patrick.net

An Antidote to Corporate Media

1,198,134 comments by 14,127 users - Kepi, mell, Onvacation online now

NO thread about rise in interest rates ?

2013 Jun 19, 9:34am 14,669 views 37 comments

Comments 1 - 37 of 37 Search these comments

"Has Bernanke lost control ?"

That would presume he had any in the first place.

I don't really care at all what the Bay Area house prices are, I lived there for 10 years and would never go back. I'm more interested in the parts of the country where real, sane people live who have normal lives and median income by Text-Enhance">jobs. :)

Increasing interest rates will have a larger impact on the Bay Area and So Cal where prices have bubbled up. As for places where "sane people" live, the price are still cheap and interest rates will note have much impact on prices.

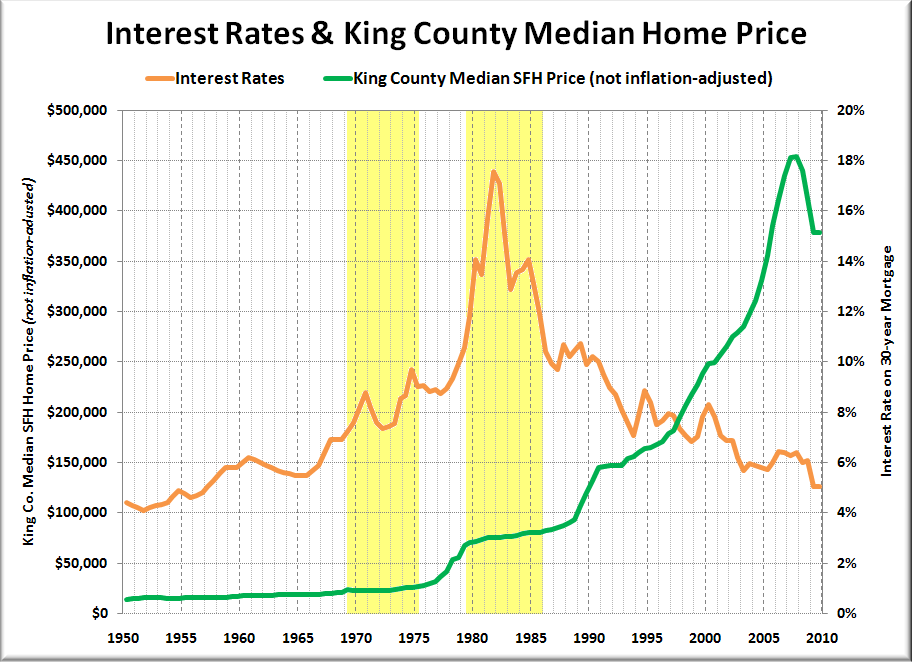

Conventional wisdom says each one percent rise in rates = 10 percent lower house

(cash) price.

Do you have a source for this "conventional wisdom"?

1% in rates = 10% drop in prices... so I guess if rates get near 18% again, homes will be basically free?

homes will be basically free

that wisdom is 100% emotional. don't attempt to qualify it with math.

10.75 %

http://themortgagereports.com/6354/mortgage-rates-purchasing-power

10 year at 2.41 yield this AM.

http://finance.yahoo.com/q/bc?s=%5ETNX&t=3m&l=on&z=l&q=l&c=

Low looks like it was at the end of April - so 6 or 7 weeks from 1.66 to 2.4+

1.4 a year ago.

Could be a frightful summer for all those hedge funds who piled into houses.

Stop loss selling of houses ?

Ouch.

Could be a frightful summer for all those hedge funds who piled into houses.

Stop loss selling of houses ?

Ouch.

That's fine. So, again, do you have some source for your statement "each one percent rise in rates = 10 percent lower house (cash)", or are we left to conclude (in spite of, or perhaps in accordance with the graph of historical rates vs prices) that your statement is just wishful thinking?

Increasing interest rates will have a larger impact on the Bay Area and So Cal where prices have bubbled up. As for places where "sane people" live, the price are still cheap and interest rates will note have much impact on prices.

I concur. South CA and South Florida should see major price drops if interest rates rise even a bit more. But for places that have already deflated, this rise won't make much of a difference.

I think it will effect speculators the most because there will be fewer fools to flip the house to. Speculators hate high interest rates and low rates encourage speculation and flipping.

I am wondering if this isn't bigger news because .69% is not much and it needs to stick and keep going up. For all I know it will be back th what it was before in a couple of weeks.

I am wondering if this isn't bigger news because .69% is not much and it needs to stick and keep going up. For all I know it will be back th what it was before in a couple of weeks.

Hmm sure seem to be moving up quick at this point and I think we will be at 5% before the end of the summer. Here in San Jose it seem like the market has cooled down a bunch in the last few weeks. Maybe the rate jump scared off some of the speculators... I mean investors. Could all the housing bulls be wrong.... Could higher rates affect the Bay Area fortress?

It's already insane to make $100k a year and buy an $800k house. If prices don't go down, which would be a natural dynamic to make the house price affordable at rising interest rates, then some other insanity must ensue.

There is a balance of the interest rates and prices that makes houses "affordable." The problem recently is that the only way you "afford" a house with a price you will only pay back using most of your living years is if the house appreciates accordingly. That's the gamble. Leverage gets more and more force and is expected, or thought, to only go in a positive direction. People get it, go ahead and jump in, then live their lives under the pressure of that force.

It's already insane to make $100k a year and buy an $800k house.

That's a pretty general statement. What is their debt, down, interest rate, etc. It would be uncommon for 100K a year to rate a 800K home, but it isn't out of the realm of possibility.

The problem recently is that the only way you "afford" a house with a price you will only pay back using most of your living years is if the house appreciates accordingly. That's the gamble.

Or you put all your money in stocks? That isn't a gamble?

It's true, if you want to sell for a profit it may not happen. If you are going to hold onto the house, retire in it, etc. that becomes something completely different.

Typically, if you can hold a home for 5-10 years you do ok. Prices are back near 2006 levels ... so that was what ... 6 years?

Say worst case, you bought a home at the peak. So, if you were smart you probably re-fi in the 3% range in the past year or so. Additionally, you have been building some equity in the home with your payments for the past 6 years. You likely had some repairs/upgrades/etc. In those 6 years you also likely got general raises at work. So with the 3% re-fi and the income increase the house is more affordable than ever, you have been building equity, and your house is worth right now ... near what it was.

Gosh! Sounds horrible!

Unless you have a financial advisor helping your money grow, or you yourself are very active in managing your accounts you are typically going to benefit from being in real-estate. Additionally, you do get a house of your own.

If you aren't a homeowner, then everything is rolled into stocks and bonds ... and you get to rent. To each their own.

I'm not saying there is a huge rationale behind the prices we see for houses, for what they are (rotting termite boxes out in the rain/sun). But here in the bay area, there is a large demand for property in good school districts near work. They don't "make" a lot of those ... so scarcity demand laws apply.

Or you put all your money in stocks? That isn't a gamble?

If those gambles are to be equally considered then where's the "mortgage" for stocks?

Or you put all your money in stocks? That isn't a gamble?

If those gambles are to be equally considered then where's the "mortgage" for stocks?

There are methods of borrowing money to invest in stocks. It's typically a stupid thing to do since stocks are considered a higher risk investment than real-eastate.

Here is pretty quick/good summary of advantages and disadvantages ...

http://irc1031.wordpress.com/2010/06/10/risk-reward-stock-vs-real-estate

Again, if you are seeking balance in investment, and have the cash to do it, why wouldn't you buy a home? Booms and busts will continue to come and go. If you want to perfectly time the market, then do that. Me personally I'll spread out my funds as best I can, and timing I'll try and time, but part of it will be circumstance for me. I'm not "investing" in anything other than a primary residence.

(Let' say there is a huge devastating housing market crash. You think stocks are going to be immune to that market force? You think money will flood into stocks for shelter? Also, where are you going to plant your yams and gatling guns?)

(Let' say there is a huge devastating housing market crash. You think stocks are going to be immune to that market force? You think money will flood into stocks for shelter?

That's true but that's why there is nothing comparable to a mortgage for stocks. You can get a margin account with some leverage but it will get called quickly, the brokerage hardly ever loses any significant amount of money when people go broke. But for some reason for housing it is ok to leverage yourself to the hilt and then have the taxpayer bail out all the involved parties. If there were no bailouts and FHA and all that crap, you'd see suddenly requirements of 50% down ant the minimum or even all cash transactions only. And why not, owning a house is not a birth right. It's fine with me if they continue to offer leverage as long as all these crony programs and bailouts disappear.

Again, if you are seeking balance in investment, and have the cash to do it, why wouldn't you buy a home?

I agree. The tricky part is "and have the cash to do it." For me the cash considered enough "to do it" would upset the balance. So I consider it unafforable while having an income and assets much higher than most of my peers who somehow consider buying "affordable." It's a mystery, except that I know many of my peers have had support not available to me, especially in the form of parents with money. I still know a friend in the bay area who owns a house and didn't get money from parents. In several of those cases I know they received the entire downpayment from their parents. Nice! Although, I was once faced with the prospect of getting a downpayment from inlaws and ran the other direction. To each his own. My need for autonomy is rarely met. I need a lot.

If there were no bailouts and FHA and all that crap, you'd see suddenly requirements of 50% down ant the minimum or even all cash transactions only. And why not, owning a house is not a birth right. It's fine with me if they continue to offer leverage as long as all these crony programs and bailouts disappear.

Try and go buy a home with little down right now anywhere around the bay area. I don't think it can be done. You could get a subprime loan, but ouch, you'd have to want a pretty crappy place very badly to make it work ... and even then it would be hard.

All cash buying is also at record highs. The simple fact is though the most common way to buy the expensive things in life is to take out a loan. Not everyone owns a home, typically 40-31 percent don't! Compared to other countries that seems to be right near the middle of the trend 50-70% home owners on average across the world ... with the US typically posting a number in the 60% range.

I'm with you though, the bailouts sucked. It was a bad deal, and it's hard to say whether the alternative would have been worse. It would be awesome to know what would have happened if HAMP/TARP/QE and all of it were not done.

You have to imagine though, the shockwaves through the US and global economies would have been horrible! Remember, Europe got smacked hard, and it was because they were following our lead.

The economy is a man made system, and it needs tuning and oversight to run. We will stray back into trouble again, because we are human, and we are horribly stupid in pack behavior, but we will also correct and prosper too.

"It's not fair, it's not fair, it is their fault" .... little comfort and wears thin fast. Life is short.

Hang in there FunTime. I hear ya. You may find one day the equation adds up for you to jump in. I, like you, am pretty risk adverse myself.

The economy is a man made system, and it needs tuning and oversight to run. We will stray back into trouble again, because we are human, and we are horribly stupid in pack behavior, but we will also correct and prosper too.

"It's not fair, it's not fair, it is their fault" .... little comfort and wears thin fast. Life is short.

Sure, not advocating to complain and hide ;) One needs to act. Personally - even though I trade stocks mostly on the long side - I'd like to see the economy correct towards the deflationary side because inflation is wrecking the middle class. So I'd like to see those programs subsidized by the taxpayer that distort the market go. Everybody should make their own investment decisions and prosper if they can. It gets bizarre though when people boast about their gains gotten from taxpayer subsidized fed-induced (housing-)market levitation and then pat themselves on the back arguing those programs are for the greater good. Instead they should extend a warm thank you to the middle-class who was forced to make their gains happen ;)

I, like you, am pretty risk adverse myself.

I just find it astounding that what I'm doing is considered risk-adverse. I have more money than the median U.S. household net worth invested individually in several of the single company stocks I own!(Of couse, the median U.S. household networth is a pittance)

I, like you, am pretty risk adverse myself.

I just find it astounding that what I'm doing is considered risk-adverse. I have more money than the median U.S. household net worth invested individually in several of the single company stocks I own!(Of couse, the median U.S. household networth is a pittance)

Had similar thoughts. But you ain't a real big boy speculator if you don't leverage yourself to the hilt with some good RE! Go buy those shacks already! ;)

Of couse, the median U.S. household networth is a pittance)

What is the median household net worth these days?

deflationary side because inflation is wrecking the middle class

If you are a saver, it can absolutely feel this way. Deflation, on its surface, sounds good if you have cash in hand, or want to buy an expensive asset.

The truth is though, inflation overwhelmingly benefits the middle class. Just do a quick look at what a market looks like under deflation or inflation and what it means to the average guy on the street. (avoid hyperinflation or hyperdeflation models)

I, like you, am pretty risk adverse myself.

I just find it astounding that what I'm doing is considered risk-adverse. I have more money than the median U.S. household net worth invested individually in several of the single company stocks I own!(Of couse, the median U.S. household networth is a pittance)

Putting money in the stock market isn't a risk adverse behavior. Money in bonds, savings accounts, cash under your mattress ... that is much more "safe".

Or should I interpret your comment as: "I believe in the stock market more than I believe in RE : so the majority of my money is going there."

That's a perfectly fine investing strategy. You do have heavier exposure in the stock market of course, and just like housing, we know it can face some interesting times. Stocks also rise and fall typically faster than RE prices. They are typically a more risky asset class.

deflationary side because inflation is wrecking the middle class

If you are a saver, it can absolutely feel this way. Deflation, on its surface, sounds good if you have cash in hand, or want to buy an expensive asset.

The truth is though, inflation overwhelmingly benefits the middle class. Just do a quick look at what a market looks like under deflation or inflation and what it means to the average guy on the street. (avoid hyperinflation or hyperdeflation models)

On the short term inflation looks better for the debt-laden consumer, but bad for the responsible saver, but eventually inflation is bad for both of them as the debt-laden consumer goes more into debt and has no incentive to form capital to get out of this. The debt-laden consumer also needs to spend most of the debt-financed cash on daily necessities (besides buying the latest hip table or smart phone) for higher prices (due to inflation) while he has little-to-none capital left to invest (except for leveraging themselves to the hilt with the only vehicle backed by the taxpayer, housing, esp. FHA). Meanwhile the upper class can put all that extra money flooding the economy into assets of choice that rise with inflation, plus they get some of the debt-laden consumers money back from their spending. They don't need to spend that extra money on necessities and therefor fare much better. I have provided graphs of periods of extreme stable wealth for the middle class in countries such as Germany while there was slight deflation-to-slight inflation, it's just that if you look short term the American, debt-laden consumer is fucked. But that doesn't change by printing money, time to get off the addiction and go cold turkey. If one really wanted to help the poor they could take existing money directly from the rich and give it to the poor. They could start with government officials, esp. congress and senate and then move on to Paul Krugman ;) Btw. I am not fixated on deflation, just stability. I consider slight deflation and slight inflation (around 1%) mostly ok.

You think the haves vs have-nots equation gets better in a deflationary economy?

You think the haves vs have-nots equation gets better in a deflationary economy?

It really depends on the segment. A middle-class with reasonable capital formation/savings will do equal or better the have-nots on welfare could also benefit from falling prices as long as their welfare is not adjusted.It depends on whether jobs will be lost, i.e. if the deflation is coupled with an economic downturn and significant job-losses. Hard to answer. Depends on where the deflation is. If it is in energy, shelter and food it is mostly good for the non-debt laden consumer, if it is in electronics or other non-essential items only it's fairly useless. If you are in debt and have loaned against periodically reevaluated assets then you are screwed. That's why you should never do that or take adjustable rates unless you can afford to lose everything. Now I am not saying that the US currently has a middle class with reasonable savings/capital formation, but if they could reign in on the debt/consumerism addiction mild deflation would certainly lose a lot of its scare. It's not scary for Germans ;)

What is the median household net worth these days?

I found a source, which I posted somewhere here on patnet, which had it at about $10800.

Median net worth is not a popular number to discuss. So finding number is difficult and mixed with lots of references to "average family" "median homeowner" and so forth. This source puts the median number for homeowners at $77k, then corrected to $65k in the footnote. It does not say how net worth is calculated, whereas the $10k number I found specifically said only the house equity was being used, not the house value. I think it is typical of houseowners to think of their house asset value as the price for which they paid or for which it has been appraised rather than the piece for which they've actually paid.

You think the haves vs have-nots equation gets better in a deflationary economy?

There is more that goes into the equation, such as taxation, and other rules. But I price stability (low fluctuation) is key to a stable economy with sufficient upward and downward mobility. So if prices are relatively stable and all other factors are equal then the haves vs have-nots inequality would be at least stable around a natural equilibrium (given all the other factors).

oops forgot the link

http://money.cnn.com/2012/06/11/news/economy/fed-family-net-worth/index.htm

This source puts the median number for homeowners at $77k, then corrected to $65k in the footnote. It does not say how net worth is calculated, whereas the $10k number I found specifically said only the house equity was being used, not the house value. I think it is typical of houseowners to think of their house asset value as the price for which they paid or for which it has been appraised rather than the piece for which they've actually paid.

Right--it's difficult to try to appraise every house in the US to determine net worth... It's sad that it's so low, however, when you consider that the largest demographic (boomers) are pretty close to retirement.

With deflation it can feel as though the world is your oyster if you have savings in cash that have not been whacked by the stock market and if you did not lose your job. The closest I got to that was in 2008-2009. Eventually the deflation and consequent fall in real estate prices allowed me to purchase my pad at the end of 2010. If the deflation has not occured and prices were to keep going up from 2003 till today with no drops, I would probably not be able to afford to buy.

This report shows similar numbers to the CNN aricle, but also shows numbers without home equity, which are, of course, less than half of the numbers with home equity.

http://www.census.gov/people/wealth/files/Wealth%20Highlights%202011.pdf

I see now I missed a word in the description of that $10800 number. That is the "financial" net worth, which seems to refer to certain assets outside a house that can be invested. Here's the article:

$10890 median "financial" net worth!!!!!according to calculations by Edward N. Wolff, an economics professor at New York University. (He bases this estimate on 2010 Federal Reserve data, which he has updated for Sunday Business according to changes in relevant market indexes.) http://www.cnbc.com/id/100803102

What gives :)

So interest rates (10 yr / mortgage) are up almost one percent in the last 6 weeks or so (ok 0.69 percent but still ...) . Conventional wisdom says each one percent rise in rates = 10 percent lower house (cash) price.

So the 150k houses I was looking at in April, I should now be bidding 135k cash ? Ouch (for the sellers).

Thoughts on how far the rise goes and how long it continues ?

Thoughts on effect on housing prices ?

And no, sorry I don't really care at all what the Bay Area house prices are, I lived there for 10 years and would never go back. I'm more interested in the parts of the country where real, sane people live who have normal lives and median income jobs. :)

Has Bernanke lost control ?

#housing