patrick.net

An Antidote to Corporate Media

1,192,740 comments by 13,872 users - porkchopXpress, richwicks, stereotomy online now

Call me crazy.. but I'm calling a bottom!

2012 Feb 24, 8:23pm 54,243 views 167 comments

« First « Previous Comments 129 - 167 of 167 Search these comments

. So that gives a person room to do something else with that difference. So that difference opportunity is also figured into the calculations, but I didn't see where when I just peeked at the patrick.net calc.

Yes I'm aware of the theory. You you spend less on rent then you pay in a mortgage, you can take the difference and invest it earning lots and lots of money in the stock market. The problem is very few people do. They extra money ends up getting spent on an extra starbucks latte or those sexy jeans. Statically homeowners have greater wealth then renters, so while renters do have more disposiable income than homeowners, typcially they are not investing it, otherwise they would be more wealthy then homeowners. You could argue that renters have a better life cause they afford to buy that extra cup of starbucks latte or buy those jeans instead of going without, but they are certainly not wealther in the long run.

Source: http://www.thedanielsgroup.com/homeowners-do-save-more-than-renters

You are always renting. You either rent a house or rent money. If you have the full cash then you are stealing from your investment growth so in effect renting money from yourself. No one really owns.

Bingo.

You think you "own" your house? Try missing a property tax payment.

The only people who "own" are the elite banking class, who own everyone's labor.

I can't claim to be any expert in San Fransisco real estate market, but you can get a 2 bedroom, 2 bathroom 2,600 sq ft house for about 600k. It order for it to make more sense to continue renting the house would have to lose 3.5% value a year to break even the first year, 3.6% the second, 3.7% the third year to break even on rent vs. deprecation.

It definitely depends on the area. Around Mountain View, a 2600SF house will be, at a minimum, $1.2M. It is absolutely outrageous, and renting in this area is vastly cheaper than buying. Condos around here are sort of approaching rental parity thanks to rents shooting up, but buying a condo has never made any sense to me. They have all of the downsides that apartments do, for the same or slightly higher cost (and the HOA can nail you with assessments at any time). So you can paint the walls...yeah, great selling point!

I am perfectly fine giving up some of the conveniences of having my own house to save all of the money I am not spending on one (rather than blowing it on consumer goods), and to keep my 5 minute bike commute. Eventually my fiancee and I will buy because I want a garage for woodworking and car projects. I do not plan to go into it with any expectation of using the house as some sort of financial instrument because primary residences, long term, are lousy investments. Buying properties & renting them out can generate decent income, but that is a different scenario. I want to buy a house, live in it & pay it off and then have a nice low, fixed living cost for when I am old.

We have the cash to put 20% down on a $900k house right now. However, that is just too much money to spend on a house in our opinion because of the property tax liability, and all of the money that would be tied up in interest and taxes instead if being put into our retirement funds. Around here, the kinds of houses we are looking for basically start at $900k (2-3BR, 1200-1600SF, 40+ years old). We have a hard cap set at $500k, and we will likely move out of Mountain View to San Jose / Campbell after prices slide a bit more there.

Unless prices implode for some reason, we aren't really going to care if the house slides down in price a little after we buy it. At that point, it will make more long term sense to make payments on a slowly depreciating house than to rent since renting will lead to more wasted money than the house. For now though, renting sure as hell is cheaper, and we are saving every penny of the difference so that we don't have to borrow any more than we absolutely have to.

Prices are still at 2004 levels. The bottom is 1996 levels.

Realtors Are Liars.

But how long will it take to reach your 1996 price level? 2 years? 4? 6? If your renting for $1775 a month, in a year your spending $21,300 in rent, 2 years $42,600, 4 years $85,200 and so on. I looked at a housing price chart, for median-priced house adjusted for inflation were 150k in 1996, they are around 175k right now. So your going to wait out the market to save another 25k when you spending 21k a year doing it? Unless your living in a cave (or your parents) rent free, it make absolutely Zero sense to wait. Your far better off to buy NOW even with the depreciation hit.

In many markets yes, but over here in South Orange county the taxes and HOA alone are $800-1000/month (2% property and mello roos and about $300 HOA). Then add the mortgage payment for a $350,000 home (starter 1600sqft 3bd/2ba condo) with a $70,000 downpayment, add in maintenance, add in extra emergency cushion etc. and it's still a very pricey proposition...especially since incomes are falling in this area.

It is a bottom alright! A bottomless pit.

---- taken from the link below

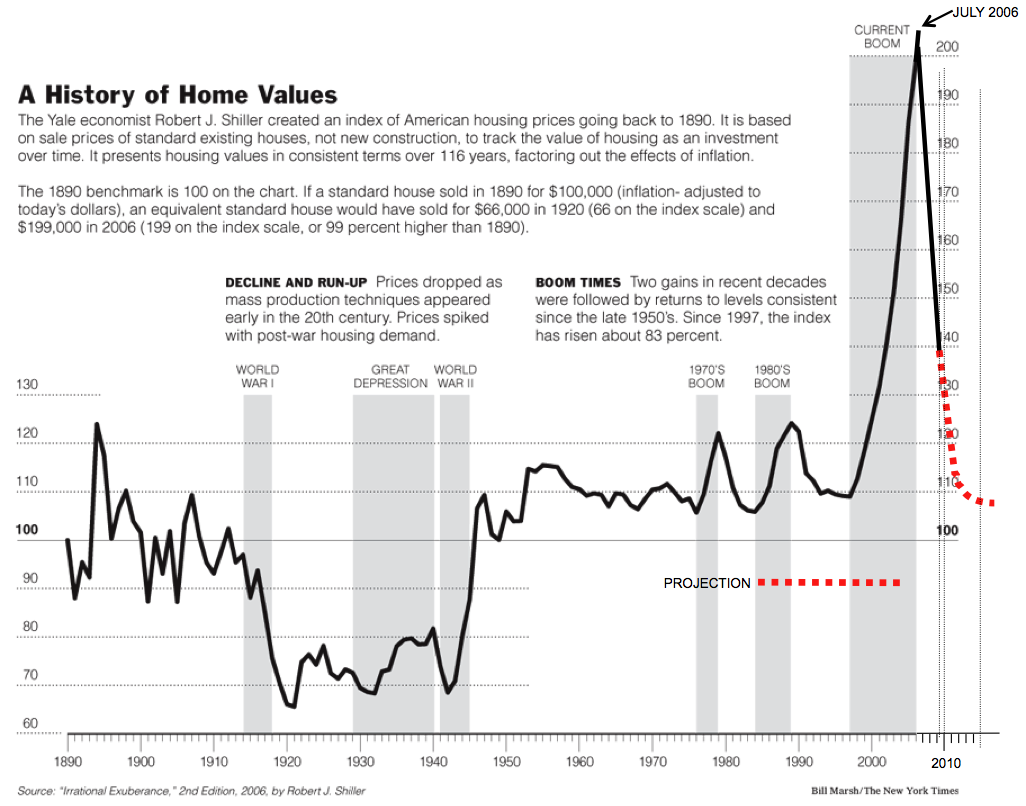

I asked Yale economist Robert Shiller -- of S&P/Case-Shiller housing index fame -- that question in an exclusive interview earlier this month. His answer might shock you: Not only do home prices, on average, not produce real returns over time, but history shows they could actually decline over the long haul

----

What many of us have been saying all along. Momentum is a bitch. Go ahead, argue with a Yale economist. Use your 20K purchase that rents for $5000/mth to justify. Shiller is no joke. I get a sense he is actually trying to be overly optimistic. ;)

I didn't say they were going up, I just said that in most markets, average sale price will not go down (In real $$$, not Infaltion adjusted) much more. Keep in mind that 1) prices will not go up any time soon and 2) the upper tier will still fall further, but on average, the nominal home prices will not change much from here on out. I expect the declines (measured in average sale price) have more or less stopped.

See you at the beginning of 2013 - we'll pick it up then, if you are still around.

This is monotonous and boring.

SubOink - agreed. I'll check back in about a year (presuming I remember) and we'll see if I'm right or not.

E-man - Thanks for the good wishes.

See you at the beginning of 2013 - we'll pick it up then, if you are still around.

This is monotonous and boring.

End of 2012 predictions just for the record.

- I'll still be renting for half the price in the BA

- House prices will have dropped another 10-12% from todays dollar amount. Because of real inflation (you know the one with energy and food included) being 4-6% that will mean a 14-18% drop in inflation terms.

- US will continue to run a high deficit (> 1 trillion) trying to firm up the housing industry only to keep failing badly.

- The jobs market will be turning the corner. We will be back to under 10% unemployment (again the real number) for the first time in 5 years.

- Obama repeats another term, but now looks much older than the beginning of his first term. Time will not be good to him.

- Buffet will stop making housing predictions because he has said "I was dead wrong" too many times already.

- Google will have traveled to the moon just ahead of SpaceX in the contest of "things we can do with our money instead of giving it back to shareholders". Google wins easily. In the race, spaceX was exposed while they were taping their supposed landing in the Arizona desert. The ironic part was it was caught by someone using google earth.

- Facebook will be reduced to a 2 inch x 2 inch portal that is surrounded by animated ads that get activated by just having your mouse pause over them at anytime. Facebook users will be skilled at the art of gliding the mouse over the ad mines without setting them off. A lot of people will give up and just resort to calling their friends again. It will take a while for people to get used to everyones voice again. After the initial IPO explosion of 2012 Facebook will have cratered in valuation. A study will be release late 2012 that will show that out of all the data Facebook collects on its users, only 15% of it is accurate. Facebook was being used by most people to create the people they wanted to be, not the person they were, so all the directed ad value just went out the window. You can't sell Cobe sneakers to a 90 year old man who is posing as a 15 years old jock. Or the 45 years old prisoner posing as a 18 years old sexy teenager with 1500 friends.

- Apple will have gone bad. The lack of Jobs will finally catch up in the release of iPad4. Same as iPad3 but with new colors and a cigarette lighter attachment. Apple valuation gets to 700B before the fall back to 200B. It'll happen quick and painfully at the benefit of Microsoft and Intel.

That's all folks.

There's no law that says there has to be a "bottom" is average RE prices. Prices could stay relatively constant for a long time.

Or worse (better, if you want to buy) prices could slowly erode for a long time. Japan had a huge asset bubble in the late 80's and early 90's. Average prices are still not back to the levels they were then.

RE prices are a reflection of what people can pay. For average REAL (not nominal) prices to rise, Americans' REAL (not nominal) incomes must also rise. I'm not betting on the latter.

incomes must also rise

The only thing I'm confident will rise in this country over the next decade will be taxes and liabilities. Jobs? Income? It doesn't look good.

The only think I'm confident will rise in this country over the next decade will be taxes and liabilities. Jobs? Income? It doesn't look good.

I wish you were wrong. But I don't think you are.

The only think I'm confident will rise in this country over the next decade will be taxes and liabilities. Jobs? Income? It doesn't look good.

Quite a summary there. Where are we gonna get the bucks to raise the home prices? Banks should be really stupid to give away loans at current prices,or we need all the black money from third world flown here. We'd be extremely lucky if prices hold.

- I'll still be renting for half the price in the BA

- House prices will have dropped another 10-12% from todays dollar amount. Because of real inflation (you know the one with energy and food included) being 4-6% that will mean a 14-18% drop in inflation terms.

So basically, your rent will also be reduced the same amount house prices loose, otherwise if home prices fall...how would you still be renting at half price? :)

Good luck with that rent deduction.

My prediction:

- The big fall has ended. We are stabilizing around here...maybe a little lower but nothing that would make it worth the wait if you hate your rental and want to move on and start paying into your own pocket.

That was my prediction last year (when we bought) and when I look at actual sales in my neighborhood - I was wrong.

To my surprise prices actually came up slightly (Probably due to the 1 point drop in interest rates).

Now, that the predictions are in - See ya in 2013

- I'll still be renting for half the price in the BA

- House prices will have dropped another 10-12% from todays dollar amount. Because of real inflation (you know the one with energy and food included) being 4-6% that will mean a 14-18% drop in inflation terms.

So basically, your rent will also be reduced the same amount house prices loose, otherwise if home prices fall...how would you still be renting at half price? :)

Good luck with that rent deduction.

Rents are set by the current economy (jobs, income, demand, etc.). They are really a supply/demand market. Home ownership has not been that for the last 20 years. Owning is highly subsidized by the fed, gov't, Fanny/Freddie, etc. Keeping interest rates artificially low is part of the racket. Having no accountability for the buyers risk of default has got us in a whole heap of trouble. It will take us at least another decade to work through the greed and manipulation.

Part of that working through, will make the cost of homes come back closer to a supply/demand market. This will mean the cost of owning will close in on the cost of renting. We are no where near it yet, hence why I can rent for half. However, as you said, and you will be correct, the cost of ownership will drop. There will be a point where they will be even. Imagine that. That means when I run the numbers I might actually decide to buy along with many other people on this site. Running the numbers now, and listening to the hairbrain reason people are buying just increases my resolve that it makes no sense today.

All the people who rely on real estate for a living will not agree with me. Most home owners will not agree. I expect that and it doesn't change my view. I have been proven right to sell in 2009 and I am continued to be proven right. I have yet to see any positive sign in this downward market. The smartest people don't even talk about housing anymore, they are on to better prospects.

Good luck to all.

To my surprise prices actually came up slightly (Probably due to the 1 point drop in interest rates).

I predict it would be wise for you to sell into the manipulation. Oh wait, when all said and done you would lose money because of the 6% transaction costs, inflation, etc. Hmmm. Yah, you are better off being trapped.

You called it wrong. We are at a peak, not a bottom.

Did you see the date of the original post? He nailed it. And there's no chance we're at a peak. No chance.

You're crazy.

Congrats ECBB. How's the new house working out for your family so far? Tell us how it feels to be living in a house you mortgaged compared to the rented one?

Tell us how it feels to be living in a house you mortgaged compared to the rented one?

It feels like your balls are in a different pocket than the last one they were in.

So far so good. I keep telling my friends that I don't own - I just rent from the bank. That said, as with most things there are pros and cons and I do my best to be objective.

I'll freely admit, there was a bit of selective bias going into this. If anything in the weeks leading up to my offer, I kept coming here to talk myself out of it – but for my situation, the writing was on the wall.

For some perspective the principle, interest, and insurance that I pay now is LESS than what my rent was. Taxes were (and always has been) the bugaboo. Taxes put any house (be it the one we bought or a comparable one) on the "rent" side of the buy vs. rent ledger unless you plan on staying put for seven years (or more). Which (Lord willing) we do.

That said, we felt as if were running out of space in our apartment, and larger places - even a rental, meant more money. Using the metric of $/ft2 as my guide, it was surprisingly a wash - even when you account for the tax burden. It's amazing what sub-4% interest rates can do to increase "relative" affordability. A

More so than that, we were continually outbid on anything "reasonably" priced - and since our metric of reasonable were not in line with the prices the market was bearing (hence our being outbid) we figured being first bid in and getting aggressive would be better than being an also-ran. Hence we ended up in a house, purchased directly form the seller, with no middle men (Less the lawyers).

Anyhow the house is nice. We had a few people over for the holiday weekend, and it didn't feel like we were elbow to elbow - plus I could actually put a few friends up, rather than having them stay at the "no tell motel" nearby. My family loves going on hikes on our property – and I’ve actually lost weight since we bought.

Having to fix minor stuff when it breaks, I must still be in the honeymoon phase, because I actually am enjoying being handy - and proving certain members of my family wrong in the processes. Let me cross my fingers now lest something major crap out tonight while I’m sleeping..

If nothing else in 23 years we'll own the place outright (my plan is to pay it off in 15 to 20 - but I couldn’t quite swing the 15 year mortgage - at least not comfortably. I went for the 30 year and simply pay a hundred bucks or so extra every month.

Best part - I don't have to worry. We over budgeted to account for the inevitable "black swan" event that will come up from time to time, and have weathered everything well so far. It's actually easier than I would have thought. I figured I'd be working to hard to even enjoy living here - but I'm sitting on my back porch as we speak - and still got my 12 hour day in at the office before the sun set.

So I must thank Patrick, and the rest of you regulars for your advice, council and lambasting as I went through this process. All's well that ends well. I do truly hope that some of you who haven't yet been able to buy eventually have good fortune come your way. Persistence, persistence and perseverance is the only way I got to where I am right now. A little bit of luck never hurts either. If nothing else, the failures and false starts we had along the way led us to a better place.

Some final perspective for the evening. While cleaning out some papers prior to my company, I found a copy of and offer for a different house in our area. It was dated 2009 if I’m not mistaken. The purchase price was less than what we paid for the place we are now but 1) the going rate was 6% and 2) the offer was contingent on an FHA 203(k) rehab loan (the previous owner ripped out the kitten and tore out the plumbing on his way out) which put the total cost almost 15% MORE than what we ultimately paid. All that and the place only needed (and need is subjective here) a fresh coat of paint, a handful of new appliances, and a once-over on the hardwood floors. So in short a painful loss early on was a blessing in disguise. With each lost opportunity (from the originally 20 acre parcel we almost bought in 2004) we learned a little more and adapted our strategy accordingly.

I’ll never forget what my High School English Teacher told me.

:â€You may not like the rules of the game, you may not think they are fair, but until you get to a point where you can change the rules, the best you can do is know the rules as they are, rather than as you want them to be, and use them to your advantage.â€

So far so good. I keep telling my friends that I don't own - I just rent from the bank. That said, as with most things there are pros and cons and I do my best to be objective.

Maintaining an objective point of view is critical. You can never lose perspective of the big picture. If you do that, you get complacent, and then you get set up to lose everything.

I'm with you in that I tell my friends that I am renting from the bank, or that I am a debt slave now. Buying a house is not a panacea for happiness, and you can easily end up being miserable if you take the attitude that the mere act of buying one will automatically endow you with happiness. Nope, just like anything you must put work into being happy, house or not. A house gets you a different set of options, but whether you exercise those options correctly or at all is still your responsibility. It's important to know that, especially for people that are thinking about buying. I'd hate to see someone get emotionally crushed because they went into the purchase expecting to buy happiness, only to find that it was up to them all along. Fuck, I think that I just described the definition of "marketing" and the rotten backbone of America's economy lol.

:â€You may not like the rules of the game, you may not think they are fair, but until you get to a point where you can change the rules, the best you can do is know the rules as they are, rather than as you want them to be, and use them to your advantage.â€

Worth repeating. Your teacher is a wise individual.

Again congrats ECBB.

Thanks E-man (and to BMWman91, and others who have wished me well).

I've been reading this site for far longer than most (little know fact, I was an admin on the forum that pre-dated this one) if there's one two (OK three) things I've learned it's 1) life's too short and 2) this place has given me a place to vent, bounce ideas of people of all stripes and opinions, and 3) prices don't always go up = but they don't always go down either.

Again - my heartfelt appreciation to Patrick who's been a beacon of both hope and sensibility for almost a decade now.

"the rotten backbone of America's economy"

As rotton as it is, there's a very very long line of people all over the world that are willing to sacrifice their lives to get here.

Again - my heartfelt application to Patrick who's been a beacon of both hope and sensibility for almost a decade now.

That's right. It's almost a decade now. Time flies.

"the rotten backbone of America's economy"

As rotton as it is, there's a very very long line of people all over the world that are willing to sacrifice their lives to get here.

Sure. My concern is that if we don't find something more substantial than consumption to drive our economy, we'll stop being the kind of place that people would risk dying to get to.

As rotton as it is, there's a very very long line of people all over the world that are willing to sacrifice their lives to get here.

Talk about resting on one's laurels.

"the rotten backbone of America's economy"

As rotton as it is, there's a very very long line of people all over the world that are willing to sacrifice their lives to get here.

It depends. I know more and more immigrants who are considering moving back. A citizenship is becoming more like an insurance policy or just another option. Things change. Now for the unskilled labor-yes this place offers a lot-but if the dollar drops hard, then that advantage vanishes.

1) life's too short

Yes...there is definitely an argument to be made for the oft-maligned idea of 'instant gratification.'

my heartfelt application to Patrick

I've never heard it put quite that way before...?

Nope, just like anything you must put work into being happy

I think happiness is overrated.

Sure. My concern is that if we don't find something more substantial than consumption to drive our economy, we'll stop being the kind of place that people would risk dying to get to.

Then it goes back to what ECBB's teacher said above. It's beyond your control. The best we can do is know the rules as they are and use them to our advantage.

It depends. I know more and more immigrants who are considering moving back.

Could it be that you're hanging out with the wrong crowd?

Then it goes back to what ECBB's teacher said above. It's beyond your control. The best we can do is know the rules as they are and use them to our advantage.

I disagree that it is the BEST we can do though though. When everyone takes that attitude, everything just goes to shit as we are presently witnessing all across America. Schools do not teach civics like they used to, and even when I was in primary school what they taught was vastly watered-down compared to what my parents got, but going all the way through Boy Scouting to Eagle made up for it I suppose. It is a citizen's responsibility, and ultimately in their own best interest even if it is not immediately apparent, to maintain the system and work to preserving it. The system is MORE than just the economy, but everyone seems to have forgotten that. I can't really hold it against people that immigrated here for not necessarily thinking along those lines since it is sort of one of those things that gets taught in elementary school here, but it is still important. Besides, wouldn't we want to leave to our children an America that is at least as good as it is today? Money alone isn't the best that one can leave to their kids, at least not here. If freedom continues to become something that one must BUY, then America is headed straight for the pits.

So, one needs to be realistic and understand that they are very unlikely to totally fix the system, but it is important to see what is wrong with it and at the least try not to add to that. America can't survive if everyone just keeps to themselves and works solely for their own gain/survival.

my heartfelt application to Patrick

I've never heard it put quite that way before...?

I should spell check better... Guess that what happens when you're up at 12:00 am. after a ten hour day.

the days of large year over year price drops are over.

You speak as if we had years and years of large price drops...

We had almost a two year period where, every month, the Y-o-Y decline was significant. Many said that prices "always went up" until they suddenly didn't. Once the trend of rising prices started to reverse itself, others said "prices are going to continue to drop" and were saying it at the time of my OP. So far it seems as if my analysis has been mostly correct.

Also, I put my money where my mouth was, buying in 2012. Yes I'm breaking my own arm patting myself on the back - but even I'm impressed at how right I was. Normally when I make predictions on blogs like this I end up with egg on my face

Here's my take on it. If you look at the long term C-S index it tells quite an interesting story. Prior to the 1900's, prices were more erratic. Boom and bust cycles were seen as natural events back then, and the government did not intervene much, if at all. You can see the wild price swings, but they all centered around a mean of about 100.

Fast forward to the deceased after WWII. Price swings were more modest, and the mean shifted up to about 110. I think this is due to the rise of the two income household. More money = more house.

Now lets look at recent history. Level is now in or around 130. I think this is directly attributable to the governments attempt to put a floor on this - from low interest rates to large hedge funds buying up properties, The powers that be wanted to stop the bleeding and like it or not, it seems that they have succeeded.

Going forward I think we'll see a few smaller boom / bust cycles over the next decade with the index fluctuating around the "new normal" mean index value of about 130.

(Images below) Large chart is taken from Barry Ritzholt's blog. The link to the smaller chart of more recent data is from the New York Times website.

« First « Previous Comments 129 - 167 of 167 Search these comments

http://money.cnn.com/2012/02/22/real_estate/home_sales/index.htm

Now in some areas prices might still have 5% to 10% to go, but on the average, we're probably more or less at the bottom. Prices may move slightly (+/- 1.5%) up or down month to month from here on out, but from my take on the available data, the days of large year over year price drops are over.

Just my two cents.