patrick.net

An Antidote to Corporate Media

1,198,247 comments by 14,128 users - FortwayeAsFuckJoeBiden, Patrick online now

15 Day Timeline of the Dollar Collapse and the HOUSING NIGHTMARE

2010 Nov 7, 3:41am 16,002 views 49 comments

« First « Previous Comments 11 - 49 of 49 Search these comments

If food and energy prices skyrocket due to high inflation, that leaves less money for house payments. With the down economy, corporations will not be able to increase wages to keep up with inflation.

How dare you call out our benevolent overlords! Of course they'll pay us more.

HousingBoom, I think you may be overlooking the fact that Bernanke WANTS the dollar to fall. He does not say so, but many people thinks this is what he wants.

Hence he is is not going to raise interest rates to "protect the dollar" if/when it falls.

What Bernanke and the banks want is ASSET INFLATION without CONSUMER GOODS INFLATON. That is going to be very difficult to engineer.

Again, you people theorize instead of just observing what actually happened everywhere else in this situation. This has nothing to do with importing houses or demand for them, and everything to do with huge economy-wide inflation pulse (including both wages and prices) triggered by currency devaluation. This has ALWAYS happened in EVERY country after currency collapse, and I explained what did and why. The onus is on you to explain why it should be different here.

Hmm... If you say so.

I don't think it turned out that way here in the 1930's.

Nor in Japan in recent decades.

Why should "it" (what do mean by "it") be different here? Different than what?

I don’t think it turned out that way here in the 1930’s.

Nor in Japan in recent decades.

Why should “it†(what do mean by “itâ€) be different here? Different than what?

??!!

There was no dollar collapse in the US in 1930-s, nor Yen collapse in Japan since 1990.

Opposite, both saw broad deflation and some currency appreciation relative to other currencies. For example, Yen has increased from ~130 to ~80 per USD.

Different than all other cases of currency collapse, such as:

Austria - 1921

Germany - 1923

Italy after WWII

Russia - 1998

Argentina - 2002

or chose your own favorite example.

HousingBoom, I think you may be overlooking the fact that Bernanke WANTS the dollar to fall. He does not say so, but many people thinks this is what he wants.

Hence he is is not going to raise interest rates to “protect the dollar†if/when it falls.

What Bernanke and the banks want is ASSET INFLATION without CONSUMER GOODS INFLATON. That is going to be very difficult to engineer.

Not raising rates at all will destroy the dollar completely. They will have to raise rates.

Not raising rates at all will destroy the dollar completely. They will have to raise rates.

People are getting cause and effect reversed. Interest rates are at zero because everybody wants to save save in dollars, and they're willing to take 0%. More importantly, nobody (except the treasury) is borrowing either, which is what makes rates rise.

I know people think it's the Fed, and it is to a small extent, but interest rates would be very low even without fed market operations. Rates were falling dramatically well before QE.

People are confusing 2 things that are not very related:

1) The deficit. It's pretty bad thanks to tax cuts and a recession, and stimulus spending, but it nowhere near the level where default is in question.

2) Quantitative Easing. This is monetary policy to try to stimulate the economy. It has absoltely nothing to do with the US Treasury being able finance it's debt.

1) The deficit. It’s pretty bad thanks to tax cuts and a recession, and stimulus spending, but it nowhere near the level where default is in question.

You sound just like Bernanke!

1) The deficit. It’s pretty bad thanks to tax cuts and a recession, and stimulus spending, but it nowhere near the level where default is in question.

You sound just like Bernanke!

Krugman had an interesting point (?) that QE and interest rate point drops are equivalent fiscal policy. QE is just what happens when you're already at the lower bound.

http://research.stlouisfed.org/fred2/graph/?chart_type=line&s[1][id]=FEDFUNDS&s[1][range]=10yrs

if the dollar were to collapse there would be a rush into housing because nobody wants to hold worthless dollars.

Man Talk about tunnel vision.

if the dollar were to collapse there would be a rush into housing because nobody wants to hold worthless dollars.

lol I think food will be first priority. I doubt there are million of Americans with tons of cash in their savings account.

Again, you people theorize instead of just observing what actually happened everywhere else in this situation. This has nothing to do with importing houses or demand for them, and everything to do with huge economy-wide inflation pulse (including both wages and prices) triggered by currency devaluation. This has ALWAYS happened in EVERY country after currency collapse, and I explained what did and why. The onus is on you to explain why it should be different here.

Because the united states is a super power. Name another superpower that this scenario played out in? The US is not zimbabwe... Once again... We will enter world war 3 in almost ANY worst case scenario u can think of.... The world runs on the us dollar... To unwind from that would be disastrous for the entire world economy.

if the dollar were to collapse there would be a rush into housing because nobody wants to hold worthless dollars.

Man Talk about tunnel vision.

No it's not tunnel vision just like Patrick I realize that the deck is stacked against housing bears. You have to "know when to fold em" Patrick is a smart guy and now this is the housing market forum.

Pretty much any scenario housing prices are going up unless there is another recession.

Pretty much any scenario housing prices are going up unless there is another recession.

there could be a Great Separation -- Brasil style -- coming this decade, between the haves and the have nots. This will slaughter the lower end (even more) while putting a safety and quality premium on functional fortress nabes.

The middle will find itself pressured to move out of marginally safe areas but the gates will be locked.

Pretty much any scenario housing prices are going up unless there is another recession.

Reality called and wants to sit down and have a chat with you. You don't actually believe the rubbish you type, do you?

Prices aren't going anywhere without massive wage inflation.

Different than all other cases of currency collapse, such as:

Austria - 1921Germany - 1923

Italy after WWII

Russia - 1998

Argentina - 2002

or chose your own favorite example.

Because the united states is a super power. Name another superpower that this scenario played out in? The US is not zimbabwe… Once again… We will enter world war 3 in almost ANY worst case scenario u can think of…. The world runs on the us dollar… To unwind from that would be disastrous for the entire world economy.

Well technically Russia was/is a superpower, but never an economic one. Los Angeles Renter is right, Chinese might be the most widely spoken language in the world, but Business speaks English and the world runs on the dollar. The U.S. Dollar is the most widely held currency internationally, the Euro is a distant second. You also have to remember the Euro is a fairly recent, it's only been around for a little over 10 years. I'm sure more mattress is stuffed with Dollars than Euros. Anyway the collapse of the dollar with have more devastating consequences to the world economy then any of the previous currency collapses have had. We could very well see trillions of dollars of foreign held dollars pouring into the country looking to purchase items of value before there dollars are worth nothing. And of course one of the things they will look to obtain is property. So while in other currency collapses the value of property declined as people worried more about buy basic life staples than buying property, the Argentina Peso or the Russian Ruble wasn't widely held outside those countries. The money looking to buy property is going to be staggering. And were not just talking about people who hold US treasuries there, there 500 of billions of dollars in physical currency currently outside the United States. ALL of that money will rapidly flow back into this country if it start to become worthless. So no only the cost of Gas and Food will skyrocket, so will the price of real estate as well.

I dont think anyone is praying for a collapse as it will be bad for everyone. Just less bad for people who own land than for people who own cash.

So no only the cost of Gas and Food will skyrocket, so will the price of real estate as well.

Not necessarily. If salaries don't go up, then higher food and gas just means less money for housing.

Personally, I think the market is now very schizophrenic: the low end (usually bad neighborhoods) is too low, but the high end is still WAY too high compared to renting the same thing. Like 2x too high.

So the crash may be over downstream, but it is moving upstream. I think I can even see it geographically on my maps, as the good deals slowly spread out from bad neighborhoods toward good neighborhoods.

Jobs and salaries are key though. If salaries don't go up, house prices can't go up either, and in fact inflation in food and energy will force house prices down.

When it comes right down to it, people will spend on food and energy before they'll spend on housing.

ALL of that money will rapidly flow back into this country if it start to become worthless. So no only the cost of Gas and Food will skyrocket, so will the price of real estate as well.

Yes, im so sure the RED states will welcome with open arms a bunch of immigrants coming in and buying their land/houses and moving in or renting to them at a premium. That im sure will go over really well with all the guns they have stockpiled.

Jobs and salaries are key though. If salaries don’t go up, house prices can’t go up either, and in fact inflation in food and energy will force house prices down.

When it comes right down to it, people will spend on food and energy before they’ll spend on housing.

I agree. Even if companies can afford to give out raises, that money will probably go to food and gas anyways. Wages have been going down recently and I think the trend will continue even if inflation kicks in.

Can you guys discuss this point further. Why is that?

The most extreme example is buying a house 0% down with borrowed money, then hyperinflation happening. You basically get a free house, since the money you pay back is worthless. If there is a 100% inflation where everything's price has doubled, you get half a free house.

The dollar devaluing will gut the pensions and social security (value wise) -

Dollar devaluation and inflation are not the same thing. Devaluation just refers to a currency buying less of other currencies, not less goods and services in the country where the currency is used. It's quite possible we would have a dollar devaluation and no inflation. See my comments above about SE asia.

Another example: The Japanese yen has strengthened about 35% in the past 3 years. Does that mean prices have fallen in Japan by 35%? No.

Also - at what point will the banks step in and refuse to accept worthless dollars? They have been getting things their way so far - why in the world would they let you pay off a loan for a vauable asset with worthless paper money - especially when they could step in and take the asset??????

I'm not sure I follow you. How could they NOT accept dollars? How could they step in and take the asset? A mortgage is a legal contract detailing the terms and conditions of the loan. If the banks didn't charge enough interest to cover the coming inflation, that's their mistake.

Jobs and salaries are key though. If salaries don’t go up, house prices can’t go up either, and in fact inflation in food and energy will force house prices down.

When it comes right down to it, people will spend on food and energy before they’ll spend on housing.

If we had massive collapse of the dollar the jobs may actually start coming back here. Imagine if a US worker suddenly costs half as much as someone in India. Jobs come back and wages would go up.

If your food costs 10 times what it does today and ends up taking all your money just to buy food - where and how does the house end up being free?

Because my fixed-rate mortage on my rental properties will remain, well...FIXED. The rent I charge my renters will go up 10 times (like the price of food in your example). So in effect, housing, through fixed rate mortgages, are a great hedge against inflation. Renting isn't.

Of course, the Perma Bears and Perma Renters believe that their rent won’t go up with inflation. Only the cost of everything else, except their rent, will go up with inflation.

Not true. The perma-bears believe there will be no significant inflation for quite a while.

That’s not at all what happened in SE Asia in 1997. Malaysian Ringgit dropped from 2.5 to 3.3 to the dollar. Thai baht 25 to 40 to the dollar. There was no corresponding inflation. And these are countries much more dependent on exports and imports that the US. (Oh, and this was right on the heels a RE bubble there.

These are decreases of exchange rate by ~25 - 40%, which aren't reasonably called "currency collapse". These drops are similar to those of USD vs. EUR (from ~1.2 EUR in 2001 to ~0.7 now) or CAD (from 1.6 CAD to 1.0 now) and smaller than vs. AUD (from 2.0 AUD to 1.0 now). If those are "collapse", than USD has already "collapsed". As we are discussing what would happen if USD collapses in the future, clearly we don't deem those past decreases "collapse".

But anyway, tell us what happened to RE prices in Malaysia and Thailand.

As far as I know, in Malaysia they have advanced rapidly in 2000-s, despite the govt./central bank counter-efforts via increasing the downpayment requirement to 20 - 30% and tightening other qualifications.

I imagine those in Thailand might have done less well because of political instability (coups,

street fighting, terrorism) deterring investment, but that is smth. else.

Didn't get to read it all but maybe its not the way most of you think. Might be rates are at 0 because credit is free. Who is buying? Where did their money come from? If I give you an account with $10B then you'll surely buy some of my bonds. That's just common decency. No matter what the rate. Especially when you know the purchase of said bonds will lead to me cutting you in on the next load of $10's B's. This is what the German guy is saying about "clueless". And also what everyone is talking about as to the haves and have nots or the monied interests and the rest of America. Ratesa re not low because the dollar is so strong but are so low because dollar credit is so overly available. This is the rate-credit paradox nobody seems to want to admit. Put it another way, the bailouts went to the aristrocracy and not to the people. To say the people's situation will improve is plain misguiding. The aristrocracy credit is expanding so fast they can but buy bonds. The people's credit and liquid assets are dropping so fast they can but buy food. The collapse of the dollar is when the people realize they are better off excanging another currency. The aristocracy is testing to see how quickly they can print money without driving the people from the dollar altogether!

The only reason we are a net importer is because foreigners invest here. In fact it's not possible to avoid being a net importer, as calculated in the value of goods traded, as long as people invest here. If there were not a flow of capital from China, etc. to the united states, the trade deficit would be exactly zero. Our currencies would have to balance out in the flow of trade such that the net valuation of goods traded was equal.

WTF are you talking about. What foreign bank is transacting in dollars? Who are they loaning dollars to? None of this makes any sense at all.

Plenty of foreign banks, governments, companies and individuals transact in USD. Just google "dollar denominated loans"

Take for example the first link, about dollar loans in Vietnam:

....Interest rates for US dollar-denominated loans, however, are hovering between 5.5 and 8 percent, with some experts predicting that it will be more advantageous to take out US dollar loans rather than Vietnamese dong loans.....

Anticipating the related decline in deposits, SBV lowered the required foreign currency reserve rates to 4 percent from 7 percent for loans of less than 12 months, and to 2 percent from 3 percent for loans exceeding 12 months in duration. As a result of this move, capital sources for loans have increased by US$500 million (VND9 trillion).

http://www.vfr.vn/index.php?option=com_content&task=view&id=1037&Itemid=3

This is exactly what I'm talking about. Vietnamese banks keep a billion USD cash in their vaults (and deposits in the US), and make many times that amount in loans.

WTF are you talking about. What foreign bank is transacting in dollars? Who are they loaning dollars to? None of this makes any sense at all.

As an example...Mexicans who live anywhere in Baja California, or who live within 20 km of the U.S. border elsewhere are allowed to open U.S. Dollar bank accounts in Mexican Banks, such as: http://www.bancomer.com/persona/perso_cuech_maedo_main.html

That 20 kilometer restriction is actually new, I remember a few years back there was no domicile restriction to open dollar-denominated bank accounts in Mexico.

WTF are you talking about. What foreign bank is transacting in dollars? Who are they loaning dollars to? None of this makes any sense at all.

As an example…Mexicans who live anywhere in Baja California, or who live within 20 km of the U.S. border elsewhere are allowed to open U.S. Dollar bank accounts in Mexican Banks, such as: http://www.bancomer.com/persona/perso_cuech_maedo_main.html

That 20 kilometer restriction is actually new, I remember a few years back there was no domicile restriction to open dollar-denominated bank accounts in Mexico.

Anywhere in Canada, you can open a USD checking or savings account (I had one when I lived there), just like any US person can open an account in EUR, AUD, Yen, and assorted other currencies in the US Everbank. But Can. banks do NOT give loans in USD, nor US Everbank gives loans in EUR, AUD, or Yen, hence the original argument has little merit.

But Can. banks do NOT give loans in USD, nor US Everbank gives loans in EUR, AUD, or Yen, hence the original argument has little merit.

You can get loans in Vietnam. See my post above.

Russia...

The biggest jump in Russian demand for dollar-denominated loans since the collapse of Lehman Brothers Holdings Inc......is contributing to the weakest ruble in more than two months

...The amount of foreign-currency corporate lending is the highest since before the credit crisis froze markets in October 2008 and led New York-based Lehman to fail, said Anton Nikitin, an analyst at Renaissance.

Philippines....

MORE Philippine residents took out dollar loans last year....By borrower, FCDU loans went mostly to the private sector, consisting of public utilities and exporters at $3.851 billion

http://www.manilatimes.net/national/2009/april/04/yehey/business/20090404bus6.html

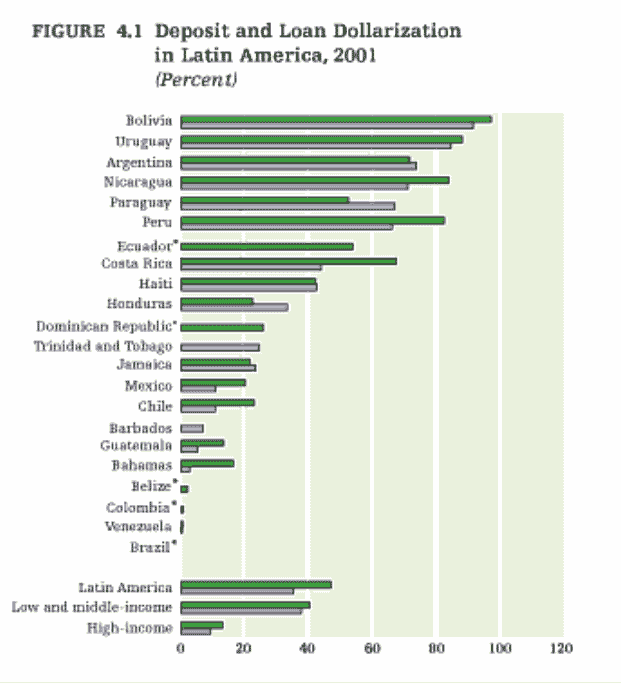

Latin America of course has loans out in USD in the biggest amounts. (Argentina currency collapse was directly related to loans in USD)

I really don't care that some people on a forum don't know this stuff, but assholes like Glen Beck are ACTIVELY SPREADING FEAR AND IGNORANCE. And it has political consequences.

See the thing is, Beck BENEFITS from the anxiety about a world seemingly out of control.

What is he selling? Fear.

Fear of collapse and degeneration and KEEP WATCHING or you'll miss something important! Ultimately the only thing that keeps his viewers glued to their seats is his mastery of spinning fears into an almost believable narrative.

No thanky sir!

See the thing is, Beck BENEFITS from the anxiety about a world seemingly out of control.

What is he selling? Fear.

He's not only selling fear, he's selling grossly overpriced Gold coins:

http://www.ritholtz.com/blog/2010/07/glenn-beck-goldline/

« First « Previous Comments 11 - 49 of 49 Search these comments

I believe anyone that bought a home in the last 5 years should hope the dollar does not collapse. If rates are hiked up to over 5-6% due to the run on the dollar, home prices will take an enormous hit across the board.

http://www.youtube.com/watch?v=hoOh08KmGvU

#housing