pancakes

2012 Jun 20, 5:21am 25,540 views 58 comments

by thankshousingbubble ➕follow (7) 💰tip ignore

Comments 1 - 40 of 58 Next » Last » Search these comments

The only reason you post on here is because you are terrified your plan is going to bankrupt you. If you are looking for the younger generation to enrich you then you are going to be bitterly disappointed. We have a temporary blip in the market that will resume falling once the temporary stimulus have been removed. Time is the buyers friend whilst you bleed cash.

You normally find that people that brag about money in reality have none. It is the quiet people that have the money who do not want to draw attention to themselves. The way you rant shows me you are an overleveraged loser.

APOCALYPSEFUCK is Shostakovich says

Also, I am a very nice guy and prefer not to leave busloads of supermodels disappointed and frustrated, weeping for hours waiting for their turn.

Tell me about it. Some chick named Kate Upton has been texting me nude pictures and calling me at all hours of the night. Sure, she's hot, but take a number honey, take a number.

It is the quiet people that have the money who do not want to draw attention to themselves.

So true, so true...

You normally find that people that brag about money in reality have none.

Agree. It's like the guy who always talks about his car, but has a bank account that is empty, and bums rides off everyone because he "just filled up" 3 weeks ago.

“So far, I've landed a couple of buys but would love to add more to the portfolio. Many people wonder where this money comes from. I will admit, I work in the tech industry and joined many successful startups.†Ladies!!! and you know who you are, STEP RIGHT UP! Here is a TYCOOON who can take you places!!, dang pudgy you should change that picture to a proud Duckhead. Shake that tailfeather BOOM BOOM!

Robert, why are you acting like a goon? Yes, you parade your real name all over the internet, you own a lot of properties in Arizona, good for you.

Just because people don't agree with you doesn't mean "their lives must suck!" Calling people coward, stupid, brain dead idiots, or moron, doesn't really do much for getting people to listen to your "real world analysis". In fact it makes you come off as insecure, and unsure of yourself.

Robert, why are you acting like a goon? Yes, you parade your real name all over the internet, you own a lot of properties in Arizona, good for you.

Just because people don't agree with you doesn't mean "their lives must suck!" Calling people coward, stupid, brain dead idiots, or moron, doesn't really do much for getting people to listen to your "real world analysis". In fact it makes you come off as insecure, and unsure of yourself.

To be truthful, most of the mud slinging on this site(in the real estate forums) comes from the housing bears. While I consider myself a moderate housing bear in most markets, I am amazed by the vitriol spewed here on a regular basis at anyone who suggests the the worst may be over. Make a post where you say you feel that housing has bottomed and the hate starts pouring in.

I think guys like Robert are posting their successes here just to rub it in and piss off the "renters". It is provocative an somewhat trollish -- Robert should know better at this point -- it is also understandable.

BTW, there is a brain dead idiot on these forums who calls anyone she disagrees with a liar. She keeps changing her name and I filtered her out with the ignore feature long ago. I'm guessing he is mostly referring to her or posters like her.

"I think guys like Robert are posting their successes"

Being in as much debt as this Realtor is hardly success.

More like a giant freeking gamble.

He's here trying to convince and calm himself in the face of a terribly uncertain future.

"I think guys like Robert are posting their successes"

Being in as much debt as this Realtor is hardly success.

More like a giant freeking gamble.

He's here trying to convince and calm himself in the face of a terribly uncertain future.

You may be right. It is a risk, that is for sure. I get that. Of course if he did in fact time it right, he will get the last laugh. If not, he may be screwed.

Here in Beach cities SoCal we are nowhere near the bottom. We have SFR at 7x median income. This is unsustainable and prices are still falling.

Here in Beach cities SoCal we are nowhere near the bottom. We have SFR at 7x median income. This is unsustainable and prices are still falling.

If it is a nice place near the ocean of course it will be 7x median income because the people with median incomes won't be the ones buying there. But it is true that the overbuilt communities inland a bit - Mission Viejo for example - will see prices continue to slide, imo.

Well this board USED TO BE a real estate board. Now its ranting, insults and jokes with some RE mixed in to spur more of the ranting.

I used to think housing was in a bubble in 1999. But it wasnt. I was really really sure it was but was using wishful thinking and zero facts or analysis other than 'it cost too much'.

The most powerful people on the planet (the US fed gov, the internantional banks, the federal reserve, the congress, the white house, plus all existing owners) have been passing laws, printing trillions of dollars, letting losers squat for free for years to make prices GO BACK UP. And they did it. NONE OF THIS is temporary. When the feds do something the never stop. All govt programs are permanent. All temporary taxes get extended. Wake up people.

I'm planning on looking to buy starting september to try and avoid the 'must buy b4 school starts' clueless crowd.

I'm planning on looking to buy starting september to try and avoid the 'must buy b4 school starts' clueless crowd

I think you will have a lot of choices next winter.

For whatever it is worth, everyone I work with knows I follow RE and have not bought anything yet here in CA. A coworker comes up to me and mentions her friend who does 'everything' in RE, broker, loans, escrow, etc. told her she does not think it is the housing market bottom here in CA yet, that short sales are just beginning to clear the bank, thus, she is not buying here in CA yet either.

Winter should be better time to buy I hope.

To determine future prices you have to accurately guess what the FEDS will do + understand economics. Really difficult.

How does the brain trust here think the nov election will effect RE prices?!? I'm hoping the news is completely taken over by the nonsense, lies, and gibber jabber enought to distract people from thier 'must buy now' mind set (to allow me to buy now!!! ha!).

If Romney is close enouh in the polls to look like he might win (impossible IMO) then this MIGHT create uncertainty in the mind of the house buyer and you MIGHT see a small, very brief time period from Sept to Nov when there are much fewer buyers. THIS IS THE TIME TO STRIKE and make lowballs everywhere. But it might not happen this way. (after 911 for 3 months NO BODDY was buying RE, then it took off to the moon).

Lol, it's rising so fast because people like OP scrambling to buy as many as they can.

What about this?

"Foreclosure activity jumps in troubling sign for housing recovery"

I can’t recall any single political rumor e.g. election year, republican or democrat president, new budget etc., to have direct impact on real estate prices, employment, salary or interest rate. So I suggest bypassing it. Low inventory is a fact now and huge number of buyers coming out of fence, intrigued by rising rent and media info: “2012 landlord yearâ€, “best affordability in yearsâ€, “lowest interest in yearsâ€, “best time to buyâ€, finely decided to buy.

Has been notice rising inventory in expensive areas, where rich see an opportunity now to get rid of expensive houses. Additionally, some recent cash buyers put their houses for sale. It is hard to bypass to earn extra 50-100K in a very short time. Meaning, they also do not believe the current run-up with prices is going to sustain.

http://www.housingwire.com/news/fed-considers-funding-lending-program

I'm working on an assumption that int rates will be this low OR MUCH LOWER the rest of our lives.

They are following the japan ZIRP model to sustain the zombie banks/asset prices. Since there will be zero growth - asset prices will go up or stay the same from ever lower int rates. There is a ALOT OF ROOM for rates to go down. Imagine buying a 1m home with a 30 year fixed mortgage at 1%. The payment would be totally affordable. THats where we are headed.

Let see; 500K mortgage with 4% … can buy $742K mortgage with 1% interest.

Japan, US, and the rest of the world are run by the same banking cartel anyway.

I used to think housing was in a bubble in 1999. But it wasnt.

In the SF Bay Area and Boston... well above the norm....bubbles..

For LA it was normal.. lucky you in SoCal.

http://www.housingwire.com/news/fed-considers-funding-lending-program

I'm working on an assumption that int rates will be this low OR MUCH LOWER the rest of our lives.

They are following the japan ZIRP model to sustain the zombie banks/asset prices. Since there will be zero growth - asset prices will go up or stay the same from ever lower int rates. There is a ALOT OF ROOM for rates to go down. Imagine buying a 1m home with a 30 year fixed mortgage at 1%. The payment would be totally affordable. THats where we are headed.

Bingo. I thought houses were way expensive when id do my paper route in 1994. Being born in 1981, my entire life has been falling interest rates, and I agree, there is room to fall. Many peoples understanding of mathematics is so crap that they see the drop from 15%-14% and 5%-4% as being the same, a 1% drop in interest rates, rather then the difference of a 6.7% change vs a 20% change. That's the push/pull relationship we're sliming thru, rates fall 10% to account for what should be a drop in prices,,,,,so we remain flat but lose ground on how much longer that game can be drawn out, as we near the end of our proverbial rope,,,,,at the same time boomers begin retiring and the paradigm shift/inflection point is spread over a long period of time as that large demographic does a role reversal from those who have always driven prices upwards since first leveraging their starter homes and such over the course of 3-4 decades of trading up. At some point they need to sell all that crap and consume whatever savings and equity they have built up with their assets. At least they have the generations younger then them to step in behind them and buy up,,,,,all their crap at perpetually higher prices. Oh wait,,,,,,,,

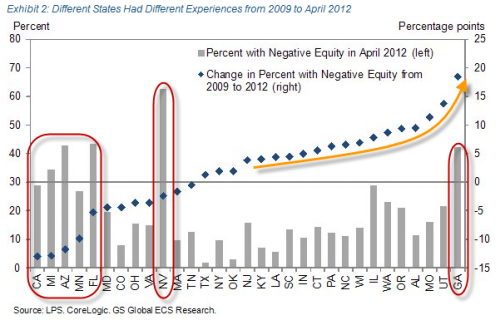

According to this chart, Arizona still has plenty of owners in negative equity situations (over 40%). How long will people onto their homes if their neighbors are buying into their neighborhoods for much, much less?

Nevada is just shocking, unreal.

My personal take on Roberto is that I'm happy he is successful with his rentals, but I really get tired hearing about his"Phoenix" market all the time. His little "slice" of the housing market there doesn't apply to the rest of the country.

what Roberto is doing is what people in the past were also doing!

buy a home as income property.. separate from personal residence.

priced at "not too hot and not too cold" ...

rent it out and keep it cash flow positive..

before the Bubble mania started -- it did apply to all parts of the country.

yes we are still in this nut case of a mania in parts of California...

where every shack is somehow special and commands at least $1 Million as a starter home.

According to this chart, Arizona still has plenty of owners in negative equity situations (over 40%). How long will people onto their homes if their neighbors are buying into their neighborhoods for much, much less?

At some point down the road.. they will just have to dump it and call it a day... it just isnt going anywhere...

You would think every single owner with negative equity would walk. Are they idiots? No. They are squatting for years for free, or getting or got a loan mod, underwater (harp) refi. So thats a lot of squatting, lots of refis, lots of short sales 'in progress'. Total mess, total broken market - but thats how it is when bankers control the place.

Japan, US, and the rest of the world are run by the same banking cartel anyway.

Thank Goodness someone else knows this! And yes, with no reliable housing news data in mainstream media, one of the only choices to find real information to base decisions on is to through comments and links on this blog, and yes, some of them are very whiny, including myself.

At some point down the road.. they will just have to dump it and call it a day... it just isnt going anywhere...

One would think. Unless the banks allow these people to simply squat for years and years. That chart just shows how messed up things really are.

Its rising however not as fast as they say. There is very little new building. Thats almost no where. Mostly people of retirement age. Its an old community. With no building no rising values. Its more difficult for them to have value with no building. Its basically a place for old people to retire.

Bullshit keeps rising new homebuyers floating.

While Phoenix may be rising (I've noticed a lot of areas rising around the country), it's only going to be temporary until the job market improves. 2012 was pegged 4 years ago has the turn around year, and with elections coming up politicians are kicking the can down the road to keep the status quo.

2013 is when big decisions will be made and the budget cuts will be much worse. Expect another fall sooner than later.

short sales make me crazy

i think HALF the owners are only 'pretending to go thru motions of short selling' so the bank will postpone the FC and/or to get a loan mod with sweet terms.

I have seen short sales with padlocked gates at driveway, agents wont return calls. Also commonly listed as 'tenant occupied no showing possible' (this one i can see being true but WTF HOW DID WE GET HERE you gotta pay 600k for a box but cant look inside!) The whooooole system is rotten.

One major change for the better would be the BANK GETS TO CHOOSE LISTING AGENT vs loan owner choosing his cousin vinny. That would end most SS fraud. Not even on radar - no one cares as its taxpayer money getting burned and SS fraud pays very very well. (the nar would not allow this law).

Haha duckhead, I'm female. LOL I'll take sexy young boy toys though.

Shoulda represented myself as a girly sheriff. But then again, you are using a duck as your web visage.

I think robert probably made some excellent investments and want to share that. If you are jealous then you may need to reevaluate your interest in the content on this site. This site has become less about housing and more about whiny people.

Like I said, it's just not as interesting here anymore, not learning anything much here. Just weirdos.

Has been notice rising inventory in expensive areas, where rich see an

opportunity now to get rid of expensive houses.

In my area fully 33% of the listings are $1 Million +. This is in an area where the median home price is $427K.

There are many people on here from all over the country (a lot from CA, I'm on the east coast), so constantly hearing from him about Phoenix...

Most of us don't care. I live in Coastal Cali and Phoenix, which is basically the desert that's hot as s furnace for a good chunk of the year fails to beckon to me.

Comments 1 - 40 of 58 Next » Last » Search these comments

patrick.net

An Antidote to Corporate Media

1,199,520 comments by 14,172 users - Blue, Ceffer, WookieMan online now