patrick.net

An Antidote to Corporate Media

1,363,560 comments by 15,734 users - Patrick, stereotomy online now

« First « Previous Comments 58 - 97 of 150 Next » Last » Search these comments

"The time has come". So you become a homeowner means it is time for every body? LOL.

And if the market goes down further - so what? If I don’t buy, I still have to pay the rent,

LOL. My rent is under $20,000/yr. Prices are still falling $20,000/yr. Free rent, sucka!

Troy, you made my day! Only problem? I have a hard time to explain this to people(including my wife) who pushes me to buy.

“The time has comeâ€. So you become a homeowner means it is time for every body? LOL.

Yes, absolutely, I signal the bottom! You got it! Haha...

It sounds like you believe prices will continue to fall and want to wait until you think we are at the bottom

Josh is kinda rare, being in such a strong cash position. Given that further declines may in fact come from stricter lending regimes like the re-institution of 20% down for non-VA buyers (or even 30%), and/or conforming limits being lowered $100,000 later this year, I don't think he needs to be in any hurry to buy.

Someone with more reliance on credit may find it advantageous to buy now, but I dunno. It's always perilous to try to time bottoms, but ceteris paribus this chart:

http://research.stlouisfed.org/fred2/series/SPCS20RSA

is not exactly screaming BUY now.

“The time has comeâ€. So you become a homeowner means it is time for every body? LOL.

Yes, absolutely, I signal the bottom! You got it! Haha…

Wait 12 more months and you will be underwater. You should have got another rental.

“(20%down 30yr loan)†- welcome to indentured servitude. 30 Years is a very very long time.

When was a 30 year mortgage not the norm?

I think the idea is to be out of a Mortgage before the loan comes to end. Either by paying down or refinancing after 10 to 15 years in. Thirty years is a long time to build and destroy equity.

When was a 30 year mortgage not the norm?

I don't think 30 year notes have been around for more than 50-60 years or so... I believe it would be more relevant if we knew what mortgage lengths have been historically.

That assumes falling prices. I don’t think anyone would disagree with you that if prices continue to fall, renting is better. That has nothing to do with your point that 30 year mortgages are indentured servitude.

And that’s what I’m counting on. Prices will continue to fall.

Back to the 30 year debt trap: If prices are falling say $18k/yr and rent is $18k/yr - wouldn’t you rather wait till what YOU WANT came on the market at a price you were willing to pay cash for? I would. Bottom line: if you can’t afford a home that you would live in, unless you finance it out for 30 years, you’re in over your head. Save a DP, and grab a 15 yr. note.

In a few years, you’ll probably wish you’d have waited because you’ll be able to buy a much nicer pad for what you paid today - or had invested your cash differently. How many people on this board purchased when they thought it was bottom? How many bottom calls have there been by so called professionals?

And that is what’s happening folks, now that the tax credits expired, we’re seeing price cuts/drops, still high unemployment, shadow inventory, record foreclosures in 2010… Really, you think that crap is going to magically work itself out of the system in a few short months?

Nope.

Of course if we go Zimbabwe style, I’m heavily hedged in metals - which have performed well. I don’t look at mortgage rates - I look at the bottom line price. I’m a cash buyer - which is why the bottom line price is the most important number in my book - not a monthly payment. I’d rather pay rent and watch prices fall, and pay outright for what I feel is a fair number for a property.

Your statement of someone needing a 30 year loan otherwise in over his head is either hyperbole or just factually wrong. Not really worth arguing.

The argument about where prices are going has been discussed plenty; we'll see.

If you are hedged in metals to the tune of several hundred thousands of dollars, then you are quite unique, and I don't think your situation applies to most. Similarly, if you are a cash buyer (even though earlier you said your minimum was 50% down), then you again are special. Realistically speaking, in the BA, telling people to wait until they have 50% down, could mean they never buy, which for some is the correct way to go. For others who can put 20% down and use a 30-yr mortgage, they will do just fine, and much better than those who wait if we have high inflation in the near future.

Similarly, if you are a cash buyer (even though earlier you said your minimum was 50% down)

This was my quote you are referencing.

My personal stance - is put at least 50% down, have at least 6 months of cash backed up in the bank, and pay your debt off as quickly as possible. Some of us are just flat out allergic to debt. In which case, when I’m ready to buy/find what I’m looking for - I won’t have a mortgage or pay interest to a bank.

Yes, I plan on paying cash for a house. My point was that if you NEED to take out a mortgage, put down 50%, hell, even 20% would be better than what most people are putting down today. Have a cash reserve. Don't be up to your eyeballs in debt. Have a plan on paying it off. 30 years is a long time to slave away to the bank.

then you again are special.

That's annoying. My wife and I've just learned to save. Do you shop sales? Clearance racks? Drive older cars? Live on a budget - and don't cheat? Use credit card points for Christmas ? It all adds up believe it or not. Do you live below your means? I do NOT make six figures, my wife works part time and yes, I have kids.

If America could get past what they want vs. what they need.... or what they need vs. what they can afford, more people would be in a better position. You'd be amazed at how much you can save if you stick to a budget.

That’s annoying. My wife and I’ve just learned to save. Do you shop sales? Clearance racks? Drive older cars? Live on a budget - and don’t cheat? Use credit card points for Christmas ? It all adds up believe it or not. Do you live below your means? I do NOT make six figures, my wife works part time and yes, I have kids.

If America could get past what they want vs. what they need…. or what they need vs. what they can afford, more people would be in a better position. You’d be amazed at how much you can save if you stick to a budget.

You being special - That's a compliment. Not sure why it's annoying. When you can do something that 90% (or whatever the number is) of the country can't do (ie buy a house with cash), you are special. It doesn't matter how you got to that position, it's still a position different from most.

I believe you said you used to own and now are renting. Did you profit on your sale? Is that how you now have a large down payment or is it really from coupon clipping? In the BA, you're gonna need a lot of coupons to be able to buy a $1M house in cash.

30 years is a long time to slave away to the bank.

I UTTERLY disagree with this idea since it is ENTIRELY counter-factual and easily falsified by looking at how borrowers have fared in the past, anytime from 1950 to now, with just a few exceptions at particularly poor times to buy (late 80s, mid-2000s).

I think looking at the ACTUAL (albeit estimated) costs over the life of the loan gives a better basis for decision than this morality play and the 'inherent nobility of thrift' crap.

On a $450,000 loan with 3.5% down, the total after-tax interest cost will be $300,000. (This includes 10 years of PMI).

So we get an average monthly cost-of-money of $800/mo over the life of the loan. Buying doesn't look to bad when we actually look at the costs like this!

Property tax will consume $300/mo, and 'other' expenses will be $400/mo, for a rough average outgo of $1500/mo over the life of the loan.

Interest and taxes for the first 10 years of the loan average out to $2000/mo, fall to $1400/mo for the next 10, and are $900/mo average for the last 10.

The "working for the bank" element is $1100/mo starting out and falls to half that after 20 years.

That's pretty good, having the interest burden fall as the loan ages, given the past history of 3-5% inflation every year.

If I take out this loan now I know my housing expense will be $1600/mo in 2026. What will rents be then? If history is any guide they will be much more than that!

So over the LONG term, buying now doesn't seem to be any worse a deal than renting.

“The time has comeâ€. So you become a homeowner means it is time for every body? LOL.

Yes, absolutely, I signal the bottom! You got it! Haha…

House got appraised (from Wells Fargo) for 11% more than my salesprice..I won't be underwater...but like I said...even if I was, it does NOT matter...because my payment is what rent would be like - if I rented a house like the one I bought, I would pay $3000/month for it...not sure how that would be better...that's the whole point!

Wait 12 more months and you will be underwater. You should have got another rental.

“The time has comeâ€. So you become a homeowner means it is time for every body? LOL.

Yes, absolutely, I signal the bottom! You got it! Haha…

Wait 12 more months and you will be underwater. You should have got another rental.

Sorry about the quote mistake above...here is the text ...

House got appraised (from Wells Fargo) for 11% more than my salesprice..I won’t be underwater…but like I said…even if I was, it does NOT matter…because my payment is what rent would be like - if I rented a house like the one I bought, I would pay $3000/month for it…not sure how that would be better…that’s the whole point!

“The time has comeâ€. So you become a homeowner means it is time for every body? LOL.

Yes, absolutely, I signal the bottom! You got it! Haha…

Wait 12 more months and you will be underwater. You should have got another rental.

Sorry about the quote mistake above…here is the text …

House got appraised (from Wells Fargo) for 11% more than my salesprice..I won’t be underwater…but like I said…even if I was, it does NOT matter…because my payment is what rent would be like - if I rented a house like the one I bought, I would pay $3000/month for it…not sure how that would be better…that’s the whole point!

Personally, I don't trust appraisals when buying. I don't like how they use your offer price to do the appraisal. Do an appraisal without knowing what you need it to be, then I'll believe it.

As far as why renting would be better...Apparently, you aren't factoring in the guaranteed price drops coming for the next 1, 3, ??? years.

You being special - That’s a compliment. Not sure why it’s annoying.

I thought it was a sarcastic comment - my apologies.

I believe you said you used to own and now are renting. Did you profit on your sale? Is that how you now have a large down payment or is it really from coupon clipping? In the BA, you’re gonna need a lot of coupons to be able to buy a $1M house in cash.

No, I actually lost $5k - back in the Dallas Fort Worth area (we sold before moving to CA). It was about that time I completely lost my appetite for debt - we had a low 30 yr. fixed - and after one year of payments, the balance only went down a grand because we over-payed every month.

From this point on, we really took control of our finances - bailed on the stock market - and decided to make decisions based on personal conviction, rather than what is/isn't popular. It's worked to our advantage. I drive a beater, my wife saves us $200-300 + month from our original food budget, and we lived in a very small, low end property for a a few years - it was just recently, we decided to rent a much nicer place. Small sacrifice for a few years to really sock some cash away.

I'm not in the BA - just south of Santa Cruz in Monterey. I'll consider purchasing in Marina/Seaside since you can get a 3/2 for $200-300k. But it really depends on what happens in the future - where life takes us.

joshuatrio says

30 years is a long time to slave away to the bank.

I UTTERLY disagree with this idea since it is ENTIRELY counter-factual and easily falsified by looking at how borrowers have fared in the past, anytime from 1950 to now, with just a few exceptions at particularly poor times to buy (late 80s, mid-2000s).

That's fine. Look at your lifespan.

i think it's pretty well documented that real estate market goes in cycles.

It will be obvious once we come out of this down cycle.

It seems obvious to me that being bullish is a no brainer right now eventually I will be proven right. Whenever something is at "all time highs" or "all time lows" best odds are to be on the other side of that trade.

Personally, I don’t trust appraisals when buying. I don’t like how they use your offer price to do the appraisal.

That was my take, the appraisal saved me 10K. But in this neighborhood at the time, the most houses that were being sold at the time I had it appraised. The average sell price was 45K, 2br 1000sqft foreclosed houses. The local Real Estate agents really tried to squeeze those houses out for 220K, but in the end investors got them wholesale, and it dragged the rest of the community down with them. At the time I bought, my house was the biggest house sold in my neighborhood since the crash. There wasn't any thing really comparable to compare it to.

It had recently been reduced from 199 to 170, I really expected the Appraiser to tow the line and give me some soft number in the middle.

i think it’s pretty well documented that real estate market goes in cycles.

It will be obvious once we come out of this down cycle.

Does this look like any cycle to you ? Reminds me of 2000 when tech stock blew up...

some said "It will come back" and the dot.com stock were going to fly up again (Jim Crammer) LOL!

Personally, I don’t trust appraisals when buying. I don’t like how they use your offer price to do the appraisal. Do an appraisal without knowing what you need it to be, then I’ll believe it.

As far as why renting would be better…Apparently, you aren’t factoring in the guaranteed price drops coming for the next 1, 3, ??? years.

Like I said - I don't care about price drops - I have savings to cover my lifestyle + mortgage for 2 years for the worst case scenario (no job)...my family has to live somewhere and we are not enslaved to a landlord that can raise the rent any time when he wants to - my payment won't change and I am comfortable with it...once again, you got to live somehwere!!

You on the other hand are subject to a massive rent increase over the next 1, 3, ??? years...and with coming inflation, I would be very worried about that because there is nothing you can do but move out - then what?

i think it’s pretty well documented that real estate market goes in cycles.

It will be obvious once we come out of this down cycle.

Does this look like any cycle to you ? Reminds me of 2000 when tech stock blew up…

yes even using the flawed FHFA chart

you can see the cycle folllowing a long term up trend.

SubOink: Congats! Ignore the hatererz! Which city in LA did you buy in?

Ive been waiting 5 years to buy in. Only 'BFE high dessert' has come down enough IMO.

Whenever something is at “all time highs†or “all time lows†best odds are to be on the other side of that trade.

The problem is that the recent highs were in fact very high, and it's unclear what's going to happen with the present economy, which is still on massive life support from the Federal government -- $1.5T/yr deficits for the rest of the decade.

http://research.stlouisfed.org/fred2/series/SPCS10RSA

People look at this and say "goody! 1970s inflation is coming!" but this is not the 1970s with the economy expanding at +5% right in the teeth of the inflation.

If inflation comes now it's just going to kill more jobs!

This is largely because we have locked-in so much of our spending into chasing high land values, thanks to low taxes, low interest rates, lax lending oversight, and the speculative premiums we were willing to pay to get on the housing gravy train.

We can easily readjust our personal budgets to stay solvent even with higher energy costs, higher taxes, higher health costs, higher food costs, higher retirement contributions, etc.

But it's all gotta come out of either higher wages or land prices in the end. If we raise the cost of living $1000/mo, a lot of that is going to come out of rents and land values.

That's my thesis and I'm sticking to it : )

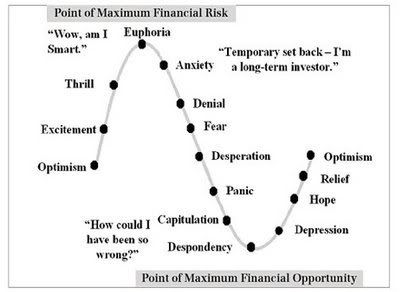

So Thomas in your opinion where are we in this chart?

Of course most bears will say we are still in the denial stage. :D

yes even using the flawed FHFA chart

you can see the cycle folllowing a long term up trend.

Knife catchers delight, young grasshopper! ... ready to be shashimi'ed.

So Thomas in your opinion where are we in this chart?

Of course most bears will say we are still in the denial stage.

We dont have a housing cycle ! We do have a housing bubble.

A chart of emotions! Oh great! Looks more like a some womens PMS cycle!

SubOink: Congats! Ignore the hatererz! Which city in LA did you buy in?

Ive been waiting 5 years to buy in. Only ‘BFE high dessert’ has come down enough IMO.

Haha...the haterz...LOL. Agoura Hills.

If inflation comes now it’s just going to kill more jobs!

Correct... either some are too stupid to understand this, or just dont give a damn!

these threads will be fun to dig up about 2 years from now. I hope patnet is still around by then. Maybe I should donate just for the satisfaction of bumping some of the bearish predictions you guys had in 2011.

@Troy

>This is largely because we have locked-in so much of our spending into chasing high land values, thanks to low taxes, low interest rates, lax lending oversight, and the speculative premiums we were willing to pay to get on the housing gravy train.

Of the things I agree with you on, I espcially like the fixed tax on land, which doesn't increase with improvements made.

“The time has comeâ€. So you become a homeowner means it is time for every body? LOL.

Yes, absolutely, I signal the bottom! You got it! Haha…

Wait 12 more months and you will be underwater. You should have got another rental.

Sorry about the quote mistake above…here is the text …

House got appraised (from Wells Fargo) for 11% more than my salesprice..I won’t be underwater…but like I said…even if I was, it does NOT matter…because my payment is what rent would be like - if I rented a house like the one I bought, I would pay $3000/month for it…not sure how that would be better…that’s the whole point!

So you think negative equity is better than rental?

So you think negative equity is better than rental?

Negative Equity just like positive equity doesn't matter unless you sell the house...you just pay the mortgage every month just like rent. Negative Equity never last forever. So you have a few years where your house is down a bit - so what...do you think your negative equity chases you around garden and comes to haunt you...

Renting is like having NO equity and that is forever and will always stay at 0 with a balloon payment that only goes up. You think that is better?

To clarify further:

- Mr. A bought a house and is underwater 50k...his mortgage is $3000/month

- Mr. B rents for $3000/month

Lets say the real estate market NEVER recovers...stays exactly where it is.

in 30 years...

- Mr. A is done paying his mortgage and owns the house, no more payments, enjoys his retirement

- Mr. B pays rent adjusted for inflation and eats up his savings just to pay the rent...until the day he dies

And that's with the most unrealistic premise, that the market would never recover - Do you get the point?

Now that you have bought you'll never admit it is/was a mistake to buy in current market in LA. Every person that buys nowadays have the same mentality. It was the same way for those who bought in 2006. Congrats on your purchase. :)

Yes, Roberto..he buys it for 50k later and saves 20% of 50k = 10k in downpayment but spent 36k in rent that year of waiting...or in the case of 3 years waiting he spend almost 100k on rent before buying - WOW! BIg savings!! ...

LOL! :)

SubOink,

I bought and I stopped posting as I believe the perma-bears don't enjoy people rubbing it on them. I also bought cheaper than I rent. I rented from 2006-2010 and I am done. Now, my mortgage is about the same as my rent used to be, bigger place, amazing view and no landlord bullshit. My wife and I feel so much better having our own place. I am expecting a baby boy so that's another reason. Price I bought $550k, 4.5%, no HOA, mello roos. I think it's still wrong to buy expensive house because the downside is too bad to bear, but if the price is reasonable compare to rent, go for it.

Just my 2 cents,

Masayako

Hey do what you feel you should, but for me renting stays fluid as the coming changes in our monthly budgets that are coming (in the blink or gradually) as our food costs go up and up, and our taxes, and our fuel costs and health care, then I see rents will adjust as will home owners, only difference will be how they adjust, renters will adjust of course with rents, while home (money renters) owners are tying themselves in to a price adjustments. so I don't see the upside in renting money (buying a home) when renting a ever changing living area able to adapt and change with current events and expenses a much smarter fit. But hey that is why we have 31 flavors of ice cream, to each his own, I wish you well and happiness and maybe your home office will be such a positive mood elevator for you that you will make more money then you MIGHT lose by having it in YOUR house. Enjoy and I am going to enjoy several places to explore and live.

Btw, Nouriel Roubini the biggest bear of all times, if not THE bear...just bought a place in NY. He makes a living on being the doom and gloomer for 20 years...how come he is not renting?

He makes a living on being the doom and gloomer for 20 years…how come he is not renting?

We went over this before here, but the income profiles of the 'big swinging dicks' of Manhattan are a bit different than the future buyers of the millions of surplus shitboxes strewn coast to coast.

There WILL be inflation this decade -- trillions and trillions -- but it's entirely likely 90% of it will captured by New York, OPEC, ie the top 10% that already own 90% of this country.

I don't know how many millions of dollars he has, but whatever his fortune is his buy of a Manhattan luxury condo is neither here nor there to him financially or to the larger debate of where middle-class home values are going.

It's amazing just how much money doom and gloom can make you, isn't it?

« First « Previous Comments 58 - 97 of 150 Next » Last » Search these comments

Every broken clock is right every 12 hours...

If you keep being a doom and gloomer...you will be right at some point, if you are bullish you will also we right.

I have been a bear on real estate ever since 2003, when we first looked into buying and got terribly frustrated here in LA, not to sound like a broken record but of course all realtors were laughing at me, CA would NEVER crash...maybe level out...yeah right, I don't call a 35% drop leveling out - I was stubbron back then and I am very happy to have waited it out...the fact is though...I have lived in a crappy rental for 6 years, landlord is a pain in the ass, I work from home and would love to setup a nice office alla new floors, cabinets, possible break down a wall and extend - all the things I cannot do in a rental. I am in escrow now on a much much nicer house (w/pool), even better neighborhood and my mortgage is going to be only slightly higher than my rent is. (20%down 30yr loan) -

I don't care what anybody says...I don't see how that is not a no brainer. And if the market goes down further - so what? If I don't buy, I still have to pay the rent, in essence I am still paying a mortgage, somebody else's mortgage because I have to live somewhere. I'd rather pay my own. Been on the sidelines way too long. We rented a really nice house for a while in 2003...then the landlord had to sell - BAM, we had to move. Totally sucks living with that uncertainty! And moving sucks anyways...

Funny Thing is...I have kept all 45 listings that we looked at in 2003 and just looked them up on zillow and guess what...that's exactly where we are now here in LA. 2003 prices. Amazing!! Of course, back then I didn't have the downpayment like now so it still helped to have rented all these years.

Don't be a bear forever! I have a few older friends that have been bearish on real estate for 30 years...I almost became one of them :)

Buy a house for the right reason - because you need a place to live. If you are waiting for the market to be at the very bottom then you are speculating just like you would with a stock. That mindset is what has caused the bubble in the first place. Don't expect to make big money with your home. Buy it so you have a place for your kids to grow up. And once its free and clear in 30 years, the kids can have it and rent it out and get a head start like some of you in this forum who were lucky enough to inherit a rental prop.

…Deals are out there!

The only person I feel bad for is the next tenant in this crappy rental house with a landlord that hates to fix anything...but there is always a sucka out there. I was that sucka for a long time...

Now, go and buy a house! The time has come.

#housing