patrick.net

An Antidote to Corporate Media

1,194,965 comments by 13,955 users - 6DOF, AmericanKulak, FortwayeAsFuckJoeBiden, HeadSet, mell, stereotomy, WookieMan online now

« First « Previous Comments 63 - 102 of 102 Search these comments

Volcker II please come now!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

Volker is long long gone. He is done with Obama.

Volcker was said to be disappointed in how the board was used a public relations tool by the White House, saying that live broadcast of its meetings made honest discussion difficult. According to former U.S. Treasury deputy assistant secretary Joseph Engelhard, “They pretty much used him to look tough on regulation, and now they’re done with him, they’re saying goodbye.â€

the 99 cent double cheeseburger at McD's hasn't gone up that much in 12 years.

the ingredients change. fillers. cow parts. process engineering.

the 99 cent double cheeseburger at McD's hasn't gone up that much in 12 years.

The 99c cheeseburger is the steak substitute our gov't has just put into their CPI basket, when they took steak out.

People don't understand what hyperinflation is.

It's when the currency is no longer accepted as having value. It has nothing to do with supply or demand. It's a political event. Hyperinflation isn't when you have a lot of inflation, it's when China, Russia, South America, and Europe don't accept dollars as having any value.

If the banking system just keeps creating money to buy what it wants, and forces China, Europe, Russia, etc to actually EARN the money to buy these assets, why would these countries continue accept US dollars as having value?

But that also is what is happening now china is going to back more of the Brazilian currency since the cheaper dollar is crushing them. If other countries buy the yuan to prop it up it could lower their own to stay competitive.

In terms of how a currency can get weak I can offer this. During the 1990's we had sanctions on Haiti. Unlike other countries with sanctions it couldn't really make anything to threaten any other. Add in being an island and a lack of any other power backing it the price of gas went to $50! I know this because I knew people there.

to note

Personally I wouldn't trust sanders with a national plan given that he's from vermont. In all due respect the area is detached and very hypocritical. Their taxes are very progressive and yet the have the loosest gun laws of the country. They claim to be for the environment but they have the worst operating nuclear plant in the country (post three mile island). It is the whitest state in the country with a open secession movement and is the wyoming of new england.

Hyperinflation is a currency event, not an economic event -- Jim Sinclair.

Think about it. Wise words, indeed.

You can have inflation (especially in necessities) along with slow economic activity.

Fed money @ 0% goes to big banks who turn around and buy US debt paying

1-2%, generating billions in profit with virtually no risk as it is backed by YOU the taxpayer. To paraphrase the old western, "Consumer loans? We don't need no stinking consumer loans."

I dont' know.. the 99 cent double cheeseburger at McD's hasn't gone up that much in 12 years.

I like your "I can haz cheezburger" index.

The average "extra value meal" at McDonald's was what, about 4 bucks back in the late 90's? Now it's about 6 bucks. Not huge inflation when spread out over 15 years, but still significant.

I'm thinking they've got to be losing money on that double cheeseburger these days. To keep it on the "dollar menu" they removed one of the two cheese slices and renamed it the "McDouble."

I also predicted deflation as I stated on this thread last year

Some more info from Elliot Wave

If the name Irving Fisher rings a bell, chances are you saw it attached to his quote from October 1929: He was on the record saying stocks had reached "a permanently high plateau."

Of course, the epic market crash came two weeks later. Fisher's reputation never recovered; the quote remains in circulation today.

Shame of it is, before that time the man's reputation as an economist had been well-earned and honorable. He was a successful inventor, health advocate, and prolific writer who made lasting theoretical contributions to the economic school of thought eventually know as monetarism. Milton Friedman said Fisher was "the greatest economist the United States has ever produced."

What's more, Fisher put his money where his mouth is -- which, in October 1929, meant that his considerable fortune was in the stock market. He lost everything in the crash and depression, including his own home.

For a time Fisher thought a fast recovery would follow, but soon enough he realized this was a grave misreading. He went back to the drawing board and undertook a study of the economic depressions of 1837 and 1873.

He published his conclusions in 1933, saying he had developed "what may be called a debt-deflation theory of great depressions." In brief, Fisher argued that great booms/depressions come with two "big bad actors" -- excessive debt, and a deflation afterward.

This analysis was spot on. But by the time he had it figured out, no one cared to hear anything from Irving Fisher about economics.

So in our day, the appalling irony is this: The conventional wisdom embraces Fisher's "permanent plateau" mistake, but is oblivious to the great lesson in economic reality he eventually learned.

Hyperinflation is a currency event. So you have to watch the strength of the Dollar.

Stocks go up....hmm...You know, one could manage to keep the water level in a swimming pool just at the desired water-mark by dumping rocks and razorblades into it to compensate for evaporation. In the case of the stock market, it is mostly rocks and razor blades now because it is being kept 'full' or rising through Moral Hazard, not through economic growth.

Good think I found this thread...many posters here apparently don't understand the difference between growth and moral hazard.

Whenever anyone talks about the recent stock market trends the automatic response to their 'snapshot' reasoning should be a simple question, "At what cost?" Until the answer to that question is known, folks can be led to believe any cause for the stock market 'level' is valid.

-Jahfre Fire Eater

Be very careful relying on that Elliot Wave stuff. I know of a guy who fell for it when he first heard Robert Prechter warning of "massive deflation" and sold everything back in 1989

http://query.nytimes.com/gst/fullpage.html?res=950DE0D61E39F935A35751C0A96F948260

He got out of the market at DJIA @ 3000. His house would have been paid off, but instead, he is in his 23rd year of renting. Somehow, I dont see this ending well for him.

I don't get the difference between monetary base and credit.

Banks were given credit from the increased monetary base. Seems like the same thing to me.

Patrick - consider the charts below.

Monetary base is the reference point for creation of credit.

It is the banks' job (both commercial and central banks) to make sure that bank credit (the people's money) and base money (the banks' money) are fungible. That is, they are always freely and equally exchangeable. But of course they are two separate things, credit and base money, with two very different volumes. Under normal conditions, there's a lot more credit money floating around than there is base money. So keeping them fungible can be a juggling act on occasion. But for the most part, we the people choose to hold bank credit as our money rather than cash. And, in fact, it is the limited availability of cash in the system (its relative "hardness") that keeps our money stable in unit value.

Think about it this way: We are free to choose cash at any time. And when we go to the bank to exchange our credits for cash, we put that bank under pressure to come up with cash that is relatively "harder" to come up with (more limited in volume) than credit. Let's say, for example, that "demand deposits" (those that can demand cash on the spot) are ten times larger than the total volume of cash in the system. Is this good for our money? Yes, because it means that the reference point unit we use is in limited supply, which keeps a vital tension on the overall system. The operations the bank must do to come up with our cash (sell off some value) maintain value in our credits.

http://fofoa.blogspot.com/2011/11/moneyness.html

Do you see the difference now?

Except for housing prices, I don't see anything else deflating.

If the homeowner isn't insulted by your offer...you didn't bid low enough!!!

Exactly. Let the home prices inflate and triple in next 5 years,but hey who will have that kinda money to buy? huh? Inflation? my a$$

[Vermont] is the wyoming of new england.

Does Vermont have more cows than people like Wyoming?

The money being printed is not sitting idle in some bank...it's being used to socialize all the losses from the mortgage crisis and on all the stimulus spending. Essentially the government is spending money in massive amounts that it doesn't have in revenues.... where do you think this money is coming from?

Not to mention all the student debt forgiveness that is soon going to come...

This spending creates massive inflation not deflation.

The average "extra value meal" at McDonald's was what, about 4 bucks back in the late 90's? Now it's about 6 bucks. Not huge inflation when spread out over 15 years, but still significant.

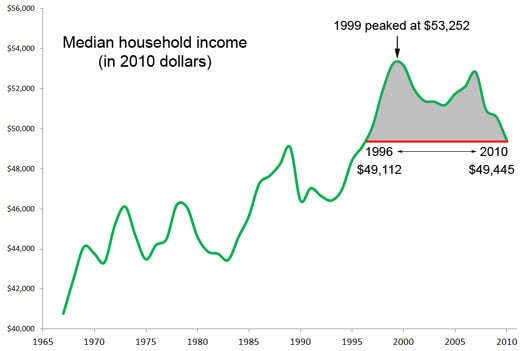

Yep, and the median workers' income hasn't gone up 50% in 15 years for sure.

when the fed is quietly purchasing 80-90 percent of the long term Treasury note to keep the government juggernaut going, how is that not inflating the money supply? Have you vivited shadowstats.com?

And when we go to the bank to exchange our credits for cash, we put that bank under pressure to come up with cash that is relatively "harder" to come up with (more limited in volume) than credit.

Is this the sole reason bank runs can sink banks? Or is it because banks gamble with our money, and a bank run takes away their collateral?

Patrick - consider the charts below.

Monetary Base (M0) is all the physical currency. Granted, we can create trillions of electronic dollars in a microsecond, the fed still needs to fire up the printing press to represent this supposedly physical currency. I have charts zoomed in 2008-present.

Notice how the reserve balances closely follow the movement of M0. At the beginning, the difference is close to $900B. Now, the difference is a little less than $1.2T. So, about $300B has already leaked out (or 33% with respect to $900B before QE1). Whatever remains in reserve balances is the same as money printed and kept under one's mattress. It is out of the system and won't cause inflation until it leaks out. On top of that, I think China has been warehousing some of the money instead of buying more Treasuries. Just guessing, since I don't have up-to-date data on Chinese holdings.

So here is my theory: As more banks fail or as more entities (companies and private citizens) go bankrupt, more of this money leaks out. M0 isn't multiplied out until the banks begin lending out this money.

One more thing. When you experience a flight of capital, such as what happens in the event of a Sovereign Default, people will be selling dollars in exchange for other currencies. This creates a tremendous downward pressure on the dollar, since tons of dollars are being sold in the foreign exchange. Doesn't this cause severe inflation? I don't think you can look at only Money supply vs Goods being bought.

Yep, and the median workers' income hasn't gone up 50% in 15 years for sure.

Very true. Remember, our government works for the big banks, not for us.

Snore......yeah, oil and food are getting cheaper by the day.

We can thank China for that. Thankfully, their whole economy (or at least the part NOT based on producing cheap shit for Americans) is a bubble which will come crashing down. And unlike Japan, China is a powder-keg ready to explode.

Is this the sole reason bank runs can sink banks? Or is it because banks gamble with our money, and a bank run takes away their collateral?

A combination of both I would say. It's out of control right now.

When you experience a flight of capital, such as what happens in the event of a Sovereign Default, people will be selling dollars in exchange for other currencies. This creates a tremendous downward pressure on the dollar, since tons of dollars are being sold in the foreign exchange. Doesn't this cause severe inflation?

Not quite. Remember US dollar is the king still, of all fiat currencies. It will actually create an upward pressure on the dollar, which Ben and company most certainly don't want right now.

US dollar is most certainly dying the slowest of all fiat currencies, purely because so much US dollars already exist in the system.

Here's a paper you can consider on Currency and Marginal Utility.

Well, Listen to John F. Kennثdy! The best American President and his last speech about the secret societies!

If you understand his speech and what he was saying to the world and Ron paul then you would understand what is going on!

PEACE TO THE WORLD FOR EVER..that is my wish! In the name of Humanity!

No....

Stop advising the sheeple to wake up. They will never wake up.

The secret societies are doing the world good. THEY are bringing PEACE to the world NOT they fucking sheeple.

Sheeple are the problem and cancer of this earth.

Join the banking elites and support the new world order. 99.9% of this entire world's population is piece of stupid shit with no intellect and serve no purpose to live on this earth.

Support the new world order, support global population reduction and support mass murder.

We the bankers are not done with you little pieces of shit peasants

Do you think a lack of inflation somehow means there will be no hyperinflation? Inflation and hyperinflation are two very different things.

Uh, the Fed can increase the money supply without more loans by buying existing assets (loans) from banks, then the banks can use the proceeds from the sales to buy equities, buy treasuries, pay bonuses, etc. ... and poof! Inflation!

I get a kick out of the limitations that people create for the Fed, what they can and cannot do.

I don't suppose you have ever bothered to read Bernanke's speech, The Fed Has a Printing Press.

And how is the Fed more limited than the central banks of Weimar Germany and Zimbabwe?

The Fed can create money at will, and use it largely at their discretion as long as they do not buy debt directly from the Treasury before it passes through the debt market, in at least some cursory manner so a Primary Dealer can put its pawprints on it.

I think hyperinflation is not likely. It is a major policy error. But the things you say are just not true.

All the best,

Jesse

Whatever the math and logic, the idea that in the next 10 years the US dollar will have actually increased its purchasing power is just outlandish. Deflation or not, the dollar will only lose value.

Uh, the Fed can increase the money supply without more loans by buying existing assets (loans) from banks, then the banks can use the proceeds from the sales to buy equities, buy treasuries, pay bonuses, etc.

All the Fed needs to do is to get new cash into the hands of congress, they will spend it to reap political glory from the perpetual religious wars and the inflation will result. No loans, no public, just buy more expendable war machines at an ever accelerating rate and the inflation will come.

-Jahfre Fire Eater

Deflation or not, the dollar will only lose value.

How exactly does deflation result in dollars losing value?

Here's a paper you can consider on Currency and Marginal Utility.

Thanks. It was a good paper.

Corollary: the relative value of a good bears no direct relation to its scarcity. Therefore the relative value of a good bears no relation to its perceived abundance.

True. It should be supply vs demand.

I still don't see how the USD will become stronger when everyone is trying to sell it. Are you saying this is because M3 will drop sharply?

On the subject of marginal utility, the vast majority of the Gold ever mined are warehoused in government vaults and whatnot, and the flow is only a trickle compared to the stock. What happens if (for some hypothetical reason) every government decides to liquidate its gold inventory? A large quantity of gold dumped into the market will surely collapse its price.

The Fed is indeed "printing" money to fund the deficit. They lend money to the primary dealers at 0-.25%, who then buy treasuries at market rates (currently 2-3%) and pocket the difference. Treasury then funds the US government's deficit spending. The primary dealers spend the "earned differential" by purchasing "preferred" assets (ie: stocks, bonds, anything to maintain the ponzi). Inflation (as measured by the money supply) **IS** occurring. It will be realized in the price of goods/services as soon as the velocity of money increases. Now that interest rates are turning up, you can expect the banks to start lending again. This will increase velocity and -- voila -- inflation. There is NO WAY out of the trap that Bernanke has laid. We WILL have a hyper-inflationary depression. The cards are already on the table.

I have a question. When debt among people increases in terms of transferring private debt to public debt then is the money supply increases or not? It comes to my mind the case of Greece where it had a haircut. One outcome of this is that half of the previous private debt was transferred to public one, so to the greek people. Will this increases money supply in this case or not? Thanks

For your consideration: http://www.economicpolicyjournal.com/2012/03/how-quickly-can-price-inflation-explode.html

the vast majority of the Gold ever mined are warehoused in government vaults and whatnot, and the flow is only a trickle compared to the stock. What happens if (for some hypothetical reason) every government decides to liquidate its gold inventory? A large quantity of gold dumped into the market will surely collapse its price.

Price measured in what? Price is different from value.

Either case, I don't think Governments are stupid to dump physical gold in the market. Look at Hugo Chavez for example.

I still don't see how the USD will become stronger when everyone is trying to sell it. Are you saying this is because M3 will drop sharply?

M3 includes long-term time deposits also right? I don't think M3 will drop sharply, what will happen is the demand for M0 and M1 will explode, therefore causing a shortage of cash.

Price measured in what? Price is different from value.

Two types of value:

Nominal Value - Dollar price (or other currency)

Real Value - Purchasing power

It will fall on both measures. Unless you measure its value relative to gold (itself). An ounce of gold will always be an ounce of gold.

Either case, I don't think Governments are stupid to dump physical gold

My example was hypothetical.

what will happen is the demand for M0 and M1 will explode, therefore causing a shortage of cash.

Thanks.

Nominal Value - Dollar price (or other currency)

Nominal value of gold measured in dollars would have no meaning if the dollar is toast.

Real Value - Purchasing power

Real value might actually increase temporarily during such a transition.

My example was hypothetical.

Hmm, then we don't have to worry about that do we? :)

« First « Previous Comments 63 - 102 of 102 Search these comments

I'm sorry to inform everyone that hyperinflation is not coming. If people fully understood the Fed they would know that the Fed cannot directly manipulate the money supply. The Fed can only make circumstances more enticing for consumers to voluntarily increase the money supply by taking on more debt. One way they do this is by lowering the interest rate. 100% of the increase or decrease in the money supply comes from our fractional reserve banking system. Accordingly, people who take out debt (voluntarily) directly increase or decrease the supply of money, not the Fed.

If the Fed creates 100 trillion dollars through quanitative easing and has it sitting in the banks, nothing happens; zero inflation. The money supply actually increases when that money is lent out to customers and is spent. Resultantly, it is turned into someone else’s income that will eventually end up in a bank which will then have a fraction (90%) of this money loaned out.

So, the process starts all over again. The bank loans it out and more money is created. The only thing remaining in the bank is the reserve of 10%. If the Fed creates 1 trillion dollars and has it in the banks, it has the potential to create approximately 9 trillion in new money through loans. No inflation has occurred form the feds actions, ONLY THE POTENTIAL FOR INFLATION! Banks are who cause the increase or decrease of the money supply, and that is based on the supply and demand of new money from customers and their loans. REMEMBER IF THE 1 TRILLION IS NEVER LOANED OUT AND CHURRNED OVER AND OVER IN THE FRACTIONAL RESERVE SYSTEM, IT IS AS IF THE MONEY IS NOT IN THE ECONOMY.... NO INFLATION!

This means when a large group a people all increase debt at the same time they are increasing the money supply. As a result you will see excessive inflation where they spend that money. This my friends is why housing has had a bubble. This is exactly what happened in the 90's when the baby boomers where in their peak spending/earning years (40-55) and bought everything on credit. The mistake that the Fed did in the 90's and in early 2000 is they adjusted the interest rate making debt look more appealing at the exact time that they should have been trying to prevent the largest cohort in U.S. history from spending debt, which would cause inflation.

Currently generation x, which is a much smaller cohort, is approaching their peak spending/earning years and will have a lesser aggregate demand for debt(created new money) than in the 90's. This decrease in the money supply will result in less new money flowing into the economy and less "stimulation". A lesser demand for the money supply produces lower wages and as a result lower asset prices.... hence, deflation. What is even worse is that we still need to pay back all the excessive debt created from the last 15 years.

This brings up the subject of deleveraging. The reason we are hurting is that we are paying back the dollars we spent 10 years ago with no economic benefit today. This problem the Fed and Gov. want to fix by taking on more debt. This thus perpetuates the cycle and makes it worse! The pain has to occur in order to restore to reality. We need to pay the money back with real money, not easy debt money. The more we extend and pretend the worse the debt gets and the more the future generations will be enslaved to pay for our Fed's mistakes.

#housing