patrick.net

An Antidote to Corporate Media

1,193,135 comments by 13,874 users - goofus, richwicks online now

Fed Rate Hike Is Coming

2015 Nov 6, 6:52am 31,009 views 62 comments

by _ ➕follow (8) 💰tip ignore

« First « Previous Comments 9 - 48 of 62 Next » Last » Search these comments

Fed Rate Hike Is Coming

So is the Easter bunny....

If there is one it will be for show.

Thanks for taking your meds.

Someone said market should be up when there is a rate hike because it signals booming economy. How come it is down?

It means the dollar is up and rates are up: slowing the economy.

Plus lower corporate profits as wages grow.

-> the 'inflation' is moving from assets toward the real economy.

The assets don't like it.

Someone said market should be up when there is a rate hike because it signals booming economy. How come it is down?

It recovered last month. Best October ever.

It appears to be going the wrong way for that..

Not if you look at the one month performance.

In the last few months their was a group of us #JustGoForIT, a group that doesn't agree on everything, but we all agreed that the Fed should raise rates from 0 to 0.25%

As you can imagine we got bombarded by the token line

Fed will never raise rates

Which was similar to the group that said #QE would never end and it ended in America a year ago.

I chart every single economic index we possibly have in the world, no need to have Zero Rates

From the article I wrote back in August

http://loganmohtashami.com/2015/08/16/fed-and-the-first-rate-hike/

Fed has a dual mandate

1. Control Inflation

2. Facilitate Employment

I like to joke that they have a DUEL mandate; count the steps to 10, aim to kill and be first to shoot.

So, we are well below their unemployment metric which triggers a rate hike.

Via Doug Short

http://www.advisorperspectives.com/dshort/updates/Employment-Report.php

U RATE

– In an interview with Bloomberg I said they need to change their metric because unemployment is dropping too fast due to the Labor participation rate and that wage growth won’t likely come until 2015 based on their data metric of ECI wage inflation metric.

CPI inflation is not at a comfortable level for them but they don’t seem to mind this as much.

Via Doug Short

http://www.advisorperspectives.com/dshort/updates/CPI-Headline-and-Core.php

CPI-headline-core-since-2000

– Another view I’ve held for years is that they should raise their inflation metric 2.25%-2.50% on CPI.

In any case they haven’t. So in reality keep a close eye on 2’s — it’s itching to break out to an 80 handle.

It appears they are headed toward their first-rate hike in years.

If you wanted to ask a provocative question ask people what do they believe they will achieve with rate hikes now. You will get some real interesting answers.

I am sticking to my model that 3% FED Funds and 4.7% on 10’s are recessionary rates with some duration after these levels. Those rate metrics would be the lowest rate curve to create a recession post WWII. The best way to counter this call is to get more dollars into labor’s pockets.

Long Term Perspective On Federal Funds Rate, 10 year Yield and Inflation

Via Doug Short

http://www.advisorperspectives.com/dshort/updates/Treasury-Yields-in-Perspective.php

treasuries-FFR-since-1962

The only reason the economy is growing is anyone with a pulse can get approved for a car.

However, while in the past we had CRA and Subprime, we can now pull cash out of our cars.

https://www.titlemax.com/title-loans/

This group is struggling

- Drug users not in jail

POTHEADUS used drugs - and he had just enough mental acuity remaining to get a JD. He then convinced members of this group who vote to vote. And then they voted.

This group is struggling

- Drug users not in jail

When I mean drug users

- heavy hard core drug users

- People who are being supported by SoberLiving.com

- People who can't function in day to day life because of their drug abuse but aren't in a mental health institution because if they're being actually

treated in a institution we can't count them in labor force group

They'll like it later when it makes for higher demand. Jesus! Did everybody forget how this works?

Extra demand is one thing, margin is an other, and p.e. multiple an other still.

Many professionals - doctors, lawyers, judges, etc. - are functional recreational drug users. Folks like to get high just like they like a good brandy or fine meal. Pharmaceutical companies must be allowed to make recreational drugs that get people what they want but that have little or no dangerous side effects. It can happen, but this anal Puritanical aversion to happiness has got to go.

so how do you make money off of rate rise? short stocks , short bonds? what is the shorting code? logan enlighten me :)

They can't raise rates too much because of debt service. Remember as Ironman indicated dear leader will have doubled the budget by the time he leaves office. If my math is right a 1/4 percent would be 50 billion a year. 1 percent would be 200 billion and so on.

You could use an index fund that shorts the market.

so how do you make money off of rate rise? short stocks , short bonds? what is the shorting code? logan enlighten me :)

economic cycles have phases. rate cuts, their is a stall and then their is the hiking cycle.

At some point the rate hikes will impact the economy negatively and if you want to short the markets look for

Claims to rise over 300K on a w 4 week moving average (323K) the key number for me and it needs to happen without an one time economic event. Also, LEI to have 4 straight negative prints with that claims data line. Their is your cycle recession data line which means profit margins are going to be hit due to low demand

Stocks in this cycle have done since 2009 with all the economic data moving positive for the most part

I am always invested in stocks and adding each month, I am not a person who tries to time the market. Obviously a separate trading account for aggressive moves is something different Portfolio Looks like this

80% stocks

15% Bonds

5% Reits

Stock profile

50% S&P Index

20% International

10% Company called MASIMO it's my biggest position single position, ticker symbol MASI

Keep a eye on rate hikes and economic activity, I don't believe we will see 17 rate hikes like we saw in the start of 2004 getting up to 5.25%

3% Fed funds rate and 4.7% 10 year to me is recessionary, we might not even get their as this was my thought 5 years ago. If wage pick up happens then you can get their as CPI should be over 2% soon.

50% S&P Index

20% International

10% MASI

15% Bonds

5% Reits

What so good about MASI? Why not BSX or MR?

What kind of bonds? Treasuries or corporate bonds?

What so good about MASI?

From my own work, it was a undervalued company for a while, finally kicking into gear, it's had a great 2015, concentrated holdings 20-22 level, only off loaded some shares at 42.43 recently from a different account, adding to it in smaller amounts , it's had a massive run already in 2015, this one is keeper for me.

Bonds are simple ticker symbol PBDAX

As always, I don't care so much for the short term cycle moves that can 2-7 years in directions up or down, it's a long slow and steady race for another 20-25 years, then I will change up the allocation.

The main thing is adding $ each month, that's more cash flow concern, that's the boring truth of it all because even I don't use my own economic cycle tracking to move my allocation, I look at every down turn as a plus until I get into my 60's

Also BSX market cap 25 billion - too big for my taste looking longer term MASI 2.1 Billion

MR went private didn't it recently, it's had bad run since 2013. Not too familiar with that company

Key levels here

2.50%

2.66%

Break those and we test 3.04%

Tell the difference between a analyst and technical chart person

Logan,

Do you think Fed would hike rate? What is the impact of rate hikes on RE in SFBA?

So far, stock market reacted poorly on possible rate hike in December.

The only reason the economy is growing is anyone with a pulse can get approved for a car.

Well you forgot that gas is sucking a trillion dollars less a month out of the world ecconomy than it was 2 years ago.

It's all right there doing exactly what I said $2.00 a gallon gas would do. Now Imagine when President Trump fires up those pipelines and gets gas down to .99 cents a gallon.

There will be an Escalade in every driveway like the good ole days.

Logan,

Do you think Fed would hike rate? What is the impact of rate hikes on RE in SFBA?

So far, stock market reacted poorly on possible rate hike in December.

Short term, it's algo city, until we break into a new highs, which I believe we can, soon the first rate hike will be forgotten and then the discussion will be how many hikes until we see the next recession.

RE in SFBA?

The FED will never raise rates....period

It's so funny to keep hearing people talk about it.

IF THE FED GETS EVERYONE WORKED UP ABOUT AN INTEREST RATE HIKE AND THEN DOES NOTHING IT ACCOMPLISHES THE SAME AS THE HIKE WITHOUT THE NEGATIVE EFFECT! JAMES

that would be a real smart move....

THE FED WILL BE MAKING A TERRIBLE MISTAKE IF IT RAISES THE RATE EVEN A QUARTER POINT AND WILL HAVE TO LOWER IT IN FEBRUARY. IT WILL ALSO CAUSE THE MARKETS TO LOSE FAITH IN THE FEDS. ABILITY TO HANDLE THE ECONOMY!

Not going to happen. All those quadrillions of interest rate derivatives would have to pay out and the broker/dealers never lose money on a trade.

Fed has a dual mandate

1. Control Inflation

2. Facilitate Employment

Those are only the *stated* mandates for the Fed . The *real* mandate for the Fed is to maximize the profits of the banks and wall st through asset inflation and debt inflation. The Fed only gives a crap about Consumer inflation (in reality: wages) and Employment if either one of those get in the way of their real goal. In particular, the Fed does care quite a bit about keeping wages down for middle class.

Never mind what the Fed says, or what the statutes say. Watch what the fed DOES, and who benefits.

I don't know exactly how many times I have said the above in the last five years, but there seem to be plenty of people out there that still do not understand this simple truth.

Never mind what the Fed says, or what the statutes say. Watch what the fed DOES, and who benefits.

I don't know exactly how many times I have said the above in the last five years, but there seem to be plenty of people out there that still do not understand this simple truth.

Because it's wrong no matter how many times you say it.

Interest rate swaps went NEGATIVE in November. That's where the smart money thinks rates are going and the derivatives market is the absolute apex of the "smart money".

Not only is the market well over 70% on future expectations of a rate hike for the First time ever in the cycle

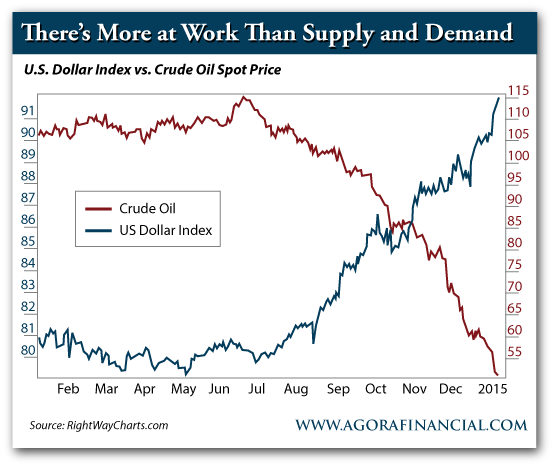

- Dollar up strong in the last 18 months

- 2 year is well above the key .80% level

However, Core CPI today finally got over 2%, this was the last and final metric they were waiting for.

Sounds like it's time to start 5 year cd laddering...0.1%, 0.2%, 0.3%...

However, Core CPI today finally got over 2%, this was the last and final metric they were waiting for.

One of things that people never decided to take into account is that the market has done half the work for the Fed

If you look back in history, the Dollar always makes it's strongest % before the first rate hike happens and it has done it again once.

I know this goes against a lot of the Anti American left and right economic thinkers, but if America was a bad as these cry babies talk about each day, we wouldn't be sitting as the best economy in the world today for a mature country

This is why the European were begging... like a dog for us not to raise rates, why we have currency wars around the world, why all the Anti American talk, never lead to the end of America

Because most of us, we don't cry, we don't whine, we don't beg, we get up, we go to work, we raise our families we do what we need to do to make our life as good as possible.

The left hates the 'good ole days'. That means 'pc' would not exist...

There will be an Escalade in every driveway like the good ole days.

For this thread

1st. The notion that #QE would never end because America would collapse, that failed

2nd, For the people that said the Fed would never raise rates, never, because America couldn't take a 0.25%

Please, come on... it's a 0.25% rate the market has priced in 3 already

So going out from now

CPI core

ECI wage inflation index

Wage Growth/JOLTS data

You won't see a lot more hikes unless these 3 metrics grow like it has before... So be mindful

The left hates the 'good ole days'. That means 'pc' would not exist...

Actually the left loves the good ole days. With strong unions, higher capital gains taxes, more progressive income taxes, tariffs.

It's not the left that has destroyed the US economy--that's for damn sure.

It's like nobody saw the dollar rising, the group that said the Fed would never raise rates.

Now, I could understand if someone didn't know the dollar to Fed rate hike relationship, that is a possible that someone doesn't have that type of education.

However, the market for a while now was doing the Fed's work for them and some people just decided to ignore the data

Anti American crowd lmao

There's nothing more un-American than rooting on the anti-capitalistic entities survival

People didn't want America to fail. Conversely, they wanted this country to be reborn, by killing the parasites that are bleeding the labor classes dry.

People didn't want America to fail. Conversely, they wanted this country to be reborn, by killing the parasites that are bleeding the labor classes dry.

This group here is struggling

- High School Dropouts

- Non- College educated Americans

- Non trade skill educated Americans

- Active Drug users

- Active criminals

- Those with a criminal record ( Hard to Find Job)

- Those on disability

I admit when you look at the data, this group is struggling

But this isn't the majority of Americans and why the Anti Americans bears who just spend every day of their life

Why they lose credibility over time

Being an Anti America bear since 1790 hasn't worked out

Focus on the poor and uneducated from a point of Strength not from weakness

If the middle class was so bad in America we wouldn't be standing at top of the economic world #1

Be mindful that demographics are going to get better in a few years, that means more household formation, more economic output

But then again, in reality if these Anti American bears really were living such horrible lives, they would leave the country for better economic opportunity, they don't any many people still want to come here

The extreme left and extreme right as always in history have been proven wrong again because they over play their hand

in isolation - because oil and other commodities are the basic building blocks of production, and because those materials are in such weak demand/consumption, one could easily think that the broader economy is very far from inflationary pressure.

It's a strategic temporary thing the Saudis are doing to mess with Russia.

Supply is growing while demand has taken a hit

But

All short term rates and dollar and the U.S. economy have been growing even with the hit in the Commodity based U.S. sectors that are priced sensitive

They data is there

However, a Fed rate hike is a huge slap in the Face for the Anti American bears who first said #QE would never end because America would fall into a recession right away

I get it, you have to make a last stand here, because if the Fed raised rates that's just another knock on thesis

X energy service inflation is running at 2.9% today, highest since 2008

A lot things are happening that wasn't supposed to happen and it's all happen with the world economies in trouble today

« First « Previous Comments 9 - 48 of 62 Next » Last » Search these comments

2 year which needs to be over .80% is now at .90%

#Housing #Economics