pancakes

2012 Jun 20, 5:21am 25,443 views 58 comments

by thankshousingbubble ➕follow (7) 💰tip ignore

« First « Previous Comments 20 - 58 of 58 Search these comments

What about this?

"Foreclosure activity jumps in troubling sign for housing recovery"

I can’t recall any single political rumor e.g. election year, republican or democrat president, new budget etc., to have direct impact on real estate prices, employment, salary or interest rate. So I suggest bypassing it. Low inventory is a fact now and huge number of buyers coming out of fence, intrigued by rising rent and media info: “2012 landlord yearâ€, “best affordability in yearsâ€, “lowest interest in yearsâ€, “best time to buyâ€, finely decided to buy.

Has been notice rising inventory in expensive areas, where rich see an opportunity now to get rid of expensive houses. Additionally, some recent cash buyers put their houses for sale. It is hard to bypass to earn extra 50-100K in a very short time. Meaning, they also do not believe the current run-up with prices is going to sustain.

http://www.housingwire.com/news/fed-considers-funding-lending-program

I'm working on an assumption that int rates will be this low OR MUCH LOWER the rest of our lives.

They are following the japan ZIRP model to sustain the zombie banks/asset prices. Since there will be zero growth - asset prices will go up or stay the same from ever lower int rates. There is a ALOT OF ROOM for rates to go down. Imagine buying a 1m home with a 30 year fixed mortgage at 1%. The payment would be totally affordable. THats where we are headed.

Let see; 500K mortgage with 4% … can buy $742K mortgage with 1% interest.

Japan, US, and the rest of the world are run by the same banking cartel anyway.

I used to think housing was in a bubble in 1999. But it wasnt.

In the SF Bay Area and Boston... well above the norm....bubbles..

For LA it was normal.. lucky you in SoCal.

http://www.housingwire.com/news/fed-considers-funding-lending-program

I'm working on an assumption that int rates will be this low OR MUCH LOWER the rest of our lives.

They are following the japan ZIRP model to sustain the zombie banks/asset prices. Since there will be zero growth - asset prices will go up or stay the same from ever lower int rates. There is a ALOT OF ROOM for rates to go down. Imagine buying a 1m home with a 30 year fixed mortgage at 1%. The payment would be totally affordable. THats where we are headed.

Bingo. I thought houses were way expensive when id do my paper route in 1994. Being born in 1981, my entire life has been falling interest rates, and I agree, there is room to fall. Many peoples understanding of mathematics is so crap that they see the drop from 15%-14% and 5%-4% as being the same, a 1% drop in interest rates, rather then the difference of a 6.7% change vs a 20% change. That's the push/pull relationship we're sliming thru, rates fall 10% to account for what should be a drop in prices,,,,,so we remain flat but lose ground on how much longer that game can be drawn out, as we near the end of our proverbial rope,,,,,at the same time boomers begin retiring and the paradigm shift/inflection point is spread over a long period of time as that large demographic does a role reversal from those who have always driven prices upwards since first leveraging their starter homes and such over the course of 3-4 decades of trading up. At some point they need to sell all that crap and consume whatever savings and equity they have built up with their assets. At least they have the generations younger then them to step in behind them and buy up,,,,,all their crap at perpetually higher prices. Oh wait,,,,,,,,

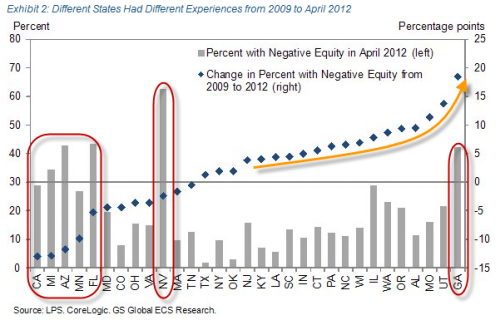

According to this chart, Arizona still has plenty of owners in negative equity situations (over 40%). How long will people onto their homes if their neighbors are buying into their neighborhoods for much, much less?

Nevada is just shocking, unreal.

My personal take on Roberto is that I'm happy he is successful with his rentals, but I really get tired hearing about his"Phoenix" market all the time. His little "slice" of the housing market there doesn't apply to the rest of the country.

what Roberto is doing is what people in the past were also doing!

buy a home as income property.. separate from personal residence.

priced at "not too hot and not too cold" ...

rent it out and keep it cash flow positive..

before the Bubble mania started -- it did apply to all parts of the country.

yes we are still in this nut case of a mania in parts of California...

where every shack is somehow special and commands at least $1 Million as a starter home.

According to this chart, Arizona still has plenty of owners in negative equity situations (over 40%). How long will people onto their homes if their neighbors are buying into their neighborhoods for much, much less?

At some point down the road.. they will just have to dump it and call it a day... it just isnt going anywhere...

You would think every single owner with negative equity would walk. Are they idiots? No. They are squatting for years for free, or getting or got a loan mod, underwater (harp) refi. So thats a lot of squatting, lots of refis, lots of short sales 'in progress'. Total mess, total broken market - but thats how it is when bankers control the place.

Japan, US, and the rest of the world are run by the same banking cartel anyway.

Thank Goodness someone else knows this! And yes, with no reliable housing news data in mainstream media, one of the only choices to find real information to base decisions on is to through comments and links on this blog, and yes, some of them are very whiny, including myself.

At some point down the road.. they will just have to dump it and call it a day... it just isnt going anywhere...

One would think. Unless the banks allow these people to simply squat for years and years. That chart just shows how messed up things really are.

Its rising however not as fast as they say. There is very little new building. Thats almost no where. Mostly people of retirement age. Its an old community. With no building no rising values. Its more difficult for them to have value with no building. Its basically a place for old people to retire.

Bullshit keeps rising new homebuyers floating.

While Phoenix may be rising (I've noticed a lot of areas rising around the country), it's only going to be temporary until the job market improves. 2012 was pegged 4 years ago has the turn around year, and with elections coming up politicians are kicking the can down the road to keep the status quo.

2013 is when big decisions will be made and the budget cuts will be much worse. Expect another fall sooner than later.

short sales make me crazy

i think HALF the owners are only 'pretending to go thru motions of short selling' so the bank will postpone the FC and/or to get a loan mod with sweet terms.

I have seen short sales with padlocked gates at driveway, agents wont return calls. Also commonly listed as 'tenant occupied no showing possible' (this one i can see being true but WTF HOW DID WE GET HERE you gotta pay 600k for a box but cant look inside!) The whooooole system is rotten.

One major change for the better would be the BANK GETS TO CHOOSE LISTING AGENT vs loan owner choosing his cousin vinny. That would end most SS fraud. Not even on radar - no one cares as its taxpayer money getting burned and SS fraud pays very very well. (the nar would not allow this law).

I think robert probably made some excellent investments and want to share that. If you are jealous then you may need to reevaluate your interest in the content on this site. This site has become less about housing and more about whiny people.

Like I said, it's just not as interesting here anymore, not learning anything much here. Just weirdos.

Has been notice rising inventory in expensive areas, where rich see an

opportunity now to get rid of expensive houses.

In my area fully 33% of the listings are $1 Million +. This is in an area where the median home price is $427K.

There are many people on here from all over the country (a lot from CA, I'm on the east coast), so constantly hearing from him about Phoenix...

Most of us don't care. I live in Coastal Cali and Phoenix, which is basically the desert that's hot as s furnace for a good chunk of the year fails to beckon to me.

Talk of a violent backlash is BS. The only time its ever happened is when a large percent of people go hungry. With modern farming it just cannot happen here.

As proof i offer the well known 'obesity epidemic' in the US every year the avg weight goes up up up. Thus we get farther from revolution not closer. And house prices are insanely cheap now in most of flyover!

And house prices are insanely cheap now in most of flyover!

Median income is 26K per year therefore housing is not cheap.

And house prices are insanely cheap now in most of flyover!

Property prices are stagnant in Dallas. From a word on the street perspective jobs are not plentiful. (Sure, bring on the charts and articles stating otherwise.)

Interest rates are the same there. Yes, you can buy with less than 20% down. Q4 is not excluding Texas. With all this 'help' I would expect home prices to rise, must be some reason they are not.

Austin.

Yes, I appreciate California more after living and working in other States a few years back. Wasn't all bad though, the contracts I landed really improved my job prospects and skills. I would go on a contract, when it ended, I would simply return to my Address in Dallas.

Ideally, I would like to do that here. Ironically, in previous posts I used 'Fontana' as an example of investor activity. The video in this article has a Realtor in Fontana explaining how both the banks and the investors are flipping properties there.

http://money.cnn.com/2013/01/31/real_estate/fha-mortgage-premiums/index.html?iid=HP_LN&hpt=hp_t2

600k in HI means you probably need to make your money first because as mentioned, there are basically no jobs that pay anything close to what will buy you a 600k house. Every time we go we meet people who are basically working 2-3 jobs just to pay the rent. Its the same story with people who own there as in the Bay Area: Either they inherited it, are loaded, or they happened to buy 30-40 years ago when it was cheaper.

Oh- and you're not kidding about food. I am spoiled by the wine prices in Cali. In HI, your typical big-brand wines that probably cost a few bucks in CA cost $15 in HI. The only food that was cheaper there was fish.

I suppose the way I look at HI is that I'd imagine it'd be the same as what it was like when I moved from -10 degrees in the Northeast in January to the Bay Area with 65 degrees and sun: For about a year it was like tropical paradise. Amazing! Flowers bloomed all year! OMG... I can wear a T-shirt in February! Holy Cow! Wine is sold like soda pop here! Sure- its still great but now I go to my job, come home, watch TV and mow the lawn like everyone else. Its not like I go to the golden gate bridge, wine country, the beach, and other things the BA is famous for on a daily basis. Likewise the same would probably be true in HI. If I moved there I'm sure it would also become somewhat pedestrian. In the meantime its just a short plane trip away. Can't wait to go back...

600k in HI means you probably need to make your money first because as mentioned, there are basically no jobs that pay anything close to what will buy you a 600k house. Every time we go we meet people who are basically working 2-3 jobs just to pay the rent. Its the same story with people who own there as in the Bay Area: Either they inherited it, are loaded, or they happened to buy 30-40 years ago when it was cheaper.

Very true! Most of the people I know around here who own houses got a huge break one way or another and hard work did not count for much of anything.

* Inheriting $$ from mom and dad

* Inheriting Prop 13 tax basis from mom and dad

* Windfall profits from stock options during the dot-com bubble

* Old, and bought long ago before the great disconnect between incomes and house prices

Roberto, is Phoenix market propelled only by low inventory and speculation OR some fundamentals; rising rent, salary, population, employment got change as well?

No offense but have you been living under a rock the past year?

It's driven only by speculation/investors. Not first time buyers.

http://www.zerohedge.com/news/2013-01-22/guest-post-real-housing-recovery-story

No offense but have you been living under a rock the past year?

It's driven only by speculation/investors. Not first time buyers.

LOL ! LIke Like Like (Yes, no offense)

There's not much in the pipeline for the past several months. That means there won't be much inventory hitting the market in the next 4-6 months.

I would view the end of this year and early next year as a great opportunity to refinance due to lower interest rate and higher sale comparables, and pull out as much equity from all investment properties as possible and get ready for the next foreclosure wave so you can load up on more income properties. If it doesn't happen, that's ok too because you have essentially transferred all the risk to the lenders, and you still have all the cash in hand waiting for the next opportunity to present itself.

Wow. Looking back at this comment 8 months later and I got 6 dislikes for it. Reality is a bitch isn't it?

Well, things were even worse in the 2nd half of 2012 and YTD. Basically, the distress market is even more pathetic than the 1st half of 2012. There will not be REO inventory in the next 6 months. The housing inventory will have to come from regular sales if any. So depressing because there's nothing to buy.

@SFace,

I expect the market to do well into the fall, and then we will see consolidation in the 4th quarter of 2013 to at least summer 2014. I wouldn't be surprised if we continue to consolidate till early 2015. Then we should see a nice move up for 3 years. That'd be my guess.

The number of regular sales have been dominating the market for almost a year now where distressed properties used to dominate. As the market is moving up, I see pent-up sellers as well as pent-up buyers. Pent-up sellers due to they cannot refinance their 6%+ interest rate for various reasons. I guess I don't have to explain the reason for pent-up buyers.

A couple of years ago, banks were foreclosing at a pace of about 500 homes/month in Santa Clara County. If you factored in the short sale market, you're looking at about about 750 distressed properties/month. Santa Clara County absorbs about 1,300 - 1,400 properties/month. Then the number of foreclosed properties gradually dropped to 300 properties/month, then 150/month, and now we're looking at 80 properties/month. That's a significant drop. The number of NODs have been dropping significantly too, which explains the drop in short sale inventory.

One month doesn't make a trend, but the number of regular listings has been increased at a healthy pace in the last month or so. If this continues, it will slowly add more housing inventory to the pipeline. By year end, we might see 2-3 months worth of inventory instead of less than 1-month.

Another year of nice appreciation coupled with increasing inventory will likely dampen the rally. That's why I predict the housing market has a good chance of going into consolidation mode starting later this year.

It's hard for me to see the market keeps on going up like this for another 3 years without any consolidation. If history is any indication, I have a decent of being correct.

I don't know honestly. After I bought my own house, I sort of stopped looking at housing trends for a long while.

How is the Phoenix market doing? My guess is low inventory still, but I suspect a lot of underwater people, and squatters as well.

Phoenix is still a pretty good buy. Weather is perfect for 3/4 year. Extremely low property taxes. The inner core is currently being modernized with public transport and heavy development. Recently there was a shortage of CONSTRUCTION CRANES in Phoenix.

Phoenix is still a pretty good buy. Weather is perfect for 3/4 year. Extremely low property taxes. The inner core is currently being modernized with public transport and heavy development. Recently there was a shortage of CONSTRUCTION CRANES in Phoenix.

Is this robertoaribas' 2nd account?

If he made so much money, why does he waste time on this website?

You posted so many sales you make it sound like you own 50 some buildings out there by now. It doesn't seem legitimate. Phoenix isn't Walmart for houses.

Is this robertoaribas' 2nd account?

If he made so much money, why does he waste time on this website?

not quite. me and Roberto are quite different sort of Arizonans you might say.

There's always been a tense relationship between Californians and Arizonans. AZ has always been small-government, cheap, anti-Californian place and thus Californians constantly deny that it's a viable option. For instance in the early proposals for High Speed Rail systems the Californian Democrats didn't even have a proposal to connect Phoenix even though it's the 5th largest city in the US(and not very far from LA).

Phoenix is having a veritable revival that you can't deny. Downtown Phoenix is everything 'downtown LA' aka Mad Max Beyond Thunderdome isn't. It's got public transport, it's relatively clean, taxes are incredibly low.

I think most on here are underestimating how poor Americans are because they are going by what they see around them and refuse to see around them. The market for affordable places like Phoenix is very strong. You can buy a functional house in Phx for about 50k right now, a bit more and youre in the middle of a major metro with access to a light rail, international airport, convention center, restaurants, large office towers, etc. AZ has been largely falsely branded by the media because Arizonans generally take a stand against the encroaching Obamization of the US.

« First « Previous Comments 20 - 58 of 58 Search these comments

patrick.net

An Antidote to Corporate Media

1,193,694 comments by 13,881 users - Eric Holder, RC2006 online now