55 of 61 Next » Last » Search these comments

More "pile-in before it's too late" mentality. Any thoughts?

Of course, most of us MIGHT buy if we had that price point available around here (SFBA). Oh well.

http://www.businessinsider.com/rupkey-home-prices-will-go-up-from-here-2014-6?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+clusterstock+%28ClusterStock%29