patrick.net

An Antidote to Corporate Media

1,358,917 comments by 15,735 users - Ceffer, floki, HeadSet, Maga_Chaos_Monkey, TheAntiPanicanLearingCenter online now

Comments 1 - 20 of 20 Search these comments

Sure. A very visible symptom.

I've been in the process of refinancing a property and it's not easy to get the symptoms....

Or, the banks are seriously worried that if a lot of loans are financed at 3 and 4 percent then the refinancing business will be dead for the next decade.

I don't think its that, the banks borrow money a near zero%, so 3 or 4 percent isn't bad.

They are more concerned with the cascading defaults when the mortgage holders stop paying when they go underwater....

More likely, it's the usual overreaction. Underwriting standards went to crap in the 2000s so now in response, banks are super tight. Well qualified borrowers aren't having any problems getting loans. It's the marginal borrowers that are having some troubles.

>>>Dump it while you still can.... or more eloquently stated:

Really? You're familiar with the property? You have a better place to put the money?

>>> in your checking account.

The house throws off a positive cash flow and tax benefits. The tenants have been there since the 1990s. If we sell we would face capital gains taxes and the necessity of finding an alternative investment. Putting money in a checking account does not seem appealing, refinancing does.

And what are the tax benefits of a checking account?

Rental rates are not falling. Check the numbers from Reis or Axiometrics.

he house throws off a positive cash flow and tax benefits. The tenants have been there since the 1990s. If we sell we would face capital gains taxes and the necessity of finding an alternative investment

With significant (?) positive equity, positive cash flow and steady tenants...why are you having trouble refinancing?

Are you trying to pull cash out? Is your other income low enough that the debt to income ratio looks high?

The property was bought in the 1980s. In the Washington suburbs prices have gone up since then.

It's not a problem to refinance but it is tedious and there are a lot of requirements for paperwork.

As to the matter of rental rates, the Financial Times reports that "for the first time in decades, it is cheaper to buy a home than rent it across much of the US. Home prices are down 35 per cent from their 2006 peak and mortgage rates are at record lows. Even so, residential vacancy rates have dropped, rents are soaring and investors are driving up prices for buildings in many US cities."

See: http://www.ft.com/cms/s/0/ae4c8274-a35a-11e1-ab98-00144feabdc0.html#axzz1x3j23jpt

Build New For Less Than Used says

That's a lie and you know it. Why are you lying about rental vacancy rates?

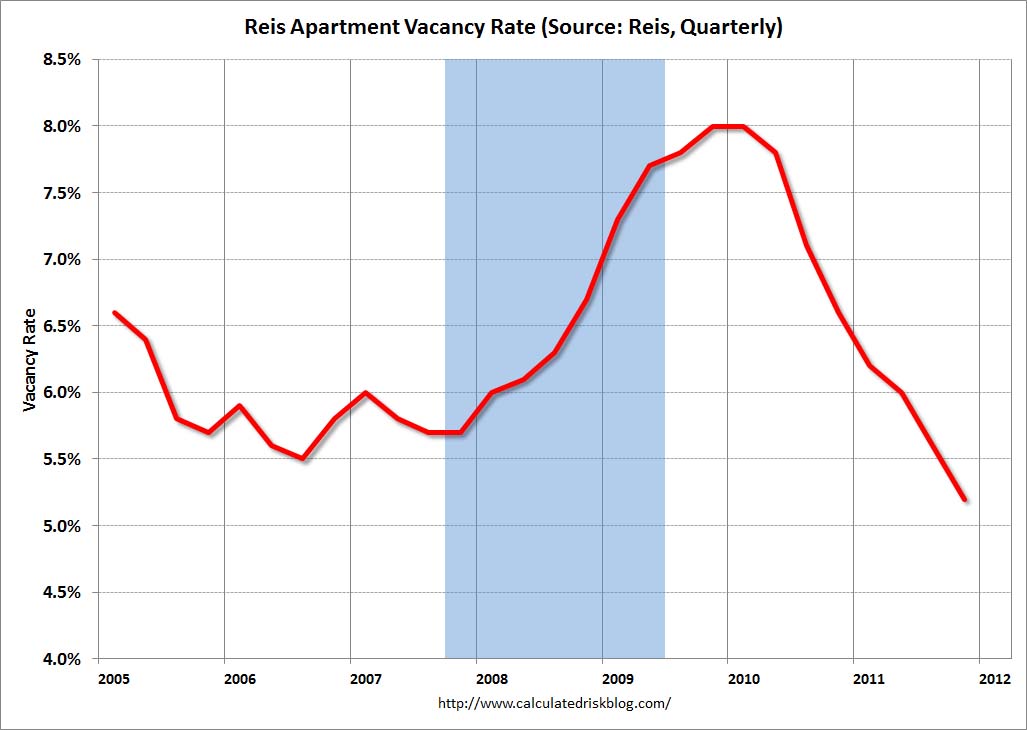

Rental vacancy rates are at a MULTI-DECADE HIGH.

Why are you lying to the public?

do you pull those charts out of your ass? I don't see any 9% vacancy rates in Los Angeles... or nationally for that matter. Did you cherry pick that unlabeled vacancy chart from the one city in the US with the highest vacancy rate? (I'm sure you did).

This article refutes your unlabeled chart above:

http://www.reuters.com/article/2012/04/04/us-usapartmentmarket-idUSBRE83305720120404

Lots of vacancies in my area of Orange County... infact my rent has not increased this year and in addition there is a new 1bd unit in my complex that was for rent - initially asking was $1100 and then they dropped it to $1040 because the manager said he was finding it difficult to attract buyers with decent credt...a lot of people have SHOT credit and shaky job history.

Build New For Less Than Used says

Stop your corrupt filthy lies. That's the US Census Bureaus data. You lying, conniving, corrupt realtors, mortgage pimps and other assorted losers are going down. And going down hard.

Well whoever is collecting this data Reuters source is DRAMATICALLY different than the US Census Bureau's data...

Reis claimed 4.9% national vacancy rate... nearly half what the census estimates.

I'm surprised you trust a government entities statistics though... Personally i think it's probably better to take the average of multiple sources than trust one entirely. I'll have to research this more.. But you go ahead blindly putting all your faith in the Governments census data.

"Lies, damned lies, and statistics"

Jaz -- there will certainly be local areas with lower rents.

The broad reason for higher rents nationally is that the population is growing, many people have lost homes through foreclosure and new home construction remains minimal.

REIS is a NAR organization. The aftermath of the constant stream of lies from you people over years and you have the gall to stand by the lies once more?

You people are so pathetic.

don't get mad at me... I don't know how these TWO charts can co-exist..

somebodies numbers are way off...

That's apartment vacancy, not rental vacancy rate

what's the difference? Does the Census Bureau have a chart for Apartment Vacancy?

That's apartment vacancy, not rental vacancy rate. Smarten up and stop lying to the public.

I just want to clarify what you're saying...

Rental vacancy = apartment vacancy + ???home rental vacancy???

Are commercial rental vacancies excluded?

>>>Rents are LOWER nationally.

Source: 2012 Federal Reserve Report To Congress

http://www.federalreserve.gov/publications/other-reports/files/housing-white-paper-20120104.pdf

Obviously the chart above shows that the "multi-decade high" for vacancies occurred several years ago.

Obviously the chart shows that vacancy rates have fallen from multi-year highs and are actually below 2004 and 2010 vacancy levels.

>>>In May, rents were 6.0 percent higher than they were a year ago, up from the 5.4 percent Y-o-Y rent increase in April, and 4.8 percent in March.[1] In San Francisco, rents rose 14.4 percent Y-o-Y in May; Oakland, Miami, and Denver rents are also up over 10 percent Y-o-Y. Of the 25 largest rental markets in the U.S., only in Las Vegas did rents decline Y-o-Y.

http://info.trulia.com/trulia-price-and-rent-monitor-may-2012

Low rates are great -- but only for borrowers who can get through the application process.

Ben Bernanke says even borrowers with 20 percent down are having a hard time getting a mortgage.

Low rates suggest little economic expansion or confidence in the economy. In a strange way rising mortgage rates might actually be a sign of economic recovery.

http://www.ourbroker.com/news/why-low-mortgage-rates-are-a-problem-060412/

#housing