patrick.net

An Antidote to Corporate Media

1,193,095 comments by 13,874 users - AD, AmericanKulak, brazil66, Ceffer, komputodo, richwicks online now

Fed Rate Hike Is Coming

2015 Nov 6, 6:52am 31,007 views 62 comments

by _ ➕follow (8) 💰tip ignore

« First « Previous Comments 24 - 62 of 62 Search these comments

What so good about MASI?

From my own work, it was a undervalued company for a while, finally kicking into gear, it's had a great 2015, concentrated holdings 20-22 level, only off loaded some shares at 42.43 recently from a different account, adding to it in smaller amounts , it's had a massive run already in 2015, this one is keeper for me.

Bonds are simple ticker symbol PBDAX

As always, I don't care so much for the short term cycle moves that can 2-7 years in directions up or down, it's a long slow and steady race for another 20-25 years, then I will change up the allocation.

The main thing is adding $ each month, that's more cash flow concern, that's the boring truth of it all because even I don't use my own economic cycle tracking to move my allocation, I look at every down turn as a plus until I get into my 60's

Also BSX market cap 25 billion - too big for my taste looking longer term MASI 2.1 Billion

MR went private didn't it recently, it's had bad run since 2013. Not too familiar with that company

Key levels here

2.50%

2.66%

Break those and we test 3.04%

Tell the difference between a analyst and technical chart person

Logan,

Do you think Fed would hike rate? What is the impact of rate hikes on RE in SFBA?

So far, stock market reacted poorly on possible rate hike in December.

The only reason the economy is growing is anyone with a pulse can get approved for a car.

Well you forgot that gas is sucking a trillion dollars less a month out of the world ecconomy than it was 2 years ago.

It's all right there doing exactly what I said $2.00 a gallon gas would do. Now Imagine when President Trump fires up those pipelines and gets gas down to .99 cents a gallon.

There will be an Escalade in every driveway like the good ole days.

Logan,

Do you think Fed would hike rate? What is the impact of rate hikes on RE in SFBA?

So far, stock market reacted poorly on possible rate hike in December.

Short term, it's algo city, until we break into a new highs, which I believe we can, soon the first rate hike will be forgotten and then the discussion will be how many hikes until we see the next recession.

RE in SFBA?

The FED will never raise rates....period

It's so funny to keep hearing people talk about it.

IF THE FED GETS EVERYONE WORKED UP ABOUT AN INTEREST RATE HIKE AND THEN DOES NOTHING IT ACCOMPLISHES THE SAME AS THE HIKE WITHOUT THE NEGATIVE EFFECT! JAMES

that would be a real smart move....

THE FED WILL BE MAKING A TERRIBLE MISTAKE IF IT RAISES THE RATE EVEN A QUARTER POINT AND WILL HAVE TO LOWER IT IN FEBRUARY. IT WILL ALSO CAUSE THE MARKETS TO LOSE FAITH IN THE FEDS. ABILITY TO HANDLE THE ECONOMY!

Not going to happen. All those quadrillions of interest rate derivatives would have to pay out and the broker/dealers never lose money on a trade.

Fed has a dual mandate

1. Control Inflation

2. Facilitate Employment

Those are only the *stated* mandates for the Fed . The *real* mandate for the Fed is to maximize the profits of the banks and wall st through asset inflation and debt inflation. The Fed only gives a crap about Consumer inflation (in reality: wages) and Employment if either one of those get in the way of their real goal. In particular, the Fed does care quite a bit about keeping wages down for middle class.

Never mind what the Fed says, or what the statutes say. Watch what the fed DOES, and who benefits.

I don't know exactly how many times I have said the above in the last five years, but there seem to be plenty of people out there that still do not understand this simple truth.

Never mind what the Fed says, or what the statutes say. Watch what the fed DOES, and who benefits.

I don't know exactly how many times I have said the above in the last five years, but there seem to be plenty of people out there that still do not understand this simple truth.

Because it's wrong no matter how many times you say it.

Interest rate swaps went NEGATIVE in November. That's where the smart money thinks rates are going and the derivatives market is the absolute apex of the "smart money".

Not only is the market well over 70% on future expectations of a rate hike for the First time ever in the cycle

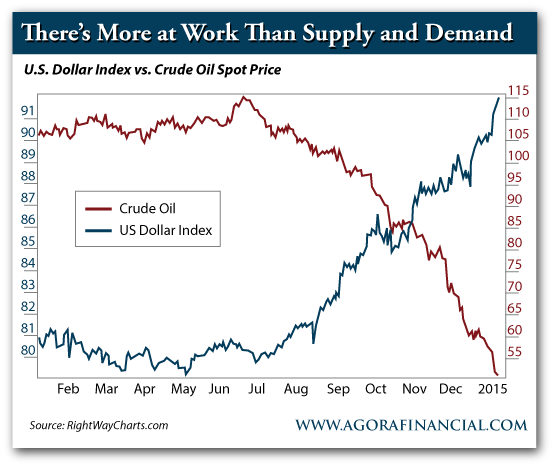

- Dollar up strong in the last 18 months

- 2 year is well above the key .80% level

However, Core CPI today finally got over 2%, this was the last and final metric they were waiting for.

Sounds like it's time to start 5 year cd laddering...0.1%, 0.2%, 0.3%...

However, Core CPI today finally got over 2%, this was the last and final metric they were waiting for.

One of things that people never decided to take into account is that the market has done half the work for the Fed

If you look back in history, the Dollar always makes it's strongest % before the first rate hike happens and it has done it again once.

I know this goes against a lot of the Anti American left and right economic thinkers, but if America was a bad as these cry babies talk about each day, we wouldn't be sitting as the best economy in the world today for a mature country

This is why the European were begging... like a dog for us not to raise rates, why we have currency wars around the world, why all the Anti American talk, never lead to the end of America

Because most of us, we don't cry, we don't whine, we don't beg, we get up, we go to work, we raise our families we do what we need to do to make our life as good as possible.

The left hates the 'good ole days'. That means 'pc' would not exist...

There will be an Escalade in every driveway like the good ole days.

For this thread

1st. The notion that #QE would never end because America would collapse, that failed

2nd, For the people that said the Fed would never raise rates, never, because America couldn't take a 0.25%

Please, come on... it's a 0.25% rate the market has priced in 3 already

So going out from now

CPI core

ECI wage inflation index

Wage Growth/JOLTS data

You won't see a lot more hikes unless these 3 metrics grow like it has before... So be mindful

The left hates the 'good ole days'. That means 'pc' would not exist...

Actually the left loves the good ole days. With strong unions, higher capital gains taxes, more progressive income taxes, tariffs.

It's not the left that has destroyed the US economy--that's for damn sure.

It's like nobody saw the dollar rising, the group that said the Fed would never raise rates.

Now, I could understand if someone didn't know the dollar to Fed rate hike relationship, that is a possible that someone doesn't have that type of education.

However, the market for a while now was doing the Fed's work for them and some people just decided to ignore the data

Anti American crowd lmao

There's nothing more un-American than rooting on the anti-capitalistic entities survival

People didn't want America to fail. Conversely, they wanted this country to be reborn, by killing the parasites that are bleeding the labor classes dry.

People didn't want America to fail. Conversely, they wanted this country to be reborn, by killing the parasites that are bleeding the labor classes dry.

This group here is struggling

- High School Dropouts

- Non- College educated Americans

- Non trade skill educated Americans

- Active Drug users

- Active criminals

- Those with a criminal record ( Hard to Find Job)

- Those on disability

I admit when you look at the data, this group is struggling

But this isn't the majority of Americans and why the Anti Americans bears who just spend every day of their life

Why they lose credibility over time

Being an Anti America bear since 1790 hasn't worked out

Focus on the poor and uneducated from a point of Strength not from weakness

If the middle class was so bad in America we wouldn't be standing at top of the economic world #1

Be mindful that demographics are going to get better in a few years, that means more household formation, more economic output

But then again, in reality if these Anti American bears really were living such horrible lives, they would leave the country for better economic opportunity, they don't any many people still want to come here

The extreme left and extreme right as always in history have been proven wrong again because they over play their hand

in isolation - because oil and other commodities are the basic building blocks of production, and because those materials are in such weak demand/consumption, one could easily think that the broader economy is very far from inflationary pressure.

It's a strategic temporary thing the Saudis are doing to mess with Russia.

Supply is growing while demand has taken a hit

But

All short term rates and dollar and the U.S. economy have been growing even with the hit in the Commodity based U.S. sectors that are priced sensitive

They data is there

However, a Fed rate hike is a huge slap in the Face for the Anti American bears who first said #QE would never end because America would fall into a recession right away

I get it, you have to make a last stand here, because if the Fed raised rates that's just another knock on thesis

X energy service inflation is running at 2.9% today, highest since 2008

A lot things are happening that wasn't supposed to happen and it's all happen with the world economies in trouble today

Not only has service X energy inflation got to the peak of the cycle

ECI wage index has been rising, even though we have seen a pull back in the last few months

Be mindful of what to look for in the next 18 months on inflation

We are just in our infancy on our demographic phase that is going to be a net net positive for the U.S. economy

This is more of next decade story line, but I am pleading with you Anti American bears, we will see a recession at some point and then we will see a recovery, but learn from this cycle that, we as a country will always find a way because our Demographics aren't anywhere close to Germany, Japan, China, Europe and other places

When they get that bad, then you have my blessing to start talking about America in a massive decline as country, but not yet...

Going ahead, keep an eye out on this metric for future rate hikes

Atlanta Fed's Wage Growth Tracker increases in November https://goo.gl/GRrv1g

You won't see a 17 rate hike cycle like we saw in the last cycle

But this, with Core CPI and the JOLTS/Wage Growth index matter going ahead

logan, just curious - would you have advised your borrowers to lock in a mortgage rate yesterday?

logan, just curious - would you have advised your borrowers to lock in a mortgage rate yesterday?

I do rate predictions for Bankrate.com weekly, so I run off technical levels for my clients that are in the process

It's funny how I speak about rates and how other people do it

- Active Drug users

- Active criminals

- Those with a criminal record ( Hard to Find Job)

The above deserve to struggle.

lol, some people just like to be vague...

key point is volatility i suppose. not a great time to roll the dice with a float to close the year.

key point is volatility i suppose. not a great time to roll the dice with a float to close the year.

I locked my last client for the year when the 10 year was at 2.14%

Rate locks can be tricky because people can get emotional about it, but the YSP spreads on credit is really a big factor in locking these days.

We had a mini taper move this year when 10's went from 1.64% - 2.50% a lot people were pissed when they didn't lock...

If Rapping Yellen Doesn't raise I will be pissed

|

http://www.jibjab.com/view/w7olzxySQde-IsuASzz6_Q

hello good morning!

I am excited to say that we have opened a car title loan website -

take a look at it

« First « Previous Comments 24 - 62 of 62 Search these comments

2 year which needs to be over .80% is now at .90%

#Housing #Economics