patrick.net

An Antidote to Corporate Media

1,195,814 comments by 14,043 users - AmericanKulak, nodetective1510, Patrick, PeopleUnited, rocketjoe79, The_Deplorable online now

« First « Previous Comments 41 - 80 of 89 Next » Last » Search these comments

Didn't NAR change their formula to make it so more people found housing

"affordable"?

Right... Go look at the source for that graph: NAR!!! Yep, totally unbiased

data....

You guys are such douches..

http://research.stlouisfed.org/fred2/graph/?g=tqP&dbeta=1

Interest carry cost of median home compared to median income. 20% down.

Historical numbers, not NAR numbers. I just used math.

The market does not operate in a vacuum. If owning housing is subsidized, causing prices to go up, then renting prices will usually go up too, whether it's to pay off those more expensive housing or just to fill the gap.

Take away the subsidies, and the price of housing should go down, and theoretically rental prices should go down too, but none of this operates in a vacuum, and it doesn't happen immediately.

The price of a rental is theoretically the cost of owning plus a profit (a penalty for liquidity or whatever you want to call it), but market distortions can change the formula and it may shift around a bit sometimes based on various conditions, but should apply over the long-run if there aren't distortions.

A very good answer to a good question. Thank you.

YOU posted the graph with the NAR as the source of the data...

The new graph tells the same story as the NAR graph. Ergo, the NAR graph is at worst, directionally correct. At best, it is absolutely correct.

Either way, your ad hominem to the point is inaccurate.

Now, do you want to actually debate something here with facts of your own, or are you going to continue with logical fallacies that don't even stand up to 5 seconds of scrutiny?

The market does not operate in a vacuum. If owning housing is subsidized, causing prices to go up, then renting prices will usually go up too, whether it's to pay off those more expensive housing or just to fill the gap.

I disagree. If owning is subsidized, causing more people to own, it will necessarily cause less people to rent and drive rental costs down. Renters don't care what your house payment is. It's supply and demand.

Take away the subsidies, and the price of housing should go down, and theoretically rental prices should go down too, but none of this operates in a vacuum, and it doesn't happen immediately.

See answer above--I completely disagree.

The price of a rental is theoretically the cost of owning plus a profit

The price of a rental is supply and demand. I guess in the infinite long run it is cost of owning plus a profit, but that never occurs. Because everyone's cost of owning is different.

What are Fannie/Freddie doing to make rents go down?

Unless you can answer that you can't make an argument we need them

They are reducing the number of renters. That should reduce rental prices.

Why can't we go back to housing prices being about twice the median income? Normal markets price adjust all the time. What would happen if Freddie and Fannie were eliminated? What if at the same time we tightened regulations for foreign investors, or better yet, made it a law that only tax paying citizens can purchase property? We could tax the 1% their share and force everyone the government bailed out to pay back the government at 14% interest. How about more afforadable housing? How about a tax on anyone owning more than one home? How about eliminating prop 13 while on this roll? If all that happened, and it could (and we the people could push for all of the above) then where would housing prices be?

Businesses and governments rise and fall. Is it impossible to imagine that housing prices could go back to former healthy numbers? Is the American housing market the most infinite institution in all of history? Is the American housing market and our government immune to change in a way no government or business has ever been before?

It takes some nerve to be so dishonest as to argue that houses are at their most affordable, while at the same time most expensive when you consider the price tag.

Yea, we all know that rates have never been lower, so the fuck what? What kind of asshole wants to finance a house with a 30 year mortgage? Anchored to 30 yrs worth of exhorbitant PMI?

I want to buy a house with cash, hence, an honest person would not dare to muddy the conversation with such bullshit as "housing is more affordable now, than ever.

Is it just coincidence that these lyijg ASSHOLES! All cheerlead the democrap party while blaming all societies ills on republicans. The same people that blindly support the affordable care (republican) act.

How can anyone take these people seriously if they are willing to be so dishonest on this particular issue,,,,the entire point of this website and its forums existence

Yea, we all know that rates have never been lower, so the fuck what? What kind of asshole wants to finance a house with a 30 year mortgage? Anchored to 30 yrs worth of exhorbitant PMI?

Why is renting for 30 years OK, but paying a mortgage for 30 years is being a debt slave?

If you don't want to pay PMI, then save some damn money and put 20% down.

Why can't we go back to housing prices being about twice the median income?

get the specuvestors out of the market would have to be the first step.

How about more afforadable housing?

Housing is housing, the price level is largely set by the need for it and how much we are able to pay vs. the mix of available homes. Price is the sorting mechanism for who gets what from the mix, not what you get per se.

If by "affordable" you mean subpar quality aka "shitty", then that's not the place we need to save money on, all that will result is us paying more for shittier places to live.

What is actually needed is more QUALITY housing supply. Not gold-bricked $500/foot that developers prefer building, but decent stuff that ticks everyone's checklist for "reasonable" build finish and amenities and won't fall apart in 10-15 years.

How about a tax on anyone owning more than one home?

That would be good. We can imagine a lot better ways to penalize, er, de-incentivize, land-hoarding. Parcel taxes, rent taxes, land value tax. . .

then where would housing prices be?

absent more supply than the demand, whatever we are able to borrow, or whatever cash buyers want their cash-on-cash yield to pencil out at.

So if landlords can rent out a place for $1100 -- call it $12,000/yr gross -- $120,000 would give them 10% gross yield, $240,000 would be 5%.

With 4.25% interest rates, a family who can handle a PITI etc of $1200/mo can buy a $220,000 place (with 20% down).

The thing about real estate is this:

https://research.stlouisfed.org/fred2/series/CUUR0000SEHA

wages go up, rents go up.

it's a brutal cycle. breaking it is tough; even the nordic socialist paradises have screwed themselves with housing borrowing debt, and the periphery -- Spain, Greece, Ireland -- doubly so. Only Germany and maybe France is doing OK here, and I guess the former communist bloc, since they started with zero mortgage debt in 1990 at least.

India is horrific for housing, as is China. Maybe Mexico is OK but consumer credit doesn't exist there basically. UK, home of "buy to let", is screwed.

Japan blew themselves up with housing in the late 80s, but at least their ongoing depopulation should result in continued collapse of real estate -- when one out of four houses are empty, prices simply HAVE to go down.

http://www.japantimes.co.jp/news/2014/01/07/national/abandoned-homes-a-growing-menace/

Housing is a really peculiar sector of the economy, since land cannot be manufactured or shipped, yet it is considered capital anyway.

Obscuring this peculiarity is partially how the rich stay that way. It's really quite something.

We're so immersed in land economics that we cannot really see them for what they are. Just like fish in water, or worms in soil, do not think about the reality of the medium they're living in.

You guys are such douches..

http://research.stlouisfed.org/fred2/graph/?g=tqP&dbeta=1

Interest carry cost of median home compared to median income. 20% down.

Historical numbers, not NAR numbers. I just used math.

Well, you're the one who used NAR data, not me.

I don't know if medians are fully accurate for housing prices, but it'll do. I would include principal + interest + tax + insurance, although ideally it'd include maintenance too.

Even if principal comes back to you, you will eventually have to pay it. That's why I'd much rather pay 8% on a $300K loan vs. 3% on an $800K loan. The interest cost in the first year is roughly the same, but I can pay off the former much quicker and if the interest rate drops, I'm golden.

I disagree. If owning is subsidized, causing more people to own, it will necessarily cause less people to rent and drive rental costs down. Renters don't care what your house payment is. It's supply and demand.

That assumes that all of the housing being purchased are being newly occupied and not part of existing occupied housing stock, right? The reality is that assumption is false -- if renting is no longer a viable enterprise, landlords will sell houses to these new owners, so in the long-run. What you're saying shouldn't happen or else there would be a lot of vacants.

If you are a proper investor, if you're not getting the right percentage return on your rental, you should sell and deploy your money elsewhere. Why take the risk if the return sucks?

Someone on PatNet recently suggested that 3% would be an appropriate return on a house in Palo Alto, but that only works if you're speculating. When you're getting 2.7% on 10-year government bonds, 5% in intermediate bond funds, and some crazy number in the stock market, it's stupid to risk your money for 3% on speculation.

Why can't we go back to housing prices being about twice the median income?

Normal markets price adjust all the time. What would happen if Freddie and

Fannie were eliminated? What if at the same time we tightened regulations for

foreign investors, or better yet, made it a law that only tax paying citizens

can purchase property? We could tax the 1% their share and force everyone the

government bailed out to pay back the government at 14% interest. How about more

afforadable housing? How about a tax on anyone owning more than one home? How

about eliminating prop 13 while on this roll? If all that happened, and it could

(and we the people could push for all of the above) then where would housing

prices be?

Politics in a nutshell. 50% wants something and the other 50% doesn't. It is a waste of time. The reason you are for somemthing is also something many are against for the same reasons.

In a capitalistic society, resources are scarce and things people like are coveted and competed for. Things will always get more competitive, not less competitive in the future.

That assumes that all of the housing being purchased are being newly occupied and not part of existing occupied housing stock, right?

Nope--just that people have to have a place to live. So, they either buy or rent. Those are your two options. corntrollio says

If you are a proper investor, if you're not getting the right percentage return on your rental, you should sell and deploy your money elsewhere. Why take the risk if the return sucks?

Yes--I agree.

Nope--just that people have to have a place to live. So, they either buy or rent.

Right, but what you're saying can't really happen easily in the long-term.

I disagree. If owning is subsidized, causing more people to own, it will necessarily cause less people to rent and drive rental costs down. Renters don't care what your house payment is. It's supply and demand.

Let's go back to the quote above -- you can't say it's supply and demand and then say that the rental market will act completely independently of the purchase market. Those markets are intertwined, as you apparently agree now. If there are fewer renters, then fewer people will be landlords because it won't be as lucrative, so rents can't go down independently in the long term.

Why can't we go back to housing prices being about twice the median income? Normal markets price adjust all the time. What would happen if Freddie and Fannie were eliminated? What if at the same time we tightened regulations for foreign investors, or better yet, made it a law that only tax paying citizens can purchase property? We could tax the 1% their share and force everyone the government bailed out to pay back the government at 14% interest. How about more afforadable housing? How about a tax on anyone owning more than one home? How about eliminating prop 13 while on this roll? If all that happened, and it could (and we the people could push for all of the above) then where would housing prices be?

Name one thing from above we shouldn't push for, and if we shouldn't, why?

Except that in certain parts of CA, it costs significantly more to build due to fees and permitting and other government requirements.

That's exactly the point: subsidize demand, penalize supply.

That's the game they play to raise prices, and this is plain evil.

Let's go back to the quote above -- you can't say it's supply and demand and then say that the rental market will act completely independently of the purchase market. Those markets are intertwined, as you apparently agree now. If there are fewer renters, then fewer people will be landlords because it won't be as lucrative, so rents can't go down independently in the long term.

I've always agreed that they are intertwined. In the long run, the only thing that can lower house prices is more supply. Freddie and Fannie have no effect. But they do allow people who would be renters for life the opportunity to buy. Which takes money from the landlord's pockets and puts it in the back in the pockets of the new homeowner. IMO, that is a good thing.

Name one thing from above we shouldn't push for, and if we shouldn't, why?

Eliminating Freddie and Fannie won't lower housing prices and will make lifelong renters out of people that would like to own. Which would make inequality even worse.

Name one thing from above we shouldn't push for, and if we shouldn't, why?

Eliminating Freddie and Fannie won't lower housing prices and will make lifelong renters out of people that would like to own. Which would make inequality even worse.

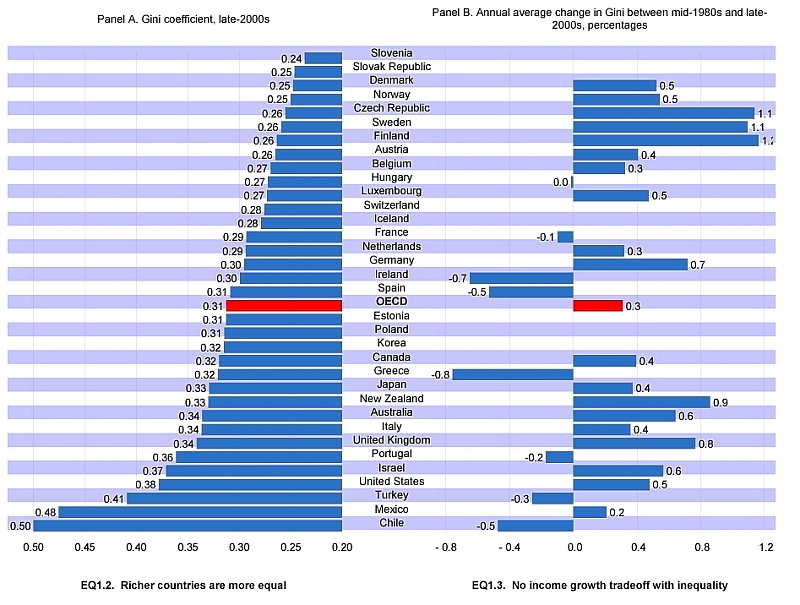

Bullshit - plenty of countries with far lower house-ownership and less inequality. If there is a correlation, than it's the opposite: the more debt-serfs a country produces, the bigger the inequality. Debt is slavery.

the more debt-serfs a country produces, the bigger the inequality.

. . .

Gini vs. private DTI levels in the nordic states runs counter to that assertion.

http://runningofthebulls.typepad.com/.a/6a00d83451986b69e20134828024c4970c-450wi

Switzerland has 200% debt to income, LOL.

Furthermore, Mexico has negligible consumer debt and very high Gini, which rather destroys that assertion outright.

and if we shouldn't, why?

mainly

http://research.stlouisfed.org/fred2/series/HHMSDODNS

there's still $9.4T of TBTF assets tied to mortgages. Lowering the asset value by half or whatever would destroy the financial system we have.

It'd be a replay of 2008-2009 all over again.

Plus homeowners aka voters don't want to see their property values decline like that and will always vote to defend their property valuations.

it's stupid to risk your money for 3% on speculation

the only speculation on 3% in PA is on continued wage and income growth in PA.

http://research.stlouisfed.org/fred2/graph/?g=ttK&dbeta=1

SF to SJ employment

Nominal wages for the top 10% have tripled in 20 years, maybe quadrupled -- average high-level salary has gone from $30,000 ~ $40,000 to $120,000 ~ $150,000.

And this is aside from the fortress nature of PA itself, with all the non worker-bee residents.

Plus a lot of successful worker-bees become ex-worker bees and retire in-place, too. Most of my Gen X peers who beat me to the SV gold rush, sigh.

Plus that's just tech, and not health care and other high-end professional residential demand.

Name one thing from above we shouldn't push for, and if we shouldn't, why?

"Why can't we go back to housing prices being about twice the median income? "

That presumes much lower prices which will benefit some but will devastate others. I don't think 2009 was all that great.

"What would happen if Freddie and Fannie were eliminated?"

Nothing really, private market will pick up the void. The US financial system is too dynamic to not pick up an extremely profitable segment.

"What if at the same time we tightened regulations for foreign investors, or better yet, made it a law that only tax paying citizens can purchase property?"

That implies that low price is a good thing. Good for some, not good for some. Almost everyone was a foreignor at one time anyway so not sure why natives are all that special. We want to attract bright foreignors not alienate them. nothings wrong with recruiting elites, that makes the country stronger.

"We could tax the 1% their share and force everyone the government bailed out to pay back the government at 14% interest. "

Taxing “everyone†but yourself is popular. Unless it effects you, it must be good. I support all taxes I don't have to pay as well and get government subsidized affordable housing.

"How about more afforadable housing? "

Who will pay for it and who will get it? Let's use the 1% money.

"How about a tax on anyone owning more than one home?"

Where in American law that says one home for all? Taxing “everyone†but yourself is popular. Unless it effects you, it must be good.

"How about eliminating prop 13 while on this roll?"

Taxing “everyone†but yourself is popular. Unless it effects you, it must be good.

All the questions amount to is socalism. I get that. but the US is competing against the world in a capitalistic driven society in a smaller planet. Better to compete than to give up.

Bullshit - plenty of countries with far lower house-ownership and less inequality

Of course. Your logic is flawed. There are many, many factors leading to inequality--home ownership is only one small one. That doesn't mean I'm not right.

If there is a correlation, than it's the opposite: the more debt-serfs a country produces, the bigger the inequality. Debt is slavery.

Now that is BS. Again I'll ask. What is the difference between paying $2000/mo. in rent and $2000/mo. in a mortgage? Why is one "debt slavery" and the other not??

Now that is BS. Again I'll ask. What is the difference between paying $2000/mo. in rent and $2000/mo. in a mortgage? Why is one "debt slavery" and the other not??

The difference is that you can downsize any point in time according to your wallet. You cannot do this in the mortgage case without losing a lot of equity by abandoning or short selling it. Of course it works better if house prices only go up which apparently they do! ;)

the only speculation on 3% in PA is on continued wage and income growth in PA.

You quoted me without context:

Someone on PatNet recently suggested that 3% would be an appropriate return on a house in Palo Alto, but that only works if you're speculating. When you're getting 2.7% on 10-year government bonds, 5% in intermediate bond funds, and some crazy number in the stock market, it's stupid to risk your money for 3% on speculation.

There's a difference between investment and speculation in my book. Investors try to get returns based on fundamentals. Warren Buffett has talked about this, when he says that the income something is throwing off is much more important to him than the actual share price, assuming the latter is within reason. Thinking too much about the share price is really more about speculation:

http://www.usatoday.com/story/money/markets/2014/03/10/must-read-quotes-from-buffett/6259941/

On investing in stocks as you would in a farm:

"If 'investors' frenetically bought and sold farmland to each other, neither the yields nor prices of their crops would be increased. The only consequence of such behavior would be decreases in the overall earnings realized by the farm-owning population because of the substantial costs it would incur as it sought advice and switched properties. Nevertheless, both individuals and institutions will constantly be urged to be active by those who profit from giving advice or effecting transactions. The resulting frictional costs can be huge and, for investors in aggregate, devoid of benefit. So ignore the chatter, keep your costs minimal, and invest in stocks as you would in a farm."

And this is aside from the fortress nature of PA itself

Any time someone starts thinking things can never change...

Nominal wages for the top 10% have tripled in 20 years, maybe quadrupled -- average high-level salary has gone from $30,000 ~ $40,000 to $120,000 ~ $150,000.

You're saying that the top 10% got paid $30-40K in San Jose/Palo Alto in 1994? I call bullshit.

That number seems extremely low, even for 1984. Here's a cite -- AGI *nationally* in 1984 was more than $40K for the top 10%, so income was even higher:

http://taxfoundation.org/article/summary-latest-federal-individual-income-tax-data-0

The real data says that in 1994, the *national* number for top 20% was around $60K and the top 5% was around $110K, and the link above says that AGI in 1994 for top 10% was $68K:

http://www2.census.gov/prod2/popscan/p60-191.pdf

In addition, I suspect top 10% in SJ is actually higher than you're saying currently too. According to this, 16% of people in the SJ metro area (separate from SF) during 2007-2011 are in the top 5% nationally:

https://www.census.gov/prod/2013pubs/acsbr11-23.pdf

Top 5% is about $180K during the period in that study -- probably around $170K or so in 2007 and something north of $185K in 2011. If 16% are at that mark or higher, logically the top 10% in SJ is higher than that mark.

Nationally the top 10% number for 2012 was about $146K, and the top 5% number was about $191K:

http://www.usatoday.com/story/money/business/2013/09/17/census-median-household-income/2825129/

Your figures are highly suspect, and inflation accounts for a lot too. $40K in 1984 would be $90K today.

You're saying that the top 10% got paid $30-40K in San Jose/Palo Alto in 1994? I call bullshit.

I was thinking about starting salaries in 1990 (what I am familiar with) around $30,000 or so for worker-bee jobs in SV. I guess the outer range for experienced worker-bees was 2X that in 1990, but certainly $60,000 was very low for anyone once the dotcom boom got going in the late 90s.

http://research.stlouisfed.org/fred2/series/SANJ906INFO

shows the employment trend in part of SV.

t'd be a replay of 2008-2009 all over again.

Really? What was so bad about those years? Prices going down certainly will not hurt any working family under 45 that I know of.

That implies that low price is a good thing. Good for some, not good for some. Almost everyone was a foreignor at one time anyway so not sure why natives are all that special. We want to attract bright foreignors not alienate them. nothings wrong with recruiting elites, that makes the country stronger.

Who is it good for besides banks, real estate professionals and people who already own and plan to make a huge profit? That's a pretty small group.

As far as all of us being foreigners at some time, that's all great and dandy, but the truth is that the system can't properly work if you allow people who are not citizens to own land within a democratic republic; it undermines the very principles of a republic. If they want to own, great, become a citizen through the same route that everyone else goes through here. If it's worth it to them they will go through the process properly and become a citizen.

What was so bad about those years? Prices going down certainly will not hurt any working family under 45 that I know of.

Money Fund, Hurt by Debt Tied to Lehman, Breaks the Buck**

http://online.wsj.com/news/articles/SB122160102128644897

Some people think banks just lend out money out of nothing, so when loans go bad nobody gets hurt.

That's not how it really works. Loans are funded from other people's savings, just like "It's A Good Life".

You want to cut home prices in half, you're going to have a $6T overhang between banks asset values (their loans) and what they can liquidate the collateral for. Probably worse, because the more recent the loan the crappier it was in 2008.

If the system had been allowed to evolve its own work-outs without massive Fed intervention 2008-2010, Wall Street would have looked like the end of Fight Club, every pension fund in the US would be twice as broke as it is now, and we'd have had many riots on the scale of LA 1992 due to the massive commercial instability having TBTF actually fail would produce.

TBTF was and is the financial cardio-pulmonary system of the economy. If it dies, our economy dies with it.

Oh look, housing for San Jose City Employees! http://www.businessinsider.com/the-jungle-largest-homeless-camp-in-us-2013-8?op=1

Teachers, librarians, engineering techs and all the rest of the clearly uneducated and lazy city employees can be found at this new low income housing development. Prices don't need to come down. For example, teachers make below the poverty line in San Jose, if teachers would suck it up and live in a homeless encampment they would be able to save for their retirement. Living below the poverty line builds character. We must keep prices high to save the banks and boomers! Real estate agents, boomers and bankers deserve to be protected.

We must keep things inflated, or we may have to live without our toys. No toys? No vacations? No new stuff? So some people can have shelter and food? Never!

Oh golly, I need to go to bed....I am rambling like the crazed sister of AF. Call me River.

Teachers, librarians, engineering techs and all the rest of the clearly uneducated and lazy city employees can be found at this new low income housing development. Prices don't need to come down. For example, teachers make below the poverty line in San Jose, if teachers would suck it up and live in a homeless encampment they would be able to save for their retirement. Living below the poverty line builds character. We must keep prices high to save the banks and boomers! Real estate agents, boomers and bankers deserve to be protected.

We must keep things inflated, or we may have to live without our toys. No toys? No vacations? No new stuff? So some people can have shelter and food? Never!

Oh golly, I need to go to bed....I am rambling like the crazed sister of AF. Call me River.

That was a pretty good first effort composite of the generally demented posters on Patnet. Thank goodness you chose not to channel Robber Baron.

t'd be a replay of 2008-2009 all over again.

Really? What was so bad about those years? Prices going down certainly will not hurt any working family under 45 that I know of.

Besides the mass unemployment?

The problem is that when you don't have a job you can't afford a house, no matter what the price.

Mass unemployment would not change if home prices were low or high, except maybe in some specialized fields dealing in real estate. If prices were not so high for shelter people would have a higher sense of security when in between jobs.

Now if a person looses their job they lose their home. This is why our parents, grandparents, and great-grandparents thought so low of the idea of buying a home more than twice your income. It was considered risky and downright stupid by every generation before this one all the way back to the American revolution. I know, it's different now, and there is an unbreakable vow with the banks and feds and we can never go back to sane and normal again because its the first indestructible institution in all of history, blah, blah blah. Or maybe we are simply not willing to make the sacrifices needed to renew a healthy real estate market. Maybe that's the problem with the government too: us.

As a society we are selfish and we are cowards, and we will get a selfish and cowardly republic as a result.

Maybe I am a populist, or a fool who has watched too many Capra movies, but I don't feel necessities should follow the rules of other investments. In my opinion, they shouldn't be monetary investments at all. Water, food and shelter should not be something a healthy or postive government or society uses as speculation, or some form of investment. It would be a sign of sickness in a civilized republic. I do think gluttony of any necessity is a sign of mental illness in the individual also. We practically praise gluttony in this society. It's wrong, and it will be part of our undoing

Gluttony, derived from the Latin gluttire meaning to gulp down or swallow, means over-indulgence and over-consumption of food, drink, or wealth items to the point of extravagance or waste. In some Christian denominations, it is considered one of the seven deadly sins—a misplaced desire of food or its withholding from the needy.

Now if a person looses their job they lose their home.

because they bid up the price in the first place!

HAMP and other bailouts to people who bit off more than they could chew in the previous decade really get my goat!

Here I was being responsible, paying $75,000 on rent instead of buying 2006-2010, and what bailout do I get? Nothingk!

Houses are priced above replacement value due to lack of alternatives (try living without *any* housing services for a couple of days) and the profits available from renting the places out instead of living in them.

his is why our parents, grandparents, and great-grandparents thought so low of the idea of buying a home more than twice your income

Those days are long, long gone. There was still buildable land in or near urban cores. NIMBY was less operative and density could be increased too. Banks only gave out 10 year balloon-payment loans, requiring refinancing every 10 years, and required 20% or whatever down, and also only looked at the man's income in setting credit capacity qualifications.

I was going to say interest rates were higher:

http://research.stlouisfed.org/fred2/series/MORTG

but in the 1940s and 50s they were what they are now, 4-5%.

of course, the current price level was set with 3-4% lending, and I think we're going to have a bit of adjustment -- some of the YOY 20% gain is going to be given back -- if rates keep going up.

The key element is the RENT LEVEL.

If my rent is $1500 now and going to be $2000 by 2020 (5% pa rise), it makes perfect sense to buy a $500,000 place RIGHT NOW.

$500,000 with 20% down @ 4.5% fixed for 30 years is:

$1840/mo PITI less the P

$2400/mo all-in outgo which includes ~$600/mo in principal pay down

Over the 30 year life of the loan the average monthly cost is ~$1200, and in 2044 and beyond the monthly cost will be $700/mo.

What will rents be in 2044?

Mass unemployment would not change if home prices were low or high

No, but it does occur when housing prices FALL. Witness 2008/2009.

If you could magically reduce all housing prices without affecting anyone's equity, then you'd be correct. Unfortunately, that's not possible.

To heck with my equity, the prices need to come down. I'm willing to make such a simple sacrifice for returning the market to a sustainable price for working families.

To heck with my equity, the prices need to come down. I'm willing to make such a simple sacrifice for returning the market to a sustainable price for working families.

That's very noble of you, but unfortunately it will still lead to layoffs and high unemployment as the economy will go into recession.

To heck with my equity, the prices need to come down. I'm willing to make such a simple sacrifice for returning the market to a sustainable price for working families.

That's very noble of you, but unfortunately it will still lead to layoffs and high unemployment as the economy will go into recession.

Proof??

2008 crash.

To heck with my equity, the prices need to come down. I'm willing to make such a simple sacrifice for returning the market to a sustainable price for working families.

That's very noble of you, but unfortunately it will still lead to layoffs and high unemployment as the economy will go into recession.

To create jobs We need more real estate construction, more sales, more confidence, more willingness of banks to loan.

That is why we need higher real estate prices, and that is why the government will make sure higher prices will come.

« First « Previous Comments 41 - 80 of 89 Next » Last » Search these comments

http://www.huffingtonpost.com/harlan-green/losing-fannie-and-freddie_b_4975985.html

Comment/post from Michael S.: "If you increase "affordability" you will increase demand. When demand increases then prices rise. When prices rise, affordability falls.

Government backed loans don't help homebuyers, they line the pockets of bankers and the real estate industry. Rising prices help increase tax revenue too, so the industy lobbyists get what they want.

17 MAR 2:47 PM"

#housing