patrick.net

An Antidote to Corporate Media

1,360,698 comments by 15,738 users - Al_Sharpton_for_President online now

Comments 1 - 17 of 17 Search these comments

IMO, all houses are priced at the ability to pay, and this is somewhat orthogonal to "inflation" as commonly noted.

This chart:

http://research.stlouisfed.org/fred2/series/MORTG/

shows how 30 year mortgages have fallen from ~7.5% in the 90s to 5% right now. This may not seem like much but $250,000 house at 7.5% has a PITI of $2100, while that same PITI buys a $310,000 house with the current 5% rates. That's almost 25% appreciation due to nothing but the lower cost of money!

The best gauge of an area's inherent ability to pay is area rents. Are they up or down from 1999?

(Past) Inflation, pools, etc. don't mean anything. The only thing YOU have to worry about to get the house is who is bidding against you and what their bid is (and these bidders includes renters). Beat their bid(s) and you get the house.

What does $550K buy in the area? How is the job situation looking over the next 10 years? Does the owner have the option of renting out the house for more than your bid is worth? $550K is pretty high . . . even with high employment if the Bush tax cuts actually expire next year, and/or if more taxes appear (unlikely but humor me), purchasing power on the high end will be reduced and prices will have to come down in response.

I'm not going to judge whether $550k is a reasonable offer. But what I DO know is the investor won't accept $550k because realtors would take 6% of the sale price ($33k). That leaves him with $517k in his pockets. I'm pretty sure the pool addition costed more than $2k. Plus he'd like to earn something for his efforts.

I do not look at flipped houses.

Keep in mind the investor paid about $3k in property taxes while holding this inventory. He would have to sell at a loss to you for $550k.

^ What one likes and what the market bids are not necessarily the same thing.

In this area (northwest suburbs of Chicago) 550K buys semi-luxury homes (4b/4b, 1/4-1/2acre houses). Prices have been dropping steadily for the last year. This particular house actually started listing at 679K a couple months ago but dropped 59K since then. Rents are around $2500-3000 for this type of home.

I just checked and it appears that the house is under contract now. Oops! Too bad!

But how can you tell if the investor made a good decision or bad. I mean it is an investment. It could go either way. You shouldn't have to always pay what investor is asking for.

True, the investor may have made a bad choice. But he's going to fight a little bit about the price before he is willing to accept the fact that it was a bad decision. He might actually try to drop the price to $599k and put it on the market before accepting a $550k offer.

The Bubble did not put the in "Inflation" indicators on pause, while the market went awry.

The Bubble took the market on a roller coaster ride, it soared as much as 30 years equity in 4 short years.

It crashed!

There's no reset button, no "Do over" switch, there's no Mulligan.

The Market will bare what people will pay for it, and not a penny more.

If you need a time line to plot exposure against inflation vs the mean value, you wont find it.

The market(All of them) will uptick with stable healthy growth. When out side forces stop intervening and setting invisible indicators that only exist in sellers psyche.

I'll buy when when I see a house I think is worth what they are asking.

AAMOF In my town, I don't think the houses are worth '99 prices. For what I would have paid in '99, I don't think I would pay the same today. Way to many amateurs and not so handy DYI homeowner repairs, has killed the value of the houses. IMO.

Before the bubble Void dirt lots, and dreary color gray and brown schemes, with zero landscaping, and all bad shoddy workmanship, would have destroyed values. Just saying you did repairs during the bubble added value.

Every home I've seen to date, has been seriously inflected. From mismatch pop fetish permanent additions fixtures, and arbitrary walls removed. People trying to make silk purse out of sows ear.

1200 sqft homes with Mansion appointments. In ten years it will far worse dated than any late 60's early 70's Avocado, Lime green and powder blue scheme.

I think this point is being skipped over because of the Market uncertainty. But when the smoke settles, and a closer look it taken at real estate across the board. New red lines will be drawn in every City and town in America. If they Lowe's and Home depot crazy as south Florida did.

"Chinese Dry Wall Deco" Sums up the whole "2000's" decade.

The house price has nothing to do with the inflation.

It is related to wage and interest rate.

I guess what he meant was that since there was inflation, wages subsequently went higher, therefore a higher dollar amount can be spent towards PITI.

If you believe Case Shiller, then house prices have tracked inflation pretty well. I don't necessarily agree with them, but they do have lots of data

Hi,

I have always wondered how we can "evaluate" what a house is worth or what is its fair value. The bubble has taught us that "market" or what someone is willing to bid for an asset is not what that asset is worth. Problem with using inflation is that I only find a national number for inflation whereas real estate is very local and sensitive to local incomes (If a Google pops up in your neighborhood then it doesn't matter how low inflation is, prices are going to sky rocket). Inflation has also been artificially low last decade due to China's currency manipulation allowing cheap imports. So I don't really trust using inflation.

The best indicators I feel are income and rent. However, I cannot find a rent to price chart over last 25 years for Bay area or California, or the income to price ratio chart over last 25 years for Bay area etc. If somebody has that data I would be really grateful to see it. And then there are things you cannot estimate like an Earthquake.

I also feel the best days of most prime Bay areas (in terms of income growth) are behind it. Income growth is what drives home prices. What do folks think will be the new areas to see most income growth? A friend of mine says that the rich will always get richer at a faster pace then others and so believes the prime areas are always best bets.

"I don’t necessarily agree with them, but they do have lots of data"

Are all of the inverter wholesale deals going in that index?

Which houses are tracking the inflation curve, the ones that "Count"?

A friend of mine says that the rich will always get richer at a faster pace then others and so believes the prime areas are always best bets.

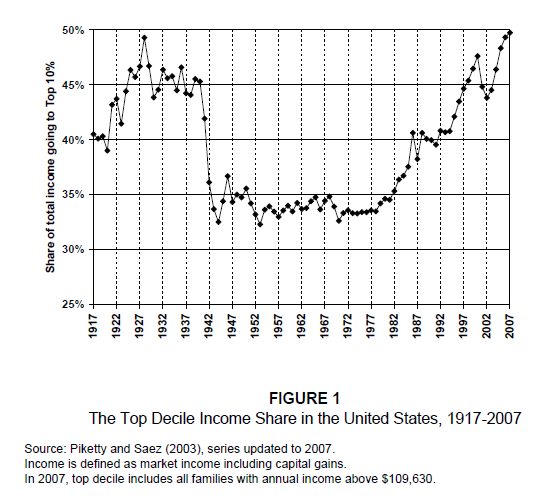

This has been the trend since the 1980s but it is possible that the macro situation will reverse and financial landscape of the rich will start changing back towards the very high taxation levels of the postwar era. Here's a chart:

perhaps the secular trend here is topped out and a reversal is coming?

Chances are low given how well the masses have been inoculated against teh socialism, but should the Left arise again, things might change. It's not income that matters, but *after-tax* income. Once Bush v Gore was decided I shoulda ran out to buy a house that night in PA or Los Altos. I see now, but totally failed to see then, that juicy tax cuts for the wealthy could only have one impact on home prices: UP.

I have always wondered how we can “evaluate†what a house is worth or what is its fair value. The bubble has taught us that “market†or what someone is willing to bid for an asset is not what that asset is worth. Problem with using inflation is that I only find a national number for inflation whereas real estate is very local and sensitive to local incomes (If a Google pops up in your neighborhood then it doesn’t matter how low inflation is, prices are going to sky rocket). Inflation has also been artificially low last decade due to China’s currency manipulation allowing cheap imports. So I don’t really trust using inflation.

The best indicators I feel are income and rent. However, I cannot find a rent to price chart over last 25 years for Bay area or California, or the income to price ratio chart over last 25 years for Bay area etc. If somebody has that data I would be really grateful to see it. And then there are things you cannot estimate like an Earthquake.

You will struggle to try and price houses based on broad income or inflation numbers. Your best bet is to simply use rent. Try to figure out what a given property would rent for by looking at rentals in the area.

House prices should run between 150-200 times monthly rent with the "prime" areas closer to 200. My neighborhood in San Mateo has yet to drop below 200x so we keep renting.

Hello,

I was wondering what factor to multiply to a house’s pre-bubble price to arrive at today’s approximate price?

Also,

I am looking at a house that sold in 1999 for 517K. It sold during the height of the bubble in 2006 at 645K. Then it appears an investor bought it in 2009 for 515K. They put in a swimming pool and are now asking 620K just 6 months later. What do you think a reasonable offer would be for this house? Without the pool, I would have applied just the inflation factor but now how do I price the addition of the pool? Do you think 550K would be a reasonable offer including both factors?